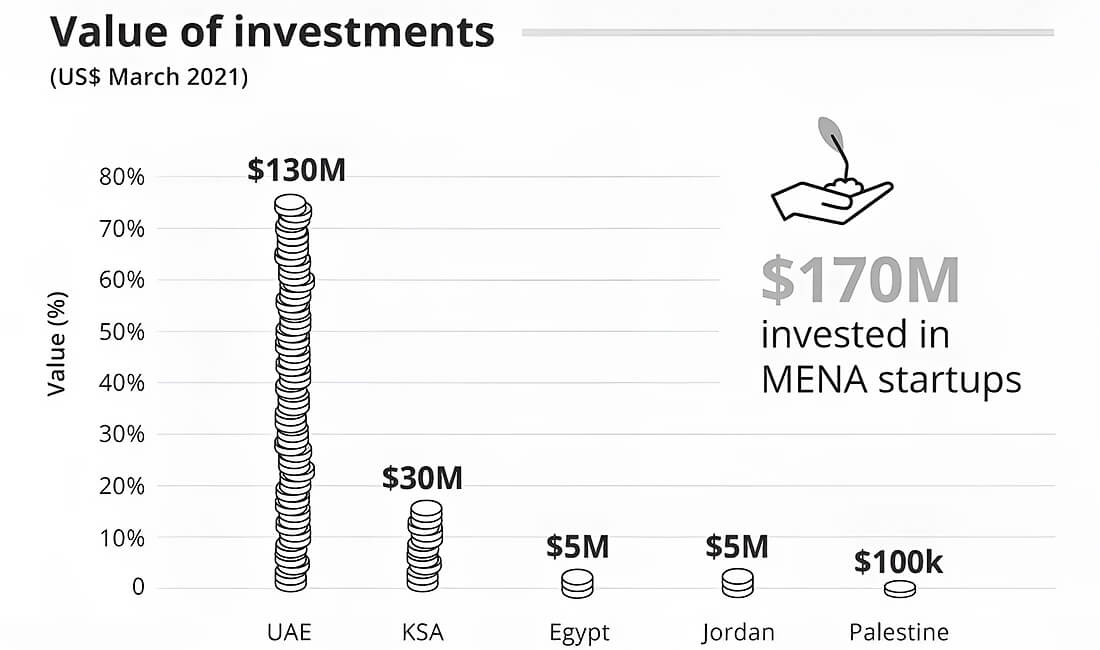

MENA tech startups raised $170 million in March 2021, showing 6% rise month on month, with 43 deals. This takes the total amount raised in the first quarter of this year to $396 million across 125 deals, marking a promising start to the year so far, according to Wamda Capital Overview. The UAE once again led the charge in terms of amount invested in March, with $130 million invested in 11 startups. This was primarily down to two companies, agritech Pure Harvest (50mln USD) and last mile delivery Luve (35mln USD). Flat6Labs’ latest cohort in Cairo helped push Egypt’s investment rounds to 18 while 11 of Saudi Arabia’s startups raised $30 million in total.

MENA tech startups raised $170 mln in March’21

Fintech attracted the highest number of deals with 10, but it was agritech and logistics that raised the highest amounts thanks to Pure Harvest and Lyve, according to Wamda.

Looking back at this first quarter, the UAE ($256 million raised across 38 deals), Egypt ($22 million across 34 deals) and Saudi Arabia ($76 million across 28 deals) account for the bulk of investment deals and value. These three countries continue to dominate in terms of startup and investment activity and with two new funds launched in Egypt this year, we can expect even more from the region’s most populous country.

During 2020, MENA startups received $1.03 billion in funds. The funds, which were granted to about 496 deals, showed a 13 percent increase compared to the financing granted in the previous year, according to an earlier report by startup data platform MAGNiTT.

Сontact our specialists by phone at +971 50 559 56 03 or in WhatsApp chat our Telegram account https://t.me/meaccurate.