Market Research & Feasibility Study for Architectural Glass Manufacturers in UAE, KSA & GCC

The architectural glass market in the UAE, Saudi Arabia, and the wider GCC is experiencing a significant boom—driven by large-scale infrastructure development, sustainability mandates, and soaring demand for energy-efficient and visually appealing facades. Does it mean that it’s easy to enter the market? Not at all! In this article, we explore key insights into the glass markets of the UAE and Saudi Arabia, and explain why conducting thorough market research and a feasibility study is essential for any company looking to enter or expand within the GCC region.

Market Research & Feasibility Study for Architectural Glass Manufacturers in UAE, KSA & GCC

Architectural Glass Market Overview: Size, Growth and Trends

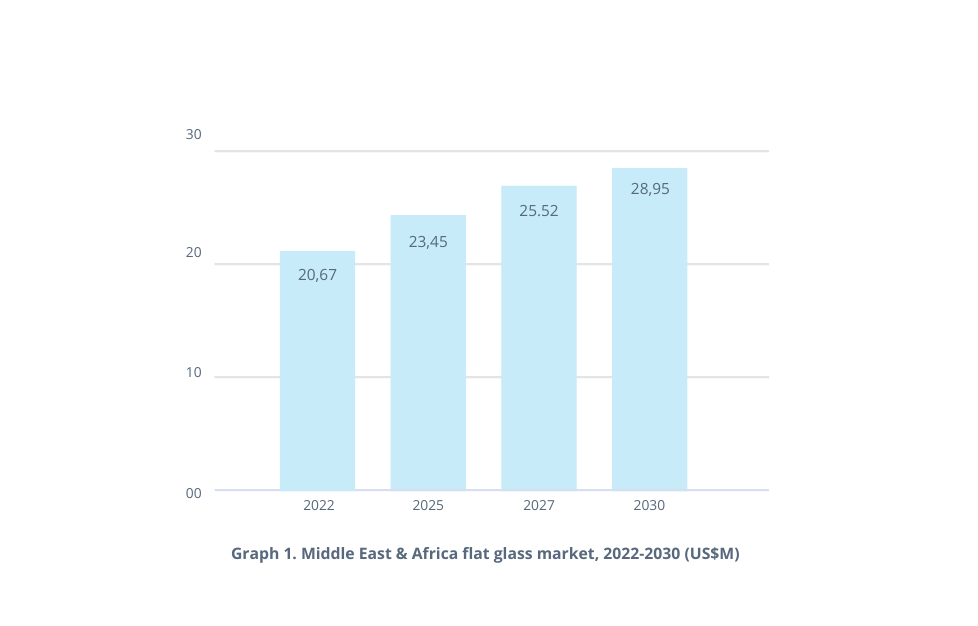

Middle East & Africa flat glass market was estimated at USD 20.67 billion in 2022, is rising to USD 28.95 billion by 2030 (CAGR 4.3%). Source Flat Glass Market – MEA Outlook.

MENA glass market size & forecast – Grandview Research

Massive projects—like NEOM, The Line, Jeddah Central, Expo City Dubai, and the Kingdom Tower—are transforming skylines and boosting architectural glass consumption. With sustainable construction now a regulatory imperative (e.g., UAE Green Agenda 2030, Net Zero 2050), the appetite for insulated, laminated, and low-E glass products has never been stronger.

If you’re an architectural glass manufacturer or distributor outside the GCC, there’s no better time than now to explore entry strategies into one of the region’s fastest-growing markets.

Market Segmentation: UAE vs. Saudi Arabia & GCC Trends

Architectural glass market UAE

UAE

In the UAE, the flat glass market reached USD 2.63 billion in 2022 and is forecast to grow to USD 4.04 billion by 2030, at a CAGR of 5.5%.

Leading segment: Laminated glass in facades.

Fastest-growing: Insulated Glass Units (IGUs), favored for thermal efficiency—aligned with green building goals.

Saudi Arabia

According to PS Market Research, Saudi’s flat glass market is estimated at USD 2.71 billion in 2024, projected to reach USD 3.58 billion by 2030 with a CAGR of 4.7%

The Vision 2030 push—including mega-projects and smart city developments—fuels this expansion.

Understanding product segmentation is crucial for positioning:

LGUs / IGUs – Leading value growth due to energy efficiency.

Laminated glass – Essential for facades, safety, and hurricane-proofing.

Tempered / toughened glass – High-durability applications in commercial/industrial sites.

Low-E, solar-reflective & smart glass – Emerging segments driven by sustainability mandates and visual innovation.

Recycled or specialty glass – Gaining traction aligned with eco-conscious construction.

Key Market Drivers & Trends

Construction Boom

Driven by mega-projects: NEOM, The Red Sea Project, Expo City, and urban expansions.

Regulatory Requirements

Sustainability schemes (UAE Green Agenda 2030, UAE Net Zero 2050 Strategy) and energy codes mandate high-performance glazing.

Technological & Aesthetic Demand

Rising use of smart, colored, printed, and decorative glass—transforming facades beyond basic insulation.

Infrastructure & Industrial Growth

Industrial and commercial constructions (e.g., airports, logistics hubs, hospitality) demand rugged and structurally sound glazing materials.

Market Entry Challenges & What You Should Know

Saudi Arabia architectural glass market size

Regulatory complexity: GCC markets require multiple certifications—safety, fire resistance, green-building compliance.

Technical standards: Specifications (e.g., thickness, U-value, lamination structure) need local alignment.

Procurement dynamics: Tenders often involve consortia, façade consultants, and framework agreements.

Competition: The market includes both global multinationals and local producers—product differentiation is essential.

Capital & logistics: Significant CAPEX for fabrication or local distribution setup; port-handling standards are strict.

Accurate Middle East Case Study: Market Entry Support for a Global Manufacturer

Overview: A leading European architectural glass manufacturer engaged Accurate Middle East to explore entry into the UAE and Saudi markets.

Research & Feasibility: Rigorous market sizing and segmentation: extracted volumes, growth drivers, and pricing per glass type. Competitive analysis covering local/foreign suppliers, fabrication capacity, and regional pricing benchmarks.

Compliance research covering UAE Civil Defense, ESTIDAMA, LEED, GBCSA, SABER, and Saudi Building Code.

Market-Entry Strategy

Advised priority markets: Dubai and Riyadh—due to regulatory readiness and project pipelines.

Recommended user cases: premium facades, hospitality, and government-backed sustainability builders.

Devised product roadmap: initial focus on laminated and IGU lines, with mid-term expansion into smart glass.

Business Development & Launch

Created qualified leads: facade contractors, green consultants, big developers.

Supported pilot installations and demo showcases with facade architects and sustainability clients.

Developed proposal templates and technical pitch materials aligned with GCC standards.

Result: Within 12 weeks, the client achieved:

2 pilot facade orders in Dubai and Riyadh.

Key partnerships with facade integrators and consultants.

A clear roadmap for product certification and distribution expansion.

“The construction and real estate sectors in Dubai and the UAE are booming—arguably experiencing some of their strongest momentum ever,” says CEO of Accurate Middle East Dr. Elena Zhukovskaya. “We’re seeing a visible shift away from standard glazing toward high-specification glass—laminated, low-E, smart glass—largely driven by green building mandates and the growing sophistication of projects. Developers are focusing more on building design and façade aesthetics, even outside of the luxury segment, and this is pushing up the glass quality bar across the board. As projects move faster from concept to execution, the pressure on suppliers has increased—creating opportunity for new entrants who are agile and technically prepared.”

Why Partner with Accurate Middle East?

- Challenge DIY Risk Our Advantage

- Market Volume & Pricing Misread opportunities Precise demand and pricing data

- Technical & Compliance Specs Reworks & delays Advanced specification support

- Tender Positioning Low conversion High clarity & stakeholder alignment

- Regulatory Pathways Certification issues Expert in green/energy codes

- Go-to-Market Speed Missed windows Accelerated partnerships & demos

Services & Typical Investment

Market Screening & Feasibility: USD 8,000-10,000

Full Entry Strategy (including technical specs and financial model): USD 25,000–40,000

Sales Enablement (lead generation, business development): USD 15,000–25,000 (5-6 months)

Next Steps – Begin Your GCC Growth

1) Book a strategy call to define your glass types and target countries.

2) Receive a custom proposal with scope, deliverables, and costs.

3) Launch research and certification pathways.

4) Begin business development with accurate, commercially validated insight.

The architectural glass market in the UAE, KSA, and GCC is in its golden era: construction megaprojects, green building mandates, and aesthetic innovation are fueling explosive demand. Success in this competitive and regulated landscape requires localized research, technical specification alignment, and strategic market positioning.

At Accurate Middle East, we build your entry roadmap—transforming glass manufacturing and trading potentials into commercial success.

For inquiries, consultations, or custom proposals, contact us directly via WhatsApp at or call us in the UAE at +971 50 599 5603. You can also request a callback or schedule a free consultation by clicking the button below. If you’re interested in market research services, simply fill in our brief form at this LINK and receive a customized proposal within 24-48 hours.

We’re here to support your business goals in the UAE, Saudi Arabia, and the GCC!