Last Updated: 25 September 2025

Real Estate Market Size UAE – 2025, 2026

The UAE remains one of the world’s leading real estate investment destinations because of its strong economy, government support, and foreign investor interest. According to CBRE Middle East the number of transactions in the UAE real estate market in 2025 surged by 23% year-on-year, with off-plan transactions increasing by 33% and ready properties up nearly 5%. Sales volume across all segments (Q1 2025, Dubai) AED 142.7 billion as per Windmills Group, so that UAE real estate market size in 2025 can reach AED 750–800 billion (≈ USD 200–220 billion), assuming Dubai continues to dominate ~70% of deals and the 23% y-o-y growth trend holds.

Real Estate Market UAE

| Metric | 2026 Outlook | Notes / Sources |

|---|---|---|

| Prices (Dubai apartments) | -5% to -10% | Oversupply risk as 2026 deliveries land. Fitch & media analysis. |

| Prices (Dubai villas / prime) | -2% to +3% | HNWI & end-user demand supports prime. Knight Frank. |

| Rents (Dubai) | Flat to +3% | Cooling from 2024–25 highs as supply completes. |

| Rents (Abu Dhabi) | +3% to +6% | Tighter vacancy; momentum from 2025 carries. |

| Transactions (UAE) | High, near 2025 levels | Off-plan normalizes; resale share rises. CBRE Q1-2025 base. |

| Mortgage rates | Drifting lower | Fed-led cuts pass through to EIBOR. |

UAE real estate market 2025 and 2026

The market is expected to increase gradually due to growing needs for residences as well as commercial and hospitality facilities. The UAE (Dubai) key real estate market trends 2025 and 2026 will continue to follow worldwide market trends.

The sector remains strong thanks to population expansion and better infrastructure alongside government efforts to transform the economy. The UAE features a broad real estate spectrum that ranges from luxury skyscrapers to affordable housing options.

Key Dubai Real Estate Trends 2025, 2026

Cooling Price Growth – Possible Corrections – After a huge raise in demand in real estate market of 2024-2025, apartment prices may fall by 5–10% in some areas due to large supply deliveries. Villas and prime residences are expected to be more resilient, with prices ranging from –2% to +3%. Analysts, including Fitch, warn of a potential market correction of up to 15% in oversupplied sub-markets.

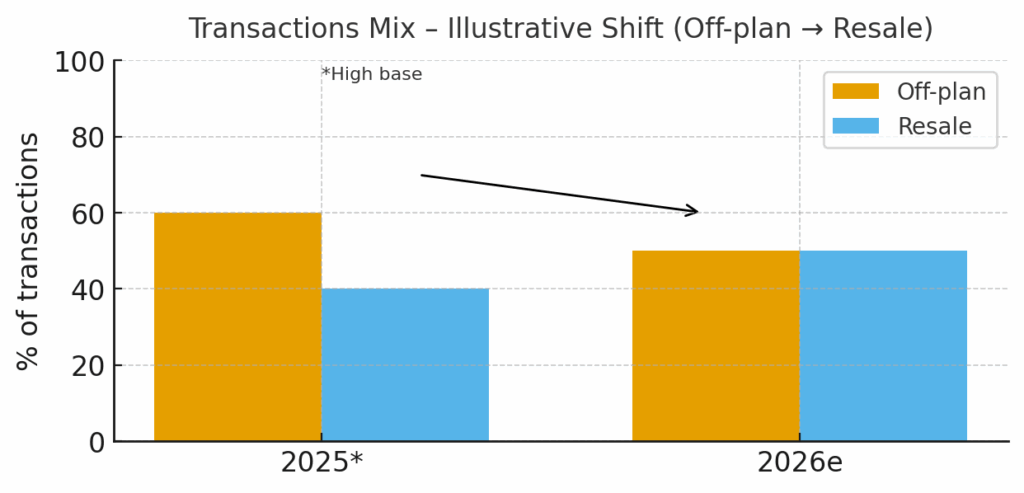

High Transaction Activity, but Shift in Mix – 2025 set a historic high in sales values (Dubai Q1 alone: AED 142.7 billion). In 2026, volumes are expected to remain strong, but the focus will move from off-plan to resale transactions, as many projects sold earlier reach completion.

UAE Real Estate Market 2026 Forecast

Rental Market Divergence – Dubai rents: growth slows significantly as new units hand over, keeping rents flat to +3%. Abu Dhabi rents: continue outperforming (expected +3% to +6%) thanks to tighter supply and rising end-user demand.

Oversupply Pressure from New Deliveries – A record pipeline of ~180,000+ units scheduled across 2025–2026 will put pressure on mid-market apartments, especially in high-density areas like JVC, Dubai South, and Dubailand.

Prime & Luxury Market Resilience – Ultra-luxury villas and branded residences (Palm Jumeirah, Downtown, Saadiyat) should remain more stable as high-net-worth buyers continue relocating and investing.

Policy & Financing Support – Continued visa reforms and government incentives will sustain demand. With the Fed rate cuts flowing into the UAE, lower EIBOR in 2026 will improve mortgage affordability and support end-user purchases.

Long-Term Growth Path Still Intact – Despite short-term volatility, the UAE residential real estate market is projected to expand from USD 36.3B in 2024 to USD 52.3B by 2030, a CAGR of ~5.1%.

Abu Dhabi Property Market — 2025–2026 Snapshot

Abu Dhabi is running on firm fundamentals heading into 2026. The emirate logged a record AED 51.72bn in real-estate transactions in H1 2025, with the number of deals up 12%—clear evidence of deepening end-user and investor demand. Villa-led momentum is visible in pricing too: annual residential price growth topped ~17% in H1 2025, with villas outperforming apartments and a measured supply pipeline stretching toward 2029. Leasing conditions remain tight across the economy—city-wide office vacancy is ~1.5%—supporting household formation and housing demand. On the occupier side, popular communities saw solid rent and sale price gains through H1 2025, reinforcing income yields for investors.

Bottom line for 2026: expect steady transactions, firm rents, and selective price resilience (especially villas/prime) as new supply is absorbed—making asset selection and micro-location more important than timing the market.

Download UAE Market-Research-Report-Q1-2025 for free.

Challenges of Entering the UAE Real Estate Market

Despite the great opportunities that exist in the UAE real estate sector, there are several important issues that businesses and investors need to be aware of when attempting to enter the market. Knowledge of these challenges is essential for producing strategic choices and to steer clear of financial losses.

Common Challenges Faced by Real Estate Business Owners:

- Regulatory Complexity – It can be complicated to comply with the UAE property laws, get the necessary licenses, and understand the free zone regulations without the help of an expert.

- High Competition – In order to create value and be successful, new entrants in the market have to identify the competitive advantage that differentiates them from existing developers and real estate agencies.

- Market Volatility – Interest rates, political tensions, and worldwide economic circumstances cause property prices to change, so it is essential to select the right time to invest.

- Limited Land Availability in Prime Areas for Investment – Due to the high return they generate, many investors cannot find adequate land in the prime areas.

- Cultural and Business Practices – It is also important for foreign investors and developers to know the buying habits of the locals and the do’s and don’ts in the business context.

- High Initial Capital Requirements – This means that prime properties and commercial developments require a lot of money to start a business with. Thus, there must be a good financial plan.

- Property Management Challenges – This means that managing rental properties, particularly in short-term rental property management, is not a cakewalk and demands a lot of experience.

How Accurate Middle East Helps Clients in the UAE

Real Estate Market Analysis UAE

At Accurate Middle East Research and Consulting, we offer specific solutions that enable businesses to overcome the challenges of the UAE real estate market.

With our expertise in market research, feasibility studies, and investment advice, our clients can make informed business decisions that will generate returns and reduce risks.

- At Accurate you can order Market Analysis Report for Market Entry or Industrial Report for regular updates in GCC sectors that you are interested in.

- We specialize in Market Feasibility Studies – We perform an exhaustive investigation to assess the effectiveness of real estate investments. For example, our company is ready to assist in a Construction Project Financial Feasibility or Hotel Feasibility Study in GCC.

- Competitive Analysis – Analyze the competition, the position of the company in the market, and where it stands in the real estate sector.

- Investment Advisory – To assist clients in generating returns from their UAE real estate businesses with as much risk protection as possible.

- Location Analysis – Revealing the areas with development potential for real estate projects.

- Regulatory Compliance Support – We also help with legal and administrative procedures that are linked to property investment.

Case Study 1: Market Entry Strategy for a European Real Estate Developer’s UAE Expansion.

The Challenge: A European developer wanted to introduce a luxury residential project in Dubai and, thus, required market analysis to achieve returns and reduce risks.

Accurate’s Solution: We performed a detailed market analysis to determine buyer needs along with a price-segmented analysis of competing products. We determined areas with high potential for sales of luxury properties.

We offered guidance on the regulatory framework and how to go about the investment. We developed a full-fledged market entry plan for the brand, price strategy, and sales distribution for the project.

Outcome: The client managed to bring out the project and sold 70% of the units in the first six months, generating good ROI and receiving funding for growth.

Case Study 2: Feasibility Study for a Mixed-Use Real Estate Project in Abu Dhabi.

Client’s Challenge: A real estate development company planned to construct residential and commercial buildings and offices but required a market feasibility analysis.

Our Solution: We performed a feasibility study of the market, the demand for lease yields, and competition. We evaluated the target audience and proposed the layout and features of the properties that suit the market trends. We created a financial model that provided an overview of the projected revenue and operational expenses as well as the return on investment. We also helped with the interaction with government entities in order to obtain permits and incentives.

Result: The project got funding from investors and had pre-leasing agreements for 40% of the commercial space before construction started, thus providing a good financial foundation for future growth.

Key Takeaways for Business Owners Aiming to Establish Business in the UAE

The UAE market is dynamic, and new trends like smart cities and co-living are defining the investment and business strategy.

- Know the legal system – This is because having the right licensing, ownership laws, and investment regulations is crucial so as not to run into legal issues.

- Leverage expert insights – It is important that investors work with market research firms like Accurate Middle East to make the right and profitable decisions.

Start Your Real Estate Business in the UAE with Accurate Middle East

To engage FDI in the UAE real estate market; one must have a good understanding of the regulatory framework and market dynamics. At Accurate Middle East Research and Consulting, we are pleased to offer tailored solutions that enable businesses to overcome UAE real estate market challenges. Our clients enjoy confidence in their decisions regarding feasibility studies, market research, and investment strategies, all based on data analysis.

Let’s Discuss Your Real Estate Project

If you are planning to venture into the UAE real estate sector, please contact our team at Accurate Middle East to find out how we can assist with your investment goals. We are ready to help you get started today!

Contact us via WhatsApp or over the phone in the UAE +971 50 599 5603. Alternatively, you can request a callback or a free consultation by clicking the button below or fill in the brief for market research or strategy development in the UAE to get a proposal within 24 hours.

With our expertise in market entry strategies, business development, and UAE real estate market insights and knowledge how to build UAE business, we can help you unlock the full potential of your future UAE real estate business.

| |

Author: | |

| Dr. Elena Zhukovskaya Senior Consultant, Partner | |

| 20+ years of experience in market research, business management, investor relations, and brand communications across the UAE, KSA, and GCC. Author of 50+ publications and a regular speaker at leading business events in the region. |

Related Article: Architectural Feasibility Study in the UAE

Behind every successful real estate or development project in the UAE lies a clear architectural feasibility study. It bridges creativity with commercial sense — evaluating zoning, technical design, site potential, and financial viability before construction begins. Our Architectural Feasibility Study in the UAE article explains how Accurate Middle East helps developers, investors, and architects align design vision with market data, ensuring each project is practical, profitable, and ready for approval.