“We are in a new environment now and contingency plans are required. Major shocks can change behaviour permanently—we cannot assume a return to the status quo ante”, – Omar Kodmani (pictured right), investment director at Ruffer LLP.

How family offices deal with current situation

Investment fund managers appeal for calm among investors as the coronavirus spreads, anticipating a six-month market disruption but doubting if there will emerge a “new normal”.

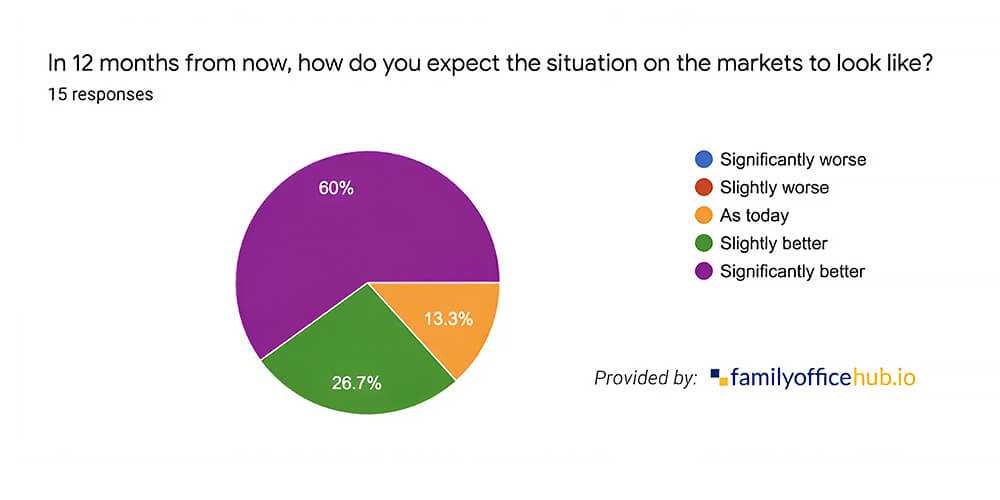

Let’s try to figure out are there evident changes in the views of potential investors. According to a Familyofficehub research, 86,7% of family offices are rather optimistic about the post-corona future. Let’s have a look at the following numbers.

- Most family offices look optimistically into the future: 60% of family offices believe in a significantly better situation (on financial markets) in 12 months and 66,7% believe in a slightly better situation in 6 months. Only 20% think that the markets will look slightly worse in 6 months.

- All family offices are exemplary in terms of home office: 46,7% of family office teams are completely working from home, 53,3% are working partly from home office. There are no family offices which haven’t introduced home office yet.

- Most family offices only experienced slight portfolio losses: 57,1% of family offices had portfolio losses between -10% and 0% since the 25th of February.

- Family offices see various investment opportunities through the Coronavirus: from food and tech stocks to distressed corporate bond

Measures to protect the family office wealth in times of Corona

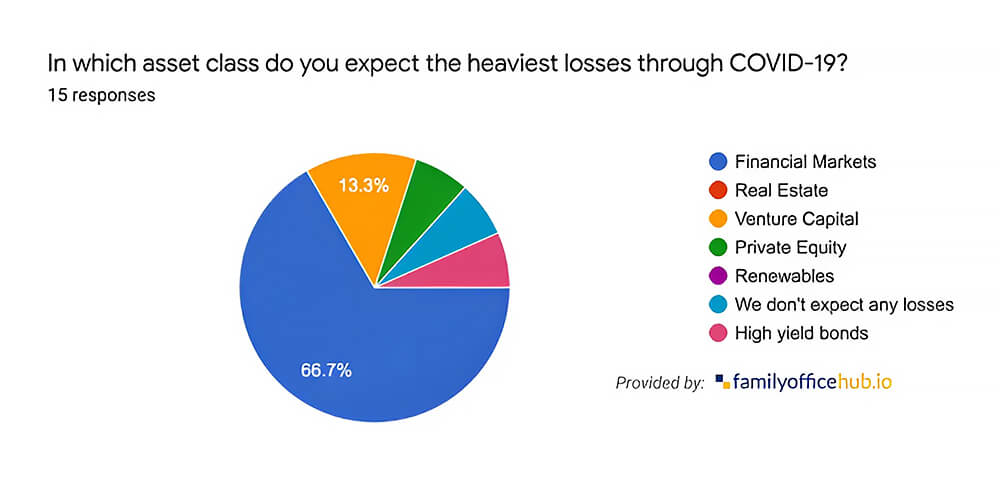

Family offices expect the worst consequences on financial markets. Besides that, some family offices also expect their heaviest losses in venture capital investments. Interestingly, only 20% of surveyed family offices have changed their investment style due to the crisis and 26,7% is considering changes tot heir investment strategy. The remaining 53,3% decided to remain calm and to stick on their investment style.

According to Familyofficehub, the upcoming months will be intense for international family offices. The family wealth has to be preserved, operations have to be maintained under difficult conditions, equity holdings have to be supported and opportunities in markets have to be seized.

“The current turmoil in global markets should serve as a wakeup call to family office investment portfolios that they should have allocations to strategies that can hold up or make money in periods of stress,” – says Professor Pele Clamour, HEC Paris.