The commercial real estate market in the Gulf is moving fast. In Dubai and Abu Dhabi, prime office space has almost vanished, while in Riyadh and Jeddah, demand is being driven by one of the world’s largest transformation agendas — Saudi Arabia’s Vision 2030.

This article brings together the latest analysis from JLL, Deloitte, PwC, BCG, and other top consultancies, and it is written for one audience: business owners, investors, and developers who are serious about the GCC.

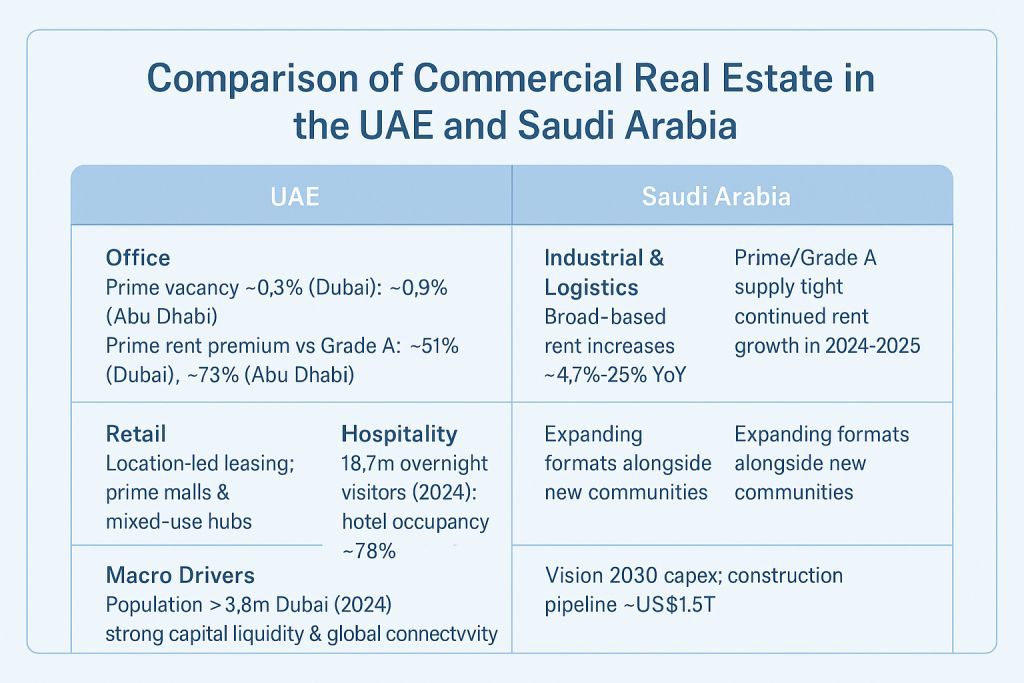

We’ll look at how the UAE has matured into a global hub with stable, transparent opportunities, while Saudi Arabia is scaling at unprecedented speed with a pipeline worth more than US$1.5 trillion. Along the way, you’ll see how different sectors — office, retail, logistics, and hospitality — are evolving, and what this means for anyone considering market entry, feasibility studies, or capital allocation in the region.

Commercial Real Estate Market in the UAE and KSA

The UAE: A Market Built on Stability and Global Appeal

Offices: A market where prime space is a luxury

By mid-2025, Dubai’s office vacancy rate had dropped below 8% overall. In the prime category, it is close to 0.3% — effectively full. Rents for prime space are now 50% higher than Grade A offices, and the gap is still widening. Abu Dhabi is following the same path, with prime vacancy under 1% and a premium spread above 70% compared to Grade A.

For occupiers, this means competition is fierce. Multinationals are securing leases early to avoid being locked out of prime stock. For investors, the message is clear: Dubai and Abu Dhabi remain safe bets for long-term rental growth and asset value appreciation.

Retail: Location decides the winners

Retail in the UAE is not about building more malls; it is about owning the right ones. Operators continue to favor established, high-traffic destinations, while new developments succeed only when they are integrated into mixed-use communities with strong residential and tourist flows.

Dubai’s status as a top global shopping destination keeps international brands queuing for space. Accurate ME often supports clients by identifying which submarkets — for example, Downtown Dubai vs. suburban mega-developments — align best with their consumer targets.

Living and hospitality: Tourism and lifestyle keep fueling demand

Institutional investors are pouring capital into the “living” segment — from serviced apartments to build-to-rent models. The logic is simple: Dubai’s population grew by more than 5% in 2024, surpassing 3.8 million people, while international tourism set a record at 18.7 million overnight visitors. Hotel occupancy stood at 78%, proving that hospitality is still one of the strongest engines for the UAE economy.

Why investors still choose the UAE

- Consistent population growth and expat inflows.

- Strong tourism flows supporting retail and hotels.

- A transparent, globally connected market with deep capital liquidity.

Commercial Real Estate Market in the UAE and Saudi Arabia (KSA)

Saudi Arabia: A Market Powered by Vision 2030

Offices: Short supply, high competition

In Riyadh and Jeddah, the office market is defined by scarcity. Prime and Grade A space is limited, giving landlords the upper hand. Rents are climbing, and new supply is still struggling to catch up with demand created by government-driven corporate relocations.

For companies entering Saudi Arabia, waiting is not an option. Early negotiations and long-term commitments are becoming the only way to secure the right location.

Industrial and logistics: A growth story across the board

If one segment captures the essence of KSA’s transformation, it is logistics. Across submarkets, rents rose 4.7% to 25% in 2024, and top-tier hubs near ports like Jeddah and Dammam now command significant premiums.

This is being driven by e-commerce expansion, new supply chain reforms, and heavy investment in transport infrastructure. For logistics developers and investors, the key is picking the right submarket — returns vary sharply depending on proximity to ports and highways.

Retail and hospitality: Building a tourism nation

Saudi Arabia is not just opening new malls or hotels; it is building entire tourism ecosystems. Projects such as Diriyah Gate, NEOM, and the Red Sea Project are designed to attract 100 million visitors a year by 2030. The hospitality pipeline is already massive, and by 2025 it continues to attract global hotel operators and developers.

US$1.5 trillion construction pipeline

According to JLL, the value of Saudi Arabia’s construction and real estate pipeline linked to Vision 2030 is around US$1.5 trillion. This includes everything from government-backed giga-projects to urban infrastructure. For international investors, it represents an opportunity on a scale rarely seen globally — but also one that requires careful feasibility validation.

Why investors bet on KSA

- The largest construction pipeline in the GCC, supported by government policy.

- Strong growth in industrial and logistics

- Hospitality potential driven by mega tourism projects.

GCC Commercial Real Estate in Perspective

The UAE and Saudi Arabia dominate the conversation, but they play very different roles in an investor’s portfolio.

- The UAE is the mature, globally connected hub. It offers transparency, liquidity, and consistent returns.

- Saudi Arabia is the transformational growth market. It offers scale, government support, and double-digit growth in select sectors, but with higher execution risk.

- Other GCC markets, such as Qatar, Oman, and Bahrain, offer niche opportunities — sports-related CRE in Qatar, logistics corridors in Oman, and selective hospitality plays in Bahrain.

For many investors, the best approach is a barbell strategy: stable income from UAE assets, combined with high-growth exposure to Saudi projects.

Comparing UAE and KSA: Offices, Logistics, Retail, Hospitality

Offices

- Dubai/Abu Dhabi: Sub-1% prime vacancy, widening premiums.

- Riyadh/Jeddah: Supply shortages, landlord-favorable rents.

Industrial & logistics

- KSA: Broad-based rent growth, up to 25% YoY in 2024.

- UAE: Steady demand, anchored by Jebel Ali and free zones.

Retail & hospitality

- UAE: Immediate strength from global tourism inflows.

- KSA: Long-term upside from giga-project-led tourism ecosystems.

| Segment | UAE (Dubai/Abu Dhabi) | Saudi Arabia (Riyadh/Jeddah) | Key Takeaway |

|---|---|---|---|

| Office | Prime vacancy ~0.3% (Dubai); ~0.9% (Abu Dhabi). Prime rent premium vs Grade A: ~51% (Dubai), ~73% (Abu Dhabi). | Prime/Grade A supply tight; landlord-favored conditions with continued rent growth in 2024–2025. | UAE offers near-full prime occupancy; KSA offers growth with limited top-tier stock—secure leases early. |

| Industrial & Logistics | Stable demand anchored by Jebel Ali & free zones; connectivity supports regional distribution. | Broad-based rent increases ~4.7%–25% YoY (2024); premiums near ports (Jeddah, Dammam). | KSA shows higher short-term growth; UAE provides connectivity and operational stability. |

| Retail | Location-led leasing; prime malls & mixed-use hubs command pricing power. | Expanding formats alongside new communities; experiential retail growing with tourism agenda. | UAE is proven today; KSA is scaling with new catchments and concepts. |

| Hospitality | 18.7m overnight visitors (2024, +9% YoY); hotel occupancy around 78%. | Tourism ecosystem build-out under Vision 2030; substantial hotel pipeline in 2024–2025. | UAE = immediate performance; KSA = long-term scale as destinations mature. |

| Macro Drivers | Population > 3.8m Dubai (2024, ~+5% YoY); strong capital liquidity & global connectivity. | Vision 2030 capex; construction pipeline ~US$1.5T; policy-led corporate relocation. | Pair UAE stability with KSA growth for a balanced GCC strategy. |

| Data window: 2024–2025. Benchmarks from leading consultancies (e.g., JLL, Deloitte, PwC/Strategy&, BCG). Figures are indicative snapshots for investor comparison. | |||

Commercial Real Estate Market in the UAE and Saudi Arabia

Key Growth Drivers Shaping GCC CRE

- Population growth: +5% in Dubai; relocation policies in KSA creating new demand.

- Tourism: UAE 18.7m visitors in 2024; KSA targeting 100m by 2030.

- Megaprojects: US$1.5T pipeline in Saudi; sustained delivery in UAE.

- ESG and financing: PwC’s 2025 frameworks show that sustainability standards are now mandatory to unlock global capital.

- Capital markets: Regional AuM rose 13% in 2023 to US$2.3 trillion, increasing allocations into real assets.

What This Means for Investors and Corporates

For occupiers: secure leases early, especially in UAE prime offices and Saudi Grade A assets.

For developers: focus on logistics in Saudi Arabia, prime office delivery in Riyadh, and mixed-use retail in Dubai.

For hospitality investors: UAE offers proven returns today, while Saudi Arabia offers future exponential growth.

For funds: ESG compliance and local feasibility validation are no longer optional — they are deal breakers.

Accurate ME works at this intersection, supporting global investors and regional developers with feasibility studies, consumer insights, and market entry strategies that align capital with local realities.

Conclusion and Next Steps

The UAE and Saudi Arabia are rewriting the commercial real estate story in the Middle East. The UAE delivers maturity, transparency, and global appeal. Saudi Arabia delivers scale, growth, and a once-in-a-generation pipeline. Both are essential for investors who want meaningful exposure to the GCC.

At Accurate Middle East, we help clients move from broad headlines to actionable strategies. Whether it’s selecting the right Dubai submarket for a new retail concept, validating a logistics investment in Jeddah, or testing feasibility for a hospitality venture linked to

Vision 2030 — our team provides the local knowledge, data, and execution support to make decisions with confidence.

📲 For inquiries, consultations, or tailored proposals, contact us directly via WhatsApp at or call us in the UAE at +971 50 599 5603.

You can also request a callback or schedule a free consultation by clicking the button below. If you’re interested in market research or feasibility services, simply fill in our form here and receive a customized proposal within 24 hours.