Primary Market Research: Why It’s the Backbone of Market Entry in the UAE

When it comes to entering a new market—especially a complex, competitive one like the United Arab Emirates—data is power. But not all data is equal. Learn more about Primary Market Research!

Primary Market Research

Introduction: The Data You Can Trust

Too many businesses rely on outdated reports, generic online statistics, or third-hand assumptions when making multi-million-dirham decisions. This is where primary market research UAE comes in. It delivers accurate, real-world insights straight from the source—customers, competitors, partners, and the market itself.

At Accurate Middle East Consulting & Research, we’ve supported hundreds of companies entering or expanding in the UAE and GCC. And in nearly every successful case, primary research was the foundation.

This article explores what primary market research is, why it matters, and how it’s used to reduce risks, validate strategies, and unlock sustainable growth in the UAE.

What Is Primary Market Research?

Primary market research is the process of collecting new, first-hand data directly from relevant sources. Unlike secondary research (which relies on existing reports or databases), primary research is gathered specifically for your business, your questions, and your goals.

🔍 Two Main Types:

- Qualitative Research

- In-depth interviews

- Focus groups

- Observational fieldwork

- Expert panels

- Mystery shopping

- Use case: exploring customer preferences, pain points, or behavior

- Quantitative Research

- Online or in-person surveys

- Structured interviews with a statistically valid sample

- Market sizing studies

- Use case: validating assumptions with measurable data (e.g., % of target audience that would buy your product)

These methods can be combined for richer, more actionable insights—especially for B2B or niche segments in the UAE where published data is often scarce or irrelevant.

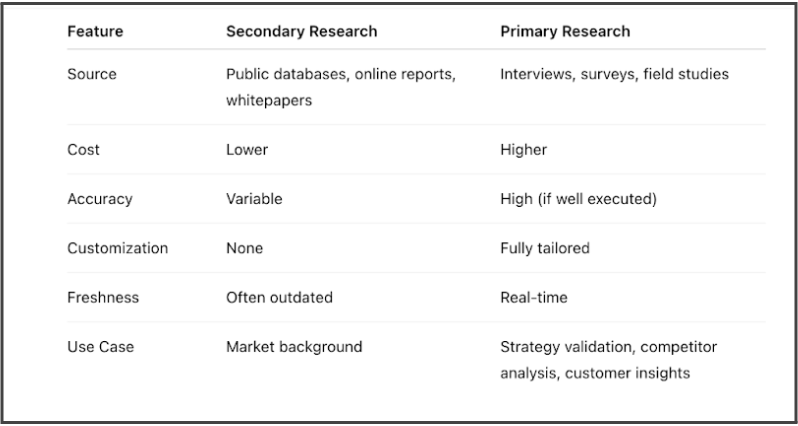

Primary vs. Secondary Research: What’s the Difference?

Primary vs. Secondary Research

Let’s be clear: secondary research has its place. It can provide useful context—like macroeconomic indicators, general trends, and historical overviews. But it cannot tell you what your customers think today. Or how your competitors price their products. Or who dominates distribution in your target sector.

Companies that rely only on desk research often walk into the UAE market with blind spots. And in such a competitive and relationship-driven environment, those blind spots can lead to expensive mistakes.

When and Why You Need Primary Research in the UAE

Primary research UAE is especially critical for:

- Entering the UAE market for the first time

- Launching a new product or service

- Entering a B2B vertical with few public data sources

- Validating demand or pricing

- Understanding cultural nuances or buying behaviors

- Identifying local partners, suppliers, or competitors

Imagine you’re launching a high-end eco-friendly cleaning product in Dubai. Public data might tell you there’s growing interest in sustainability—but only interviews with hospitality managers, retail distributors, and real customers will tell you:

- Which certifications are must-haves

- What price point is acceptable

- What formats or packaging are preferred

- Which brands dominate and why

- What gaps or frustrations customers currently face

Without this intelligence, your positioning, pricing, and product features are based on guesswork.

Methods We Use at Accurate Middle East

Market Primary Research Accurate

Our Dubai-based team uses a toolkit of proven methodologies, depending on the client’s goals, product, and industry. These include:

✅ Expert Interviews

We speak directly with local distributors, suppliers, buyers, regulators, and competitors (anonymized) to understand operations, pricing, and sales dynamics.

✅ Customer Surveys

Online or in-person surveys designed with clear logic, realistic screening, and meaningful sample sizes to measure demand and preferences.

✅ Focus Groups

Particularly useful for branding, packaging, or product design validation—especially in consumer goods, F&B, beauty, and lifestyle products.

✅ Mystery Shopping & Competitive Audits

For B2B sectors, this can involve approaching competitors or resellers under a different identity to collect quotes, pricing, or terms. It’s one of the few ways to collect realistic commercial intelligence in this region.

✅ Observational Research

From site visits to store checks, we observe what happens on the ground—because what people say and what they do often differ.

B2B vs. B2C Primary Research in the UAE

The UAE has a dual-market structure: one part consumer-driven (retail, F&B, lifestyle), the other B2B-heavy (construction, logistics, manufacturing, tech). Each requires a different research lens.

B2B Research in Dubai and GCC:

- Harder to access

- Fewer respondents

- Relationship-driven interviews

- High-value transactions with fewer players

- Requires deep sectoral knowledge

B2C Research in the UAE:

- Easier to reach customers via surveys or focus groups

- Diverse demographic segments (locals, expats from dozens of countries)

- Cultural context is key: language, values, family role in decision-making

At Accurate Middle East, we’re equipped to handle both. Our experience spans everything from government digital transformation projects to artisanal snack brand launches in Carrefour.

Real-World Example: The Risk of Skipping Primary Research

A European manufacturer recently approached us after launching a mid-range ceramic brand in the UAE through a local distributor. Sales were flat despite a booming construction market.

They had skipped primary research and assumed:

- There was a gap in the market

- Their pricing was competitive

- Their product quality was a differentiator

Through in-depth interviews with dealers, site engineers, and procurement officers, we found:

- The mid-range segment was saturated

- Competitors offered better logistics and rebates

- Their brand was unknown and lacked trust signals

- Architects had exclusive agreements with established suppliers

The result? A revised market strategy, new positioning, and renegotiation of distribution. Within 6 months, their sales turned around.

The Risk of Skipping Primary Research

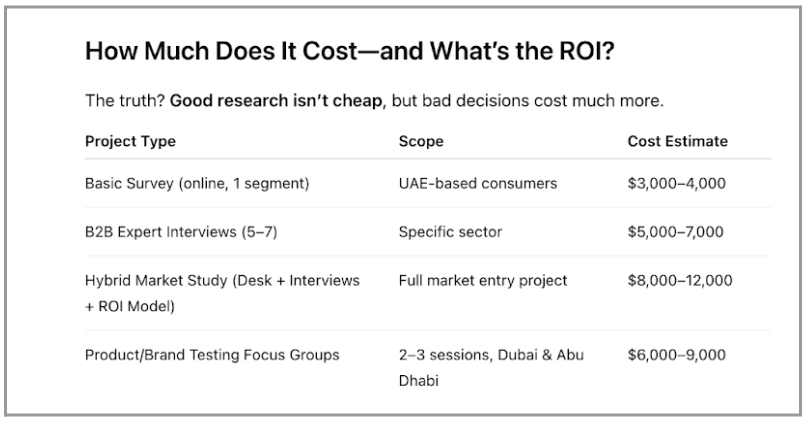

The return on this investment comes in the form of:

- Avoided costly errors

- Better pricing and margin strategies

- Smarter partner selection

- Faster market traction

- Higher investor confidence

Why Work with a Local Market Research Company in Dubai?

Working with a UAE-based firm like Accurate Middle East gives you key advantages:

🎯 Market Knowledge

We live and work here. We understand the regulatory hurdles, the unwritten rules, and the cultural nuances.

🧩 Access to Respondents

Whether it’s top real estate developers, procurement heads, or premium shoppers—we know how to reach the right people.

🛠️ End-to-End Support

We don’t just hand you a report. We help interpret findings, build action plans, and even connect you with partners.

🔍 Accuracy & Freshness

Every study is custom-made, conducted in real-time, and aligned with your business goals.

Final Thoughts

Primary market research is not a luxury—it’s a necessity for companies serious about entering or scaling in the UAE. It brings clarity to your strategy, validates your assumptions, and minimizes your risk.

At Accurate Middle East, we pride ourselves on providing actionable, trustworthy, and highly relevant research that supports long-term success—not just a soft landing.

If you’re planning your next move in Dubai or across the GCC, don’t rely on outdated reports or guesswork. Start with real data, real people, and real insight.

Ready to unlock the UAE market with confidence?

Contact Accurate Middle East Consulting & Research today to discuss your goals and get a tailored research proposal designed for your success.

If you would like to order a market research service for primary market research, please contact us via WhatsApp or call at +971 50 599 5603. Alternatively, you can request a callback or a free consultation by clicking the button below or fill in the brief for market research to get a proposal within 24 hours.