Expanding into the fertilizer market in the UAE, KSA, and GCC offers a strong opportunity. This is backed by regional food security plans, more investment in agriculture, and a move towards modern farming.

In this article, you will get a quick, but professional fertilizer market overview in the UAE, KSA and GCC region, you also explore a case study of how we supported a European fertilizer manufacturer to:

- Evaluate the fertilizer market in the UAE, KSA, and wider GCC

- Define their go-to-market strategy, legal roadmap, logistics, and supply chain requirements

- Build and validate a financial feasibility model for manufacturers of fertilizers

- Execute a successful launch with strong ROI potential

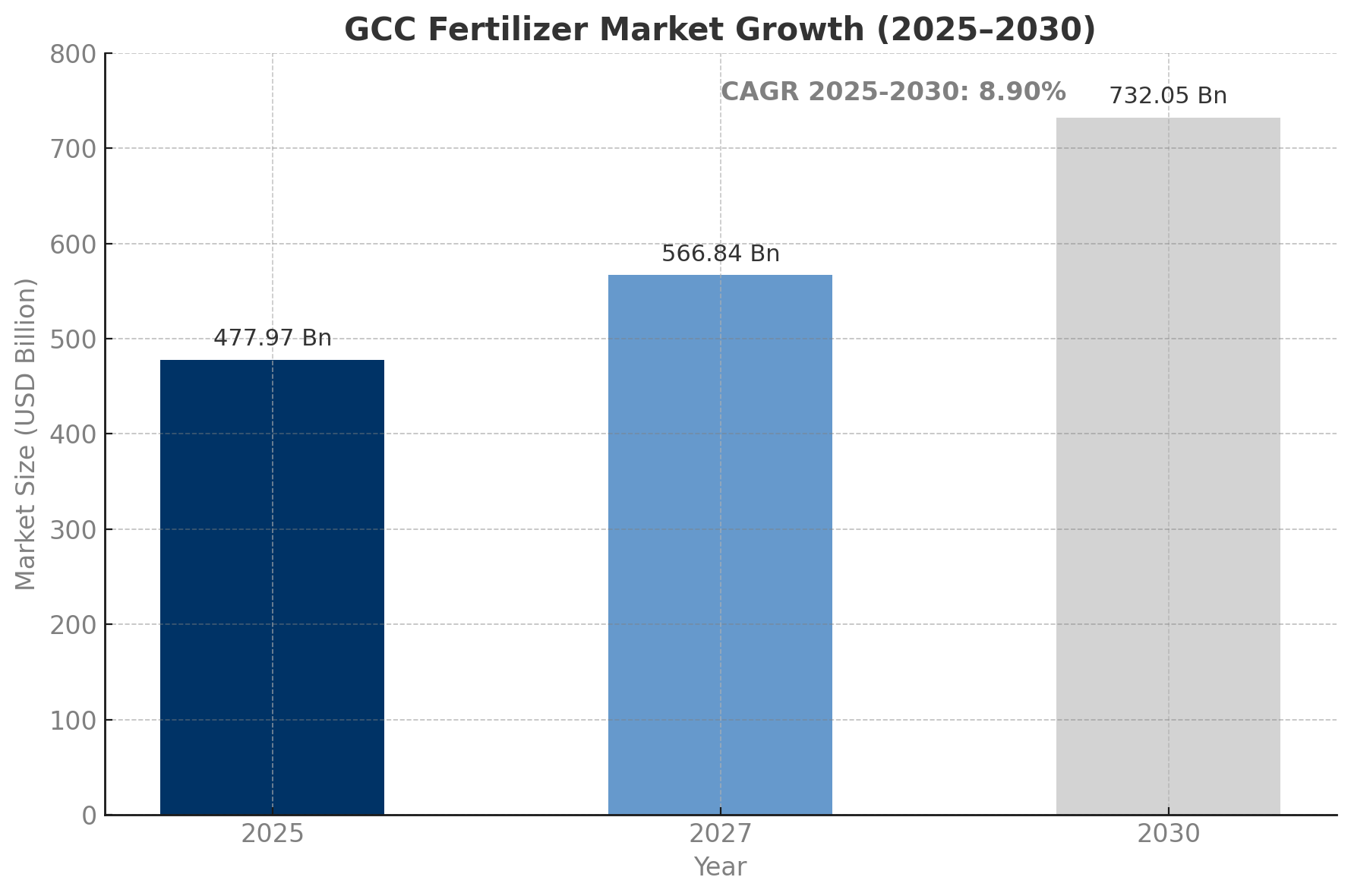

Fertilizer Market Size and Growth Forecast

Market Research & Feasibility Study for Fertilizer Manufacturers in UAE, KSA & GCC

According to industry forecasts, the GCC fertilizer market is projected to reach $438.91- 477.97 Billion in 2025, growing at around 7–9% CAGR, with specialized fertilizers—organic, bio, or controlled-release—rising at an even faster pace of 9–13% CAGR.

For international manufacturers and traders, these figures signal a lucrative growth path. Yet, entering the UAE, KSA or GCC market isn’t as straightforward as some businesses wish: monitoring market dynamics, new regulations and updated industrial standards, logistics, and positioning requires deep knowledge of the region’s perspective, expert network and good analytical skills. That’s where Accurate Middle East comes in—delivering specialized feasibility studies, market-entry strategies and business plans, tailored for GCC realities.

Why Enter the Fertilizer Market in the UAE, KSA & GCC?

1. Strong Market Demand

The GCC countries have launched massive initiatives to enhance food self-sufficiency — from Saudi Arabia’s agricultural renaissance to the UAE’s state-level food security plans. This creates rising demand for all fertilizer types: synthetic, organic, and high-value specialty blends.

2. Governmental Backing

From subsidies for modern farmers to regulations promoting sustainable practices and this sector, governments across the region, especially in the UAE, actively supporting the fertilizer ecosystem—driving demand and encouraging new market entrants.

3. Advanced Farming Adoption

Modern technologies like vertical farming, agri- IoT, precision agriculture, smart irrigation and sustainable food supply tech are gaining more attention from public and private investors and therefore – traction. These demand fertilizers that deliver exacting nutrient profiles—an ideal fit for high-quality international suppliers.

4. Wealth Potential

With the UAE and KSA funneling billions into agri-tech and supply chain modernization, there’s significant upside for well-positioned products and premium fertilizers tailored to regional needs.

However, tapping into this potential requires deep understanding—of product demand, pricing sensitivities, regulation, infrastructure, and profit levers. And that’s exactly the journey we guide our clients through.

How Accurate Middle East Structures Market-Entry Projects

Our approach is methodical, data-driven, and built around six key service phases—each combining industry knowledge with on-the-ground insight.

Phase 1: Market Sizing & Segmentation

- Estimated total fertilizer demand across the UAE, KSA, and GCC, including national and consumption breakdowns.

- Segmented markets by fertilizer type—nitrogen, phosphate, potash, controlled-release, and organic blends.

- Analyzed growth drivers and barriers: energy prices, water scarcity, crop selection, and policy incentives.

Phase 2: Competitive Landscape & Positioning

- Mapped market share and offerings of leading players: SABIC, Emirates Bio Fertilizer, Ma’aden, among others.

- Conducted price benchmarking for wholesale fertilizer, import duties, distributor markups, and retail pricing.

- Identified market gaps, such as premium organic inputs for hydroponic and F&B horticulture.

Phase 3: Cost Structure & Logistics Feasibility

- Detailed market analysis of raw material costs, manufacturing processes, and regulatory UAE, KSA or GCC countries compliance systems.

- Evaluated logistics scenarios: import routes through Jebel Ali, King Abdullah Ports, bonded storage options, and trucking models.

- Crafted optimized delivery strategies, including bulk and break-bulk shipments, warehouse design, and handling specs.

Phase 4: Regulatory & Legal Advisory

- Clarified licensing processes: MOCCAE-registered import in UAE, SAGIA registration in KSA, and GCC-wide labelling and safety guidelines.

- Created a regulatory compliance roadmap—covering testing, environmental standards, and product registration.

- Anticipated legislative shifts and helped clients prepare to comply.

Phase 5: Warehouse & Supply Chain Planning

- Recommended warehouse locations based on logistics efficiencies—focusing on proximity to ports and industrial zones.

- Developed facility layouts supporting both bulk fertilizer and blended specialty products.

- Coordinated partnerships with logistics providers, providing RFP support and service comparisons.

Phase 6: Financial Modeling & ROI Forecasting

- Built a multi-year model capturing CAPEX, OPEX, cost-of-goods sold, and financing scenarios.

- Conducted sensitivity modeling around key variables: demand volatility, pricing changes, and tariffs.

- Produced break-even analysis and ROI projections, projecting IRR >18% within three years under base-case scenarios.

Market Research & Feasibility Study for Fertilizer Manufacturers in UAE, KSA & GCC

Client Case Study: European Fertilizer Manufacturer Enters UAE and expands to the rest of GCC countries

Background & Objectives

A European fertilizer producer engaged Accurate Middle East to evaluate entry into the UAE and Saudi markets. The Client’s key objectives included:

- Market mapping – sizing, growth forecast and main competitor landscape insights

- Financial viability assessment – to take go/no go decision

- Regulatory and legal system overview and recommendations

- Operational and supply chain modeling and cost analysis

Our Methodology and Steps

- Scoping & Kick-off

- Defined project scope: markets, fertilizer categories, and logistical variables.

- Established data collection partnerships in UAE and KSA.

- Quantitative & Qualitative Research

- Used official data (e.g., FAO, Ministry of Environment & Agriculture) and proprietary surveys to collect on-ground price data and competitor insights.

- Interviewed local distributors, big-farm owners, and agri-commodity experts.

- Cost and Logistics Analysis

- Evaluated import vs. local blending scenarios.

- Compared ports, customs procedures, and transportation costs with Jebel Ali as the UAE gateway and Dammam for KSA.

- Regulatory Roadmap

- Detailed a licensing timeline (MOCCAE: 4–6 weeks; SAGIA: 8–10 weeks).

- Delivered a compliance checklist encompassing labeling, safety, storage, and environment.

- Warehouse Selection

- Shortlisted optimal storage sites: JAFZA (Dubai), KAAIA (Abu Dhabi), and Dammam Industrial Zone.

- Shared cost-benefit matrix across location proposals and service provider evaluations.

- Financial Model

- Calculated potential revenue streams, including DDP (Delivered Duty Paid) models to end customers.

- Modeled base, optimistic, and cautious scenarios—assessing IRR and break-even points.

- Strategic Recommendations

- Launch first in the UAE (Jebel Ali as hub), then expand into KSA after 12 months.

- Focus premium positioning in organic and specialty blends targeting greenhouse and F&B sectors.

Results & Client Major Benefits

- Market entry achieved within 6 months, with licensing and site selection completed efficiently.

- Financial models projected an 18–22% IRR by year three.

- Their first batch of fertilizer arrived and entered distribution within a year—converted from analysis to execution rapidly.

Why Choose a Professional Market-Research Partner in GCC?

| Challenge | DIY Approach | With Accurate Middle East |

| Market Clarity | Fragmented data & assumptions | Data-backed insights on demand & pricing |

| Risk Assessment | High uncertainty & miscalculations | Sensitivity modeling and risk mitigation |

| Regulatory Mistakes | Costly delays and penalties | Fully compliant, GCC-focused guidance |

| Logistics Gaps | Bottlenecks, poor supplier coordination | Optimized supply routing and ops planning |

| Strategic Misses | Reactive launch, poor positioning | Data-driven product and launch strategy |

Typical Investment in Our Fertilizer Feasibility Study

- Preliminary Market Scan: From USD 7,000

- Full Feasibility & Market-Entry Package: USD 25,000–50,000, depending on complexity and geographic scope

- Includes ongoing updates—covering regulatory changes, logistics shifts, or market trends

How to Get Started

- Connect with our market research specialists — available by WhatsApp/phone/email.

- Define your scope: select target markets (UAE, KSA, GCC) and product mix (synthetic, organic, specialty).

- Receive a custom proposal within 1-2 business days.

- Launch your feasibility project, and gain insight and decision confidence in under 6-8 weeks.

Reach out Today to Enter the GCC Markets with Confidence

Ready to explore the fertilizer market opportunity in the UAE, KSA, and GCC?

Partner with Accurate Middle East to unlock regional insights, reduce risks, and fast-track your market entry—delivered through structured research, expert analysis, and hands-on feasibility modeling.

For inquiries, consultations, or tailored proposals, contact us directly via WhatsApp at or call us in the UAE at +971 50 599 5603. You can also request a callback or schedule a free consultation by clicking the button below. If you’re interested in market research services, simply fill in our brief form here — and receive a customized proposal within 24-48 hours. We’re here to support your business ambitions across the UAE, Saudi Arabia, and the GCC.