Financial Model Development in the UAE & Saudi Arabia: Ensuring Business Success

Financial model development in the UAE and Saudi Arabia (KSA) is a critical tool for entrepreneurs and established companies in today’s rapidly evolving business landscape. A well-developed financial model provides clarity and structure to a business’s financial planning, helping stakeholders make informed decisions. In the UAE, where business growth is fast-paced and opportunities abound, creating a robust economic model is even more essential for success.

The UAE and Saudi Arabia are two of the most dynamic business environments in the world. New ventures are launched every week, capital is readily available for well-prepared founders, and both governments continue to invest heavily in diversification—fueling opportunities across real estate, hospitality, F&B, technology, logistics, industrial manufacturing, healthcare, and more. Yet despite the market potential, many businesses fail at one simple stage: validating the numbers.

If you are preparing to launch, scale, or enter the UAE or Saudi Arabia (KSA) markets, a well-structured financial model is not “nice to have”—it is a non-negotiable decision-making tool. In this guide, Accurate Middle East clarifies when a financial model is needed, how it is built, what services we provide, and how a professionally developed model increases your credibility with investors, lenders, and potential partners in the GCC. This article is built on more than a decade of consulting experience in the region and is designed to help you understand exactly what to expect when developing your financial projections in the UAE and Saudi Arabia.

Financial Model UAE

At Accurate Middle East Consulting, we specialize in financial model development tailored to the UAE market. We ensure businesses have the tools they need to forecast profitability, attract investors, and manage their operations efficiently. This article will guide you through the intricacies of financial model development in the UAE, the services we offer, and why professional assistance is vital for success.

Who Needs Professional Assistance in Financial Model in the UAE

Across Dubai, Abu Dhabi, Riyadh, and Jeddah, companies request financial modeling services at several key milestones. The creation of the financial model in the UAE is based on the solid knowledge of the local market and the trends of its economy. This is why firms of all sizes, even startups and corporations, turn to professional support. Here’s why:

Strategic Growth: A solid financial foundation is essential for strategic development, cost control, and potential future investors.

Regulatory Compliance: There are laws governing the laws of business and financial systems within the UAE that must be followed, but only professional consultants adhere to them completely.

Investor Appeal: The investors expect a clear and empirical set financial model that will explain when and how they will start getting their returns back.

Startups: New businesses should involve the preparation of a financial model to enable the determination of cash flows, necessary finance, and break even points.

Most common business stages for financial model development:

1. Market Entry into the UAE or Saudi Arabia

2. Fundraising and Investor Matching

3. Internal Budgeting and Expansion Planning

4. Bank Financing and Loan Applications

5. Vision 2030 & UAE 2031 Strategy Projects

By creating unique and strategic solutions that can help startups and existing companies succeed in the UAE market, Accurate Middle East delivers the professional services any business needs to grow within the UAE market.

How We Build a Financial Model: Step-by-Step Process

Every project begins with understanding your business. However, our methodology is always grounded in GCC-specific realities—market prices, competition benchmarks, demand assumptions, cost-of-talent in Dubai and Riyadh, OPEX for KSA vs UAE, and regional regulatory considerations.

1. Briefing & Business Logic Alignment

We validate your business model, revenue streams, value proposition, competitive environment, and customer acquisition strategy, making sure that the model reflects not only numbers, but the commercial logic behind them.

2. Data Collection & Market Inputs

Depending on your industry, we can integrate into financial model the following aspects:

- market sizing

- pricing benchmarks

- competitive comparisons

- supply chain and logistics structure

- licensing fees

- sector-specific KPIs

3. Model Architecture

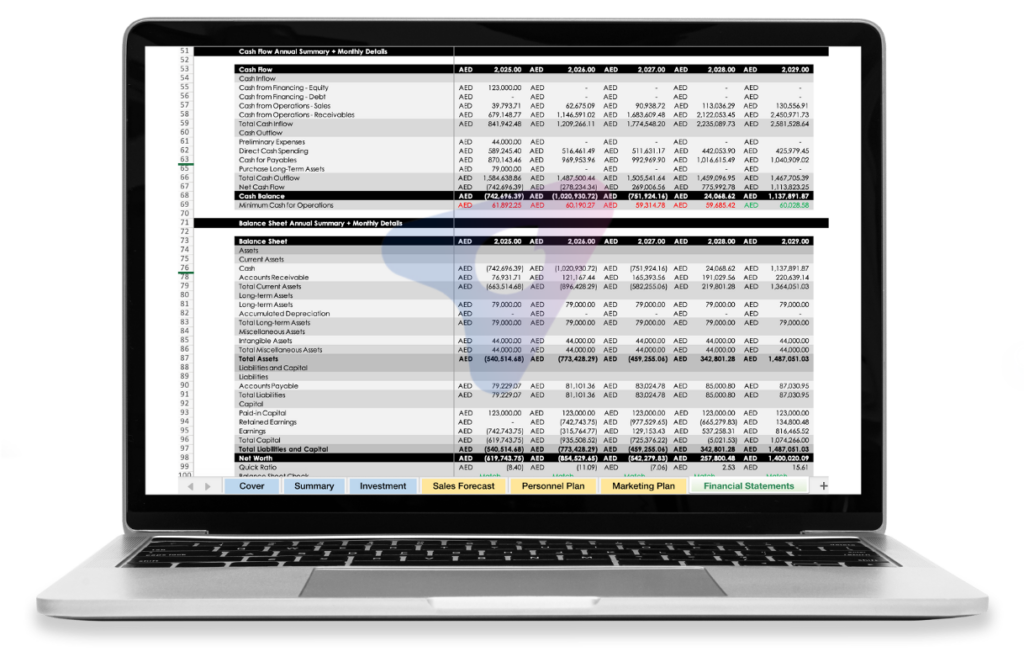

We design the structure of the financial model:

- revenue sheets

- cost sheets

- payroll structure

- CAPEX/OPEX

- cash flow

- balance sheet

- profitability forecasts

- sensitivity/scenario analysis

4. Financial Calculations & Validation

Our team applies best-practice modeling standards used by international consulting firms and validates the logic across all statements.

5. Review & Final Delivery

We provide a walkthrough session, adjust assumptions where needed, and deliver a clean, structured, fully editable Excel model.

Financial Modeling Services We Provide (Revenue, Costing, Forecasting)

Our financial modeling services for the UAE and KSA cover all levels of complexity—from simple startup projections to large multi-branch structures.

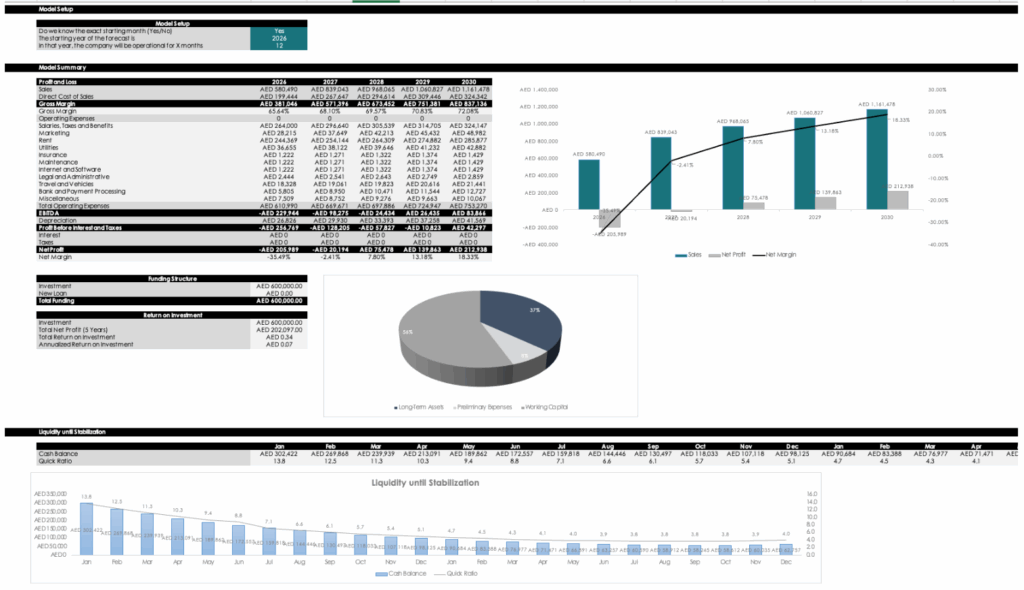

Revenue Forecasting

We build revenue models tailored to your specific industry, customer behavior, and local market conditions.

Cost Modeling & OPEX/ CAPEX Structure

Cost structures in Riyadh differ from Dubai; talent cost differs from Jeddah to Abu Dhabi; rental benchmarks vary significantly across the GCC. We incorporate accurate cost assumptions based on real market data.

Cash-Flow Forecasting

We design models that allow you to monitor liquidity, manage cash burn, and plan investment rounds.

Profitability & Scenario Analysis

We evaluate best-case, base-case, and conservative scenarios—critical for investor discussions and risk mitigation.

Valuation & Investor KPI Calculations

For fundraising, we add valuation logic, IRR, payback periods, and investor return tables.

Custom Modeling for Complex GCC Projects

We support advanced financial modeling for:

– manufacturing plants

– hospitality and hotel projects

– franchising and retail chains

– clinics and medical centers

– construction and contracting companies

– logistics and warehousing

Financial Modeling in the UAE: How to Order

Creating a financial model is a detailed, structured process that begins with a thorough understanding of the business. Here are the key stages:

Briefing and Needs Assessment: We start by understanding your business goals, industry, and market positioning. This phase includes a detailed consultation, during which we gather the necessary information to build the financial model.

Detailed Task Preparation: Based on the briefing, we prepare a comprehensive task outline that includes all financial metrics to be analyzed. This includes revenue forecasts, cost breakdowns, cash flow analysis, and funding needs.

Agreement and Documentation: Once the task is defined, we formalize the scope of work through a signed agreement, ensuring transparency and alignment between both parties.

Financial Model Development in UAE & Saudi Arabia

Financial Projections in the UAE as a Service

Our development of financial models accurately serves the needs of businesses in the UAE as Accurate Middle East Consulting. Our services include:

1) Revenue Forecasting:

We forecast your possible revenues considering the existing market trends and customers’ behavior analysis.

2) Cost Estimation:

We clearly distinguish all costs, such as operating expenses, capital expenditures, and variable costs.

Profitability Analysis:

By sensitivity and scenario analysis, we assist firms in studying how different factors play out in terms of profitability.

3) Cash Flow Management:

Any organization’s free and continuous cash flow is significant. We analyze your cash receipts and disbursements to monitor liquidity issues.

4) Investor Readiness:

We ensure that your financial structure is well-developed to help you attract and win investors.

Financial Model Cost in UAE & KSA: Pricing Table 2025-2026

The cost of developing a financial model in the UAE usually depends on such factors as business complexity, industry specifics, and the level of detail required. The cost of creating a customized financial model ranges from AED 5,500 to AED 12,500. Key factors influencing the cost include:

Business Complexity: Larger businesses with multiple revenue streams may need more comprehensive modeling.

Data Availability: Limited historical data may require more time to gather and process the necessary information.

Customization Needs: Models that involve specialized analyses, such as risk assessments or industry-specific KPIs, may incur higher costs.

Format and Complexity of a Financial Model: Depending on the format and the data that our clients possess, if the financial model should be static or dynamic, what the period of planning is required (3 or 5 years), we come up with the idea about the final cost of a financial model.

| Service Type | UAE Price (AED) | KSA Price (SAR) | Notes |

|---|---|---|---|

| Basic Startup Financial Model | 5,500 – 7,500 | 6,000 – 9,000 | 3-year projections; suitable for early-stage concepts and simple business models. |

| SME Financial Model | 8,000 – 12,500 | 9,500 – 14,500 | 5-year projections; designed for growing companies with several revenue lines. |

| Investor Model + Pitch Deck Support | 12,500 – 18,000 | 14,000 – 20,000 | Includes valuation logic, key investor KPIs and slide-level financial highlights. |

| Complex Multi-Revenue / Multi-Entity Model | 25,000 – 35,000 | 30,000 – 43,000 | For groups, holding structures or projects with multiple locations and scenarios. |

Accurate Middle East provides flexible pricing structures tailored to your specific needs, ensuring you receive the best value for your investment.

Financial Models and Pitch Decks for Startups in the UAE

Our financial model for startups includes the following:

- Funding Needs Analysis: An operating plan that decides how much money and when.

- Break-Even Analysis: Defining when your business can turn to the black.

- Cash Flow Projections: Being able to cover its near-term operations and needs to do so in at least adequate amounts.

Our key focus for early stage innovative and tech companies is tuning their finance profiles and presenting the numbers so that startups look attractive to investors.

Your financial model in the UAE will be implemented in the UAE professional company. Therefore, laying down a proper financial model for a startup is a core competence, especially for those in UAE, where investors are expected to be attracted, and adequate growth management is expected. Like every other small business, startups have many problems, including cash flow unpredictability and scaling issues, which thereby require a flexible high-level model.

Financial Models for Startups in Dubai, Abu Dhabi & Riyadh

Startups in the UAE and KSA operate in a highly competitive environment, especially in fintech, F&B, healthtech, SaaS, logistics, and retail. A financial model is essential to:

– determine capital needs and cash-burn runway;

– validate pricing strategy;

– evaluate customer acquisition cost;

– estimate breakeven point;

– present numbers professionally to investors.

Many founders underestimate expenses in Saudi Arabia or overestimate early demand in Dubai. Our job is to forecast realistically—using local benchmarks, GCC cost structures, and your go-to-market strategy.

Financial Modeling for KSA: Riyadh, Jeddah & Vision 2030

Saudi Arabia has unique dynamics that should be reflected in financial calculations:

1. Regulatory & Labor Considerations

Saudization policies affect payroll, hiring plans, and cost structures. This information must be integrated into the model from day one.

2. Market Growth & Demand Drivers

Saudi Arabia is undergoing an unprecedented transformation under Vision 2030, making it one of the fastest-growing markets globally. Demand projections can be strong—but must be validated by real sector data and competitive analysis.

3. Cost Structure Differences vs the UAE

Rental costs, logistics, licensing fees, and government compliance differ significantly between Riyadh, Jeddah, Dubai, and Abu Dhabi. We ensure your model reflects the market you are entering—not generic assumptions.

4. Vision 2030 Strategy

For such industries as hospitality, tourism, advanced manufacturing, education, and real estate, financial models must align with government scoring criteria and KPIs.

Financial Modeling Services from Professionals

Choosing a professional company to develop your financial model ensures that you receive expert guidance, accuracy, and a model that aligns with local and international standards. Accurate Middle East Consulting is known for its professional approach, detailed analysis, and client-centric services.

Why To Hire Accurate Middle East Consulting for Financial Projections Development in the UAE?

- Expert Team: Having been in the business for more than twenty years, our consultants fully appreciate the peculiarities of the UAE environment.

- Customized Solutions: Here, we are talking about customizing products and services that organizations should adopt as a culture. All our financial models are developed based on your business needs or requirements.

- Compliance: You are covered for UAE regulations compliance on any financial models developed and used in this respect.

- Successful Track Record: We have conducted over 100 consulting projects in the UAE.

Advantages of Ordering a Financial Modeling Services in UAE at Accurate Middle East Consulting

In today’s business environment of the UAE, constructing a practical financial model is critical to enterprise management. By partnering with Accurate Middle East Consulting, you benefit from:

Accurate Forecasting: Providing you with the tools you need to make the right choices that will lead to success.

Strategic Planning: Offering a guide on achieving, maintaining, and increasing profitability and growth.

Investor Confidence: A clear marketing of a financial statement to investors, enhancing financial prudence.

We at Accurate Middle East are here to assist you in understanding all the challenges involved in building your successful financial model in the UAE. We then ensure that even though this is a rich market for your business, nothing is left to chance.

Talk To Us About Your Business Tasks Today

Let Accurate Middle East Consulting help you start a business improvement journey in the UAE today. To start with, kindly fill in the brief or email us your task at: team@meaccurate.com, call us in the UAE +971 50 599 5603 or text us in WhatsApp.

Accurate Middle East is your one-stop shop for all your market analysis, business feasibility, business setup and business development (pre-sales, search for partners and distributors) needs in GCC. Contact us now to get the best solution for your business.