Feasibility Study in Saudi Arabia: Decision-Grade Analysis for Capital-Intensive Market Entry

Entering or scaling in Saudi Arabia requires more than optimism, local introductions, or high-level market narratives. Capital commitments are larger, regulatory pathways are stricter, and execution risk compounds quickly. This article explains how a feasibility study in Saudi Arabia is used by founders, investors, and corporate sponsors to make informed, defensible decisions before committing capital. It outlines when a feasibility study is required, how it is conducted in practice, what decision-makers should expect to receive, realistic cost and timing ranges, and how Accurate Middle East approaches feasibility study services for Saudi Arabia from inside the region.

What a feasibility study in Saudi Arabia actually is

Feasibility Study in Saudi Arabia

A feasibility study is a structured decision document that tests whether a business idea, expansion plan, or investment can operate commercially, legally, and financially in Saudi Arabia under local market conditions, not theoretical assumptions.

A business feasibility study goes beyond market size narratives. It connects demand reality, pricing tolerance, operating structure, regulatory constraints, and capital requirements into one integrated decision framework. In Saudi Arabia, a feasibility study in business is often the first document reviewed by boards, family offices, lenders, or internal investment committees.

Unlike generic market reports, a feasibility study in Saudi Arabia is designed to answer one question clearly: should capital be deployed here, under these conditions, at this scale, and now?

When a feasibility study in Saudi Arabia becomes mandatory

Feasibility Study Riyadh, Jedda, Dammam, Saudi Arabia, KSA

Certain decision moments in Saudi Arabia make a feasibility study unavoidable rather than optional. These are not academic exercises; they are risk-control tools.

Typical decision triggers

- First-time market entry into KSA

- Capital-intensive projects (manufacturing, healthcare, logistics, education, hospitality)

- Licensing-dependent activities requiring sector approvals

- Joint ventures with local partners

- Expansion beyond pilot or soft-launch phase

- Bank financing or investor capital raising

In practice, feasibility study companies in Saudi Arabia see demand peak before land is leased, staff are hired, or legal entities are finalized. Once fixed costs start accumulating, optionality disappears.

Why Saudi Arabia requires a different feasibility study logic

Saudi Arabia does not behave like a simplified extension of the UAE or other GCC markets. Assumptions that work in Dubai frequently fail in Riyadh, Jeddah, or secondary cities.

Saudi-specific factors tested in a feasibility study

- Demand fragmentation across regions

- Government-linked buyers and procurement cycles

- Local pricing sensitivity versus premium positioning

- Saudization implications on staffing cost and availability

- Licensing timelines tied to sector and ownership structure

A feasibility study KSA must reflect these dynamics. Imported benchmarks without local validation lead to distorted IRR calculations and false confidence.

How a feasibility study in Saudi Arabia is conducted

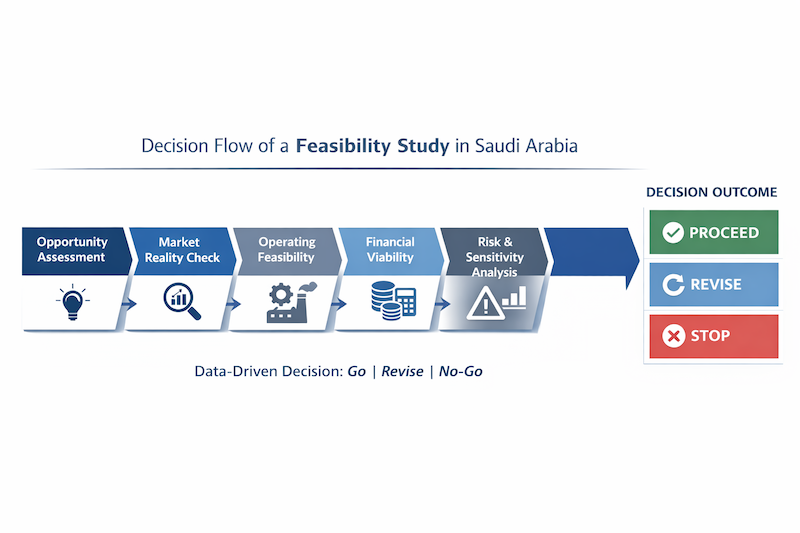

A professional feasibility study in Saudi Arabia follows a disciplined sequence. The objective is not data volume, but decision clarity.

Phase 1: Market reality validation

This phase tests whether demand exists at the proposed price, for the proposed offering, by identifiable buyers.

- Demand mapping by segment (B2B, B2G, B2C)

- Price acceptance testing

- Competitive behavior assessment

- Substitution and informal alternatives

This is where feasibility study in research intersects with real buyer behavior, not published statistics alone.

Phase 2: Operating model feasibility

This phase assesses whether the business can operate legally, logistically, and economically in Saudi Arabia.

- Legal structure and ownership constraints

- Licensing and approvals pathway

- Staffing model and Saudization exposure

- Supply chain and logistics dependencies

Feasibility study consultants in Saudi Arabia focus heavily on operational friction—what slows execution and increases cost.

Phase 3: Financial viability and sensitivity analysis

This stage translates assumptions into numbers and stress-tests them under conservative conditions.

- Unit economics and margin structure

- Capital expenditure and working capital requirements

- Break-even timelines

- Sensitivity analysis (price, volume, cost, delays)

This is where many projects fail quietly. Financial models reveal whether the idea survives realistic assumptions, not optimistic ones.

What clients receive from a feasibility study

Decision-makers should expect tangible, usable outputs—not narrative reports designed to impress rather than inform.

Core feasibility study deliverables

- Board-ready feasibility study report

- Integrated financial model with scenarios

- Key risks and mitigation pathways

- Clear go / revise / no-go conclusion

Typical structure of a feasibility study in Saudi Arabia

- Executive decision summary

- Market demand assessment

- Competitive and pricing landscape

- Regulatory and operating constraints

- Financial viability analysis

- Risk assessment and sensitivities

- Final recommendation

Case Example: Feasibility Study for Market Entry into Saudi Arabia (Healthcare Services)

Feasibility Study Company Saudi Arabia KSA Riyadh

Client context

A regional healthcare services operator with existing operations in the UAE was evaluating entry into Saudi Arabia through a multi-site outpatient model. The client had preliminary interest from local partners and access to capital but lacked clarity on real demand, regulatory sequencing, and financial viability under Saudi operating conditions.

The investment decision required board approval and external financing, making a feasibility study in Saudi Arabia mandatory before committing to leases, licensing, or partner agreements.

Decision challenge

The client faced several unresolved questions:

- Whether demand existed beyond headline healthcare growth figures

- Which cities could support the proposed service mix at sustainable pricing

- How Saudization and staffing costs would affect unit economics

- Whether the expansion should be phased, restructured, or paused

- The core risk was entering the market based on UAE benchmarks and overestimating speed to breakeven.

Scope of the feasibility study

Accurate Middle East conducted a full business feasibility study focused on decision validation rather than concept promotion. The scope included:

- Market demand assessment by city and service line

- Competitive and pricing analysis across public and private providers

- Regulatory and licensing pathway review

- Operating model testing, including staffing and Saudization impact

- Financial modeling with downside sensitivity scenarios

The feasibility study services were structured to support a go / revise / no-go decision rather than a predetermined outcome.

Key findings

The feasibility study in Saudi Arabia identified that:

- Demand was materially concentrated in two cities, not nationwide

- Price elasticity was higher than initially assumed for core services

- Staffing costs under Saudization materially reduced margins in the first 24 months

- A multi-site launch would significantly increase cash burn without accelerating payback

Under the original expansion plan, projected returns did not meet the client’s internal investment threshold.

Decision outcome

Based on the feasibility study conclusions, the client:

- Paused the original multi-site rollout

- Restructured the entry strategy into a single-city pilot

- Adjusted service mix and pricing

- Deferred partner commitments until post-pilot validation

The revised approach reduced initial capital exposure and preserved strategic optionality.

Why the feasibility study mattered

Without a structured feasibility study consultant-led process, the client would likely have proceeded with a capital-intensive rollout based on incomplete assumptions. The feasibility study allowed the board to make a defensible, evidence-based decision aligned with Saudi market realities rather than regional averages.

Cost and timing of feasibility study services in Saudi Arabia

One of the most common questions asked of feasibility study companies in Saudi Arabia relates to cost. Under-budgeted studies usually fail to answer the right questions.

| Project Type | Timeline | Professional Fees (USD) |

|---|---|---|

| Light feasibility study | 3–4 weeks | 12,000 – 18,000 |

| Full feasibility study | 6–8 weeks | 20,000 – 35,000 |

| Complex or regulated sectors | 8–12 weeks | 35,000+ |

How to evaluate feasibility study companies in Saudi Arabia

- Direct experience with Saudi regulatory processes

- Sector-specific operating knowledge

- Willingness to challenge founder assumptions

- Financial modeling depth and credibility

A feasibility study specialist should be comfortable advising against proceeding when risks outweigh returns.

Why Accurate Middle East as your feasibility study consultant

Accurate Middle East operates as a regional advisory firm, not a report factory. Our feasibility study services in Saudi Arabia are designed for decision-makers who must justify capital allocation internally.

Relevant advisory credentials

- 15+ years combined consulting and investment advisory experience

- Active feasibility study engagements across healthcare, industrials, services, education, and consumer sectors

- First-hand exposure to Saudi licensing and operating realities

Common mistakes observed in feasibility studies in Saudi Arabia

- Over-reliance on published market size data

- Ignoring regional demand differences

- Underestimating operating and staffing costs

- Treating Saudization as a formality

- Applying UAE benchmarks directly to KSA

How feasibility study results are used after approval

A feasibility study in Saudi Arabia is not a static document. It becomes a working reference for investor discussions, lender reviews, partner negotiations, and internal execution planning.

Integration with market research and business planning

In many cases, a feasibility study in business leads naturally into deeper market research, detailed business planning, and go-to-market structuring. Accurate Middle East integrates market research and feasibility study work to maintain continuity from decision to execution.

Discuss your feasibility study in Saudi Arabia

If you are assessing market entry, expansion, or capital deployment in Saudi Arabia, a decision-grade feasibility study should be your starting point.

You can speak directly with our advisory team via WhatsApp at or call our UAE office at +971 50 599 5603. Alternatively, complete our feasibility study brief at the link. We typically respond with a tailored scope and proposal within 24-48 hours.