Competitor Analysis in the UAE: Definition, Methodology, Cost & Strategic Use Cases

In the UAE, competition is visible, measurable, and accelerating. New brands enter every quarter, pricing models shift quickly, and customer expectations evolve faster than in most global markets. In this environment, competitor analysis is not a theoretical exercise — it is a strategic decision tool.

This guide explains what competitor analysis in the UAE really involves, when companies need it, how it is conducted, what it delivers, and how much it typically costs. It is written for founders, investors, and regional decision-makers evaluating market entry, expansion, pricing, or repositioning in Dubai, Abu Dhabi, or other emirates.

Competitor analysis UAE

What Is Competitor Analysis in the UAE?

Competitor analysis in the UAE is a structured evaluation of direct and indirect competitors, focusing on pricing, positioning, customer experience, operational models, and market behavior within the local regulatory and cultural context.

- Unlike generic global studies, UAE competitor analysis accounts for:

- Emirate-level market differences

- High pricing transparency

- Strong digital visibility

- Rapid product and service cycles

- Heavy influence of location, brand perception, and service quality

The objective is not only to understand who competitors are, but why they perform the way they do and how that impacts your strategic decisions.

Why Competitor Analysis Is Critical in the UAE Market

The UAE is one of the most competitive markets globally for sectors such as healthcare, F&B, retail, professional services, construction materials, logistics, and digital platforms.

- Competitor analysis allows businesses to:

- Benchmark pricing against real market behavior

- Identify gaps in value proposition and customer experience

- Understand operational advantages and weaknesses

- Anticipate competitor expansion or repositioning

- Reduce risk before investment or market entry

In practice, many failed UAE launches are not due to lack of demand — but due to misreading competitors.

When Do Companies Need Competitor Analysis in the UAE?

Competitor analysis is most commonly required at four decision points:

- Before market entry into Dubai, Abu Dhabi, or another emirate

- Before pricing or product launch decisions

- Before expansion across emirates or into KSA

- When performance underperforms expectations

Investors also rely on competitor analysis to assess commercial risk, margin sustainability, and scalability before capital allocation.

How Competitor Research Is Conducted in the UAE (Methodology)

1. Market & Competitive Scope Definition

The analysis begins by defining:

- Relevant emirates

- Customer segments

- Product or service categories

- Strategic questions the analysis must answer

This ensures insights are decision-driven, not generic.

2. Competitor Identification (Direct & Indirect)

Competitors are mapped across:

- Direct substitutes

- Alternative solutions

- Local vs international players

- Premium vs mass positioning

In the UAE, indirect competitors often capture significant demand.

3. Data Collection & Field Intelligence

Data sources typically include:

- Pricing audits and package comparisons

- Websites, apps, and booking platforms

- Google Maps reviews and directories

- Social media positioning and engagement

- Marketplace and aggregator behavior

- Mystery shopping and field visits

All findings are validated against local market realities.

4. Competitor Benchmarking & Strategic Interpretation

Competitors are compared across:

- Price-to-value ratio

- Product or service configuration

- Brand positioning

- Customer experience

- Distribution and channels

This reveals where differentiation is possible — and where it is not.

5. SWOT & Risk Mapping

Each major competitor is evaluated using SWOT analysis to:

- Identify exploitable weaknesses

- Recognize structural threats

- Assess sustainability of competitor advantages

This step connects competitive intelligence to strategic risk.

6. Strategic Output & Decision Support

Findings are translated into:

- Pricing strategy inputs

- Positioning recommendations

- Market entry or expansion logic

- Go-to-market priorities

The output is designed for executive decision-making, not academic reporting.

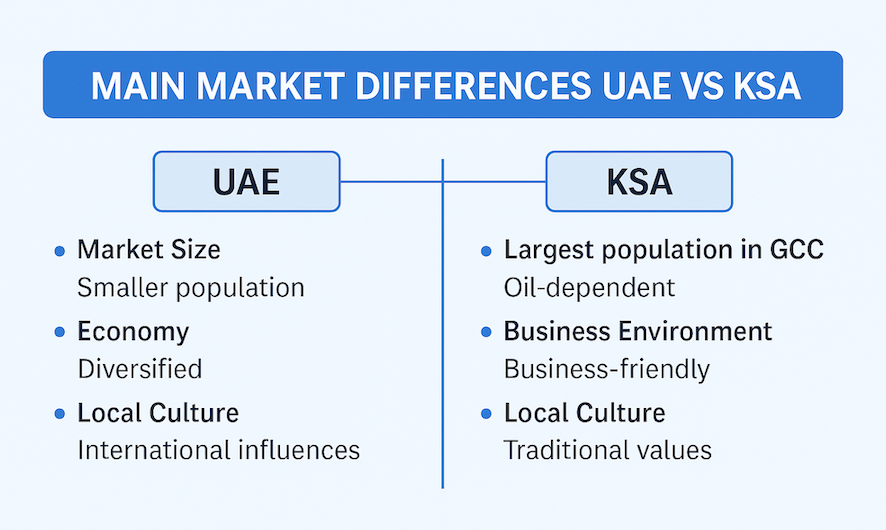

Competitor Analysis in the UAE vs Saudi Arabia: Key Differences

Competitor Analysis UAE, KSA an GCC

While often assessed together, UAE and KSA markets differ structurally.

UAE is characterized by:

- High transparency

- Fast market movement

- Strong digital competition

- Immediate customer feedback

Saudi Arabia requires:

- Deeper regulatory assessment

- Regional segmentation

- Distribution and partnership analysis

- Longer execution cycles

A UAE-only analysis focuses on speed, differentiation, and pricing precision.

Combined UAE–KSA Competitive Intelligence

Most international brands entering the Gulf market evaluate both simultaneously.

Competitor Analysis Service UAE, KSA

This integrated approach reveals:

- Pricing strategies

- Operational models and possible gaps

- Cross-border strategy differences

- Differentiation & values

- Segment prioritization

Accurate ME specializes in comparative competitor analysis UAE and KSA — a service increasingly in demand by regional expansion teams.

What You Get from a Professional Competitor Analysis

Typical deliverables include:

- Competitor profiles

- Pricing and package benchmarks

- Positioning maps

- SWOT analysis

- Opportunity and risk assessment

- Strategic recommendations

All outputs are structured for internal strategy teams or investors.

Cost of Competitor Analysis in the UAE

| Scope of Competitor Analysis | Coverage | Deliverables | Estimated Cost (AED) |

|---|---|---|---|

| Light Competitor Scan | UAE (single emirate or small category) | 3–5 competitors, pricing overview, high-level benchmarking | 18,000 – 24,000 |

| Full Competitor Analysis UAE | All emirates (Dubai, Abu Dhabi, Sharjah…) | Profiles, pricing, positioning, SWOT, customer sentiment, strategy insights | 25,000 – 30,000 |

| UAE–KSA Comparative Benchmark | UAE + Riyadh/Jeddah | Deep competitor mapping, cross-market pricing, opportunity/threat evaluation | 45,000 – 55,000 |

| Multi-Country GCC Competitor Study | UAE + KSA + Kuwait/Qatar/Bahrain/Oman | Full-scale competitive intelligence, regulatory comparison, strategy roadmap | 75,000 – 85,000+ |

Factors affecting cost include:

1) The number of competitors examined: Analyzing more rivals necessitates additional data-gathering efforts which can elevate costs.

2) Depth of examination: A more extensive study employing sophisticated tools tends to incur higher fees.

3) Level of customization: Tailored reports designed according to specific business needs may come at a premium compared with standard analyses.

4) Specific of the industry: The more complicated your industry or your market is – the more expensive it is to get valuable data. So this factor can also affect the final cost of our market research in the UAE.

Why Work with Accurate Middle East

Accurate Middle East conducts competitor analysis grounded in:

- Local field intelligence

- Sector-specific expertise

- Commercial and financial logic

- Decision-ready outputs

Our work supports founders, investors, and regional teams making high-stakes decisions in the UAE.

Market Analysis as a Services in the UAE

Benchmarking in the UAE is particularly powerful because the market moves quickly and competitors are highly transparent in their pricing, promotions, and digital performance. Our benchmarking studies compare your offerings against the most relevant players in terms of pricing, customer experience, service delivery, product range, and value communication. We help you understand exactly where you stand and what needs to change to strengthen your competitive position.

Competitor Intelligence (AI-Powered Dashboards)

The GCC is increasingly driven by digital intelligence, and we integrate AI-supported tools to strengthen your competitive visibility. Our automated dashboards provide ongoing monitoring of:

- Pricing changes

- Product launches

- Distribution updates

- Campaign activity

- Customer sentiment shifts

This allows your team to react faster, forecast trends, and stay informed without waiting for quarterly or annual studies. The dashboards combine AI scraping, human validation, and expert interpretation — giving you a real-time competitive intelligence system that mirrors the speed of the GCC market itself.

Case Example UAE – Packaging Competitive Analysis

Recently, Accurate Middle East conducted a full competitor analysis for a packaging manufacturer evaluating expansion in the UAE. The study examined local and imported competitors, factory capabilities, production economics, order lead times, B2B customer preferences, and distribution channels.

Healthcare Clinics: Clear Visibility Into Market Positioning, Demand & Patient Perception

For medical clinics in the UAE and Saudi Arabia, staying competitive requires understanding three things at all times:

- how their pricing compares to nearby providers,

- how demand is shifting between specialities, and

- how patients perceive the quality of care.

Competitor Analysis Automated Ai Dashboards GCC UAE KSA

We develop fully automated dashboards that bring these important aspects together. Rather than searching for scattered information, clinic directors can track consultation fees, services prices, diagnostic packages, and promotional activity across competing facilities. They can immediately see whether their pricing sits above, below, or directly in line with the market.

Why Work with Accurate Middle East

Accurate Middle East conducts competitor analysis grounded in:

- Local field intelligence

- Sector-specific expertise

- Commercial and financial logic

- Decision-ready outputs

Our work supports founders, investors, and regional teams making high-stakes decisions in the UAE.

How to Choose a Professional Firm in the UAE

When choosing a consulting company for professional market research and analysis of competition, some critical factors should be considered to obtain effective results. First, identify a reputable company in the UAE, as knowledge of the local market is essential for proper work. Check if they are experts, especially if your business needs their opinions – sector-specific specialists offer practical advice. Assess the approach – the best firms shall use quantitative and qualitative methods, which utilize research and analysis data relevant to the UAE market. Evaluate their social platform; they have an excellent local network, and this would ensure they get relevant, timely information. Last, rank the firms by how they value openness, elasticity, and clients’ needs, and make sure these firms can alter their approaches to match your objectives and market in UAE.

Talk to US

If you need competitor analysis, market research, feasibility study, business plan, or full strategy support in the UAE, Saudi Arabia, or GCC — our team is ready to guide you.

For consultations or tailored proposals, you can contact us directly via WhatsApp or call us at +971 50 599 5603. You can also request a callback or book a complimentary strategy session using the button below.

If you’re exploring market research or competitor analysis services, complete our brief at this LINK and receive a customized proposal within 24-48 hours.

Accurate Middle East is here to support your business ambitions with rigor, clarity, and real local intelligence.

Last Updated: 24 January 2026