Artificial intelligence in Saudi Arabia has moved beyond buzzword status. It is now a core pillar of Vision 2030, a defined national priority, and one of the most heavily funded technology themes in the region. For founders, investors and established technology companies, this creates a rare window: enter early with the right positioning and strategy, or watch others secure long-term relationships.

AI Market Research in Saudi Arabia

This article is written for leaders who are considering AI companies entering the Saudi market —or expanding existing GCC operations into the Kingdom. You may be asking:

- How large is the Saudi Arabia AI market really, and what will it look like by 2030?

- Which sectors are actually buying AI, not just talking about it?

- How do national initiatives like Vision 2030, SDAIA and the National Strategy for Data & AI translate into concrete commercial opportunities?

- What are the regulatory and practical barriers that make or break an AI market entry?

- Where do Ai market research, feasibility studies, and business plans add real value—rather than just producing another presentation?

At Accurate Middle East, we support clients with AI market research Saudi Arabia, feasibility analysis, AI strategy development in KSA, and full AI market entry Saudi Arabia support. This article consolidates what we see on the ground into a structured, practical guide for decision-makers who need more than a high-level overview.

AI as a Pillar of Vision 2030: Why Saudi Arabia Leads the Region

Saudi Arabia is not experimenting with AI on the margins — it has embedded data and AI into the core of its national transformation.

The Saudi Data & AI Authority (SDAIA) was created to drive the entire national data and AI agenda. Officially, the Kingdom links dozens of Vision 2030 objectives to AI and data; a large share of the programme’s economic diversification targets either depend on, or are accelerated by, AI deployment.

Under the National Strategy for Data and AI (NSDAI), Saudi Arabia aims by 2030 to:

- Rank among the top 15 countries in the world for AI readiness

- Train tens of thousands of specialists in data and AI skills

- Support 300+ AI and data startups

- Attract billions of riyals in data and AI investment in KSA from local and international players

This policy framework is not theoretical. It guides procurement decisions in ministries, shapes how giga-projects are designed, and influences what local enterprises expect from technology vendors.

For any serious Saudi Arabia AI industry analysis, Vision 2030 and SDAIA are not “context”—they are the operating system.

AI Market Size in Saudi Arabia (2024–2030)

Multiple reputable sources now converge on a similar message: Saudi Arabia is expected to capture the largest absolute AI gains in the Middle East.

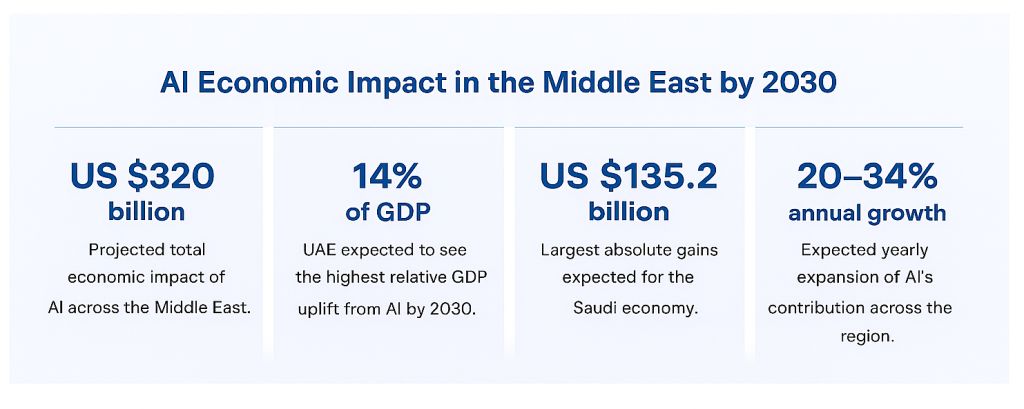

- AI is projected to contribute over USD 135 billion to the Saudi economy by 2030, equivalent to roughly 12–13% of national GDP. (PWC)

- For the broader GCC, AI is forecast to add around USD 320 billion in economic value by 2030, with Saudi Arabia taking the largest share and the UAE the highest relative impact.

- Estimates for AI sector growth in the GCC suggest annual growth rates in the contribution of AI of 20–30% per year, with Saudi Arabia among the fastest-growing markets.

When our clients ask us about AI market size Saudi Arabia 2025, we stress two major things:

- The exact number will differ by methodology and segmentation (core AI software, enabling infrastructure, AI-enhanced services, etc.).

- What matters for strategy is the direction and scale: a double-digit GDP share, structurally embedded in state spending and long-term transformation plans.

For founders and investors, this is not a speculative market. It is a macro-level bet already made by the state.

AI Market Size in Saudi Arabia

Government Investments, SDAIA Strategy and Digital Transformation

The national AI agenda is implemented through a mix of policy, investment and institutional reform.

SDAIA and the National Strategy for Data & AI

SDAIA’s strategy positions Saudi as a global hub for data-driven innovation. Its programmes span:

- Data governance and regulatory frameworks

- National AI platforms and cloud infrastructure

- AI skills pipelines and academies

- Incentives for AI startups and global partnerships

For an outside AI vendor, the Saudi Data & AI Authority (SDAIA) strategy is effectively the reference point for understanding what is encouraged, what is regulated, and where long-term support is likely.

AI and Saudi Arabia Digital Transformation 2030

Beyond SDAIA, AI is embedded in a broader Saudi Arabia digital transformation 2030 agenda:

- E-government and digital services

- Smart infrastructure and mobility

- Digital health and telemedicine

- Fintech, digital payments and open banking

- Smart industry and logistics hubs

The public sector is both a major buyer of AI and a policy shaper that defines standards for the private sector. This dual role accelerates AI adoption trends in Saudi Arabia in ways we do not see in many other markets.

Sectors and AI Use Cases in Saudi Arabia (KSA)

For any meaningful Saudi Arabia AI market research, it is not enough to quote macro numbers. We need to examine where contracts are being signed and what use cases are gaining attention.

Core Sectors Leading AI Adoption in the Country

We see consistent demand across:

- Government & smart cities – citizen services, digital identity, predictive maintenance of public assets

- Healthcare – clinical decision support, diagnostics, patient flow optimisation

- Banking and financial industry – fraud detection, credit scoring, process automation

- ECommerce & Retail – dynamic pricing, recommendation engines, demand forecasting

- Energy & Utilities – predictive maintenance, optimisation of generation and distribution

- Logistics, Transportation – computer vision, quality control, asset monitoring, route optimisation

These are not only AI use cases in Saudi Arabia in a theoretical sense; they shape budgets, RFPs and recurring contracts.

AI in NEOM and Giga-Projects

The global narrative often focuses on AI in NEOM and giga projects — and for good reason. AI underpins:

- Autonomous and shared mobility concepts

- Smart energy grids and micro-grids

- Urban digital twins and planning tools

- Advanced security and safety systems

- Immersive visitor experiences and personalised services

At the same time, recent reporting shows that Saudi Arabia’s sovereign wealth fund is recalibrating some giga-project timelines and shifting part of its focus towards sectors such as logistics, AI infrastructure and data centres.

For market entrants, this means two things:

- Giga-projects remain important, especially for infrastructure and deep-tech AI players.

- There is growing opportunity in “everyday” AI deployment across ministries, regional governments, large corporates and mid-market enterprises.

AI Economic Impact in the Middle East by 2030

Opportunities for AI Companies Entering the Saudi Market

The AI opportunities in Saudi Arabia are not uniform. They depend heavily on your profile: infrastructure provider, AI platform, vertical SaaS, implementation partner, or hybrid consulting-technology firm.

Below are some opportunity zones we highlight in AI market entry Saudi Arabia projects.

Vertical AI Solutions for Priority Industries

Sector-focused AI companies can benefit from a clear fit with national priorities:

- Healthcare AI – mostly in radiology, pathology, disease management

- Industrial AI – predictive safety & risk management, production optimisation & maintenance

- Energy AI – emissions monitoring, optimisation, renewables integration etc.

- Retail and customer analytics – omnichannel experience, loyalty programmes, churn prediction

In each of these areas, clients are looking for examples and sample insights that go beyond dashboards to measurable operational improvements.

AI Consulting and Market Research in Saudi Arabia and Transformation Support

There is a growing gap between executive ambition and delivery reality. Many organisations have AI pilots, but lack:

- Clear AI strategy development in KSA aligned with business priorities

- A rigorous view of where AI will create value versus where it is a distraction

- Data readiness assessments and governance models

- Practical implementation roadmaps

This is driving strong demand for AI consulting Saudi Arabia that combines market insight, technical understanding and local execution capabilities.

Infrastructure, Data and AI Platforms

Cloud providers, data-infrastructure vendors and AI-platform companies can leverage:

- Data localisation requirements, which often favour in-Kingdom infrastructure

- Government cloud strategies and digital platforms

- The need for scalable AI workloads in health, finance, government services and giga-projects

For these players, high-quality Saudi Arabia AI industry analysis must cover policy, procurement models and competitive dynamics—not just technology.

Barriers to Entry and Strategic Considerations

While the AI market in Saudi Arabia is attractive, it is not frictionless. This is where structured AI feasibility study KSA work makes a difference.

Regulatory and Data Considerations

Key regulatory issues include:

- Data protection and privacy regulation

- Data localisation for data sensitive sectors

- Sector-specific regulators in health, finance and telecoms

- Standards around model transparency, security and risk management

Understanding how SDAIA, the Digital Government Authority and sector regulators interact is essential for any AI business plan in Saudi Arabia that touches citizen data, financial information or critical infrastructure.

Procurement, Sales Cycles and Local Relationships

Saudi procurement frameworks can be highly structured, especially in government and large corporate segments. Practical challenges include:

- Pre-qualification requirements

- The need for a local presence or a strong local partner

- Long sales cycles, often involving multiple stakeholders

- High expectations around post-implementation support

A robust AI startup strategy Saudi Arabia must account for these dynamics from day one. Underestimating sales complexity is one of the most common reasons promising AI companies fail to scale in the Kingdom.

Competition and Positioning

Saudi buyers are already exposed to global technology vendors — hyperscalers, global consultancies, niche AI boutiques—as well as emerging local AI champions. A generic value proposition around “advanced AI solutions” is not enough.

Strategic questions we explore in AI market research Saudi Arabia include:

- Where do you genuinely outperform existing options?

- How will you localise your product, pricing and service model?

- Which references and case studies will resonate in a Saudi context?

- How will you demonstrate long-term commitment to the market?

How to Build a Successful AI Market Entry Strategy for Saudi Arabia

A credible AI market entry Saudi Arabia strategy is not a one-page plan. It is a structured process that blends quantitative analysis with qualitative insight and local validation. Typical phases we support include:

Market Sizing and Segmentation

Here, we move from general AI market growth in the GCC to segment-level clarity:

- Define which verticals, customer sizes and regions within KSA matter most.

- Quantify a realistic addressable market for your specific offer, not for “AI in general.”

- Map out current adoption patterns and AI adoption trends in Saudi Arabia for those segments.

Competitive and Partnership Landscape

We look beyond obvious competitors to understand:

- Alternative solutions that solve the same problem without AI

- System integrators, consulting firms and local technology houses that can be partners—or sometimes gatekeepers

- Government-backed programmes and innovation hubs where pilots and co-development are feasible

This feeds directly into your AI strategy development in KSA: where to partner, where to compete, and where to stay out—for now.

Go-To-Market and Commercial Model

For each priority market segment, we help to define:

- Entry to the market: the best entry model – direct, via partners, JV, or local entity

- Sales and business model: channel-driven, platform-based or hybrid

- Pricing strategy: subscription, licence + services, or mixed

- Pilot creation: sample use cases, success metrics, and commercial pathways from pilot to scale

This is where a well-structured AI business plan Saudi Arabia becomes a practical tool for internal alignment and investor communication, not just a funding document.

Feasibility, Risk Scenarios and Execution Roadmap

Finally, a robust AI feasibility study KSA will cover:

- Operational feasibility: localisation, support, hiring, partnerships

- Financial feasibility: realistic, dynamic model with scenarios

- Risk prediction: regulatory environment, competitive responses, talent constraints

- Milestone-based roadmap: where to commit fully and where to stage investments

How Accurate Middle East Supports AI Market Research, Strategy and Planning

Accurate Middle East is a Dubai-based consultancy working in the UAE, Saudi Arabia and the wider GCC, with a strong focus on market analysis, feasibility studies and market entry consulting.

For AI-focused clients, our work typically includes:

AI Market Research Saudi Arabia and GCC

We deliver Saudi Arabia AI industry analysis that goes beyond desk research:

- Interviews with decision-makers and technical buyers

- Assessment of real pain points, not just theoretical use cases

- Mapping of adoption levels, budgets and procurement dynamics in target sectors

- Comparison of Saudi Arabia AI market opportunities with the UAE and other GCC states

This allows clients to understand where to prioritise KSA, where the UAE might be a better first step, and where a joint GCC AI strategy makes sense.

Feasibility Studies and AI Business Plan Development

We support clients with AI feasibility study KSA and AI business plan Saudi Arabia preparation that investors and boards can rely on:

- Financial modelling of realistic adoption curves and revenue trajectories

- Market-backed assumptions based on our research and validation

- Scenario analysis (conservative, base, accelerated)

- Clear logic for required investment, expected returns and risk mitigation

These are not generic documents. They are structured to withstand scrutiny from internal finance teams, investment committees and external investors.

AI Strategy Development in KSA and Market Entry Support

Our team supports AI strategy development in KSA and full AI market entry Saudi Arabia programmes:

- Alignment of AI initiatives with your core business model

- Prioritisation of sectors, use cases and client profiles

- Design of go-to-market and partnership strategies

- Support in identifying and engaging local partners or representatives

- On-ground validation in Riyadh, Jeddah and other key cities

For some clients, we also act as a regional strategic advisor, helping align AI growth plans in Saudi Arabia with broader AI sector growth in the GCC, especially where the UAE serves as a regional HQ and Saudi as the main revenue engine.

Saudi Arabia’s AI Momentum: Why Now Is the Right Time to Act

The combination of Vision 2030, SDAIA’s national agenda, ambitious giga-projects and accelerating private-sector adoption means that AI in Saudi Arabia 2030 will look very different from AI in Saudi Arabia 2025.

The question for market entrants is not whether AI will be important in the Kingdom. That question is already settled. The real questions are:

- Where will you compete?

- How will you differentiate?

- What evidence will you build to demonstrate value quickly?

- Who will guide you through the local reality—beyond headlines and high-level reports?

This is where structured AI market research, feasibility work and AI market entry strategy for Saudi Arabia are no longer optional—they are risk management.

Talk to Us: Let’s Design Your AI Growth Strategy in Saudi Arabia and the GCC

If you are considering an expansion into the Saudi Arabia AI market or planning to refine your AI strategy in the GCC, our team at Accurate Middle East is ready to support you—from first market scan to full AI market entry Saudi Arabia roadmap.

- Reach us directly on WhatsApp via this link.

- Or call our UAE office at +971 50 599 5603 to discuss your plans in confidence.

Prefer to start with a structured brief?

Share your project details using our market research briefing form.

Once we receive your information, we will prepare a tailored proposal for AI market research, feasibility study or business planning in Saudi Arabia and the GCC, typically within 24 hours.

If you are serious about building a resilient, scalable AI business in Saudi Arabia, let’s turn ambition into a concrete strategy—backed by data, grounded in local insight, and designed for long-term growth.