Automation Meets the GCC Growth Wave

Across the Gulf, the conversation around facility management and landscaping has moved from manpower to machines. As the UAE and Saudi Arabia race toward their 2030 sustainability visions, the intersection of technology, hospitality, and real estate development is giving rise to an entirely new market niche — robotic and tech-enabled facility services.

From autonomous lawn mowers quietly trimming the gardens of residential communities to robotic pool cleaners maintaining resort pools in premium communities of Dubai, Abu Dhabi and Riyadh – automation is no longer futuristic. It is practical, scalable, and profitable.

This article, prepared by Accurate Middle East, explains why now is the right time for investors and developers to explore this fast-emerging sector — and how robust market research and feasibility studies can translate technological opportunity into viable business models across the UAE, KSA, and the wider GCC.

Robotic and Tech-Enabled Facility Services Market in the UAE & KSA

Global Momentum: Robotics Redefining Facility Care

Robotic Lawn Mowers

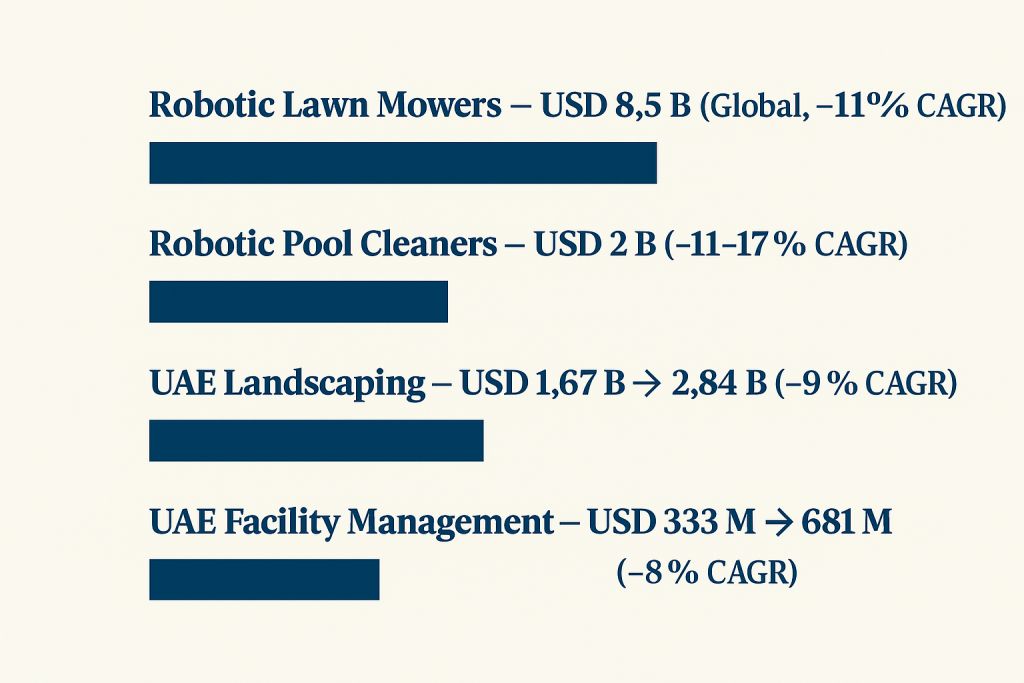

The global robotic-mower market reached USD 8.5 billion in 2024, expanding at a ~11 % CAGR. Europe continues to lead adoption, while professional landscaping contractors and residential communities drive growth elsewhere.

For the Gulf, where year-round landscaping is essential and labor costs are rising, automation offers quantifiable efficiency gains. Leading brands such as Husqvarna, Stihl, and Worx are actively mapping distribution opportunities across the region.

Robotic Pool Cleaners

Valued at around USD 2Bn in 2024, the robotic-pool-cleaner market is advancing at 11 – 17 % CAGR, led by Maytronics (Dolphin) and Zodiac.

These systems combine energy efficiency with smart navigation and remote control — crucial for luxury resorts, villas, and wellness complexes. The strong Maytronics / Dolphin reseller network in the UAE already signals high market readiness.

Together, these 2 categories form the visible layer of a larger smart-maintenance ecosystem: autonomous devices which deliver consistent service standards, reduce water and energy waste, and complement the region’s sustainability agenda and smart-city goals.

Regional Landscape: UAE Market Size & Readiness

Landscaping & Facility-Management Scale

- UAE landscaping market: USD 1.67 billion (2024) → USD 2.84 billion (2030), CAGR ~9 % (TechSci Research).

- Facility-management market: USD 333 million (2024) → USD 681 million (2033), CAGR ~8 % (IMARC Group).

Demand is fuelled by:

- Rapid expansion of residential communities (Emaar, Aldar, DAMAC).

- Continuous resort and hospitality construction.

- Green-building standards and ESG compliance.

- Labor-efficiency goals and service-quality expectations from asset owners.

Technology Drivers

The UAE has become a test-bed for service robotics — from Dubai Municipality’s smart cleaning pilots to Masdar City’s low-carbon facility operations.

With Vision 2031 emphasizing sustainability and digital transformation, integrating autonomous devices into FM contracts now offers tangible ROI: reduced operation cost, measurable energy savings, and enhanced client satisfaction.

Hospitality Boom → Automation Demand

Hospitality growth is the most immediate trigger for this innovation wave:

Total hotel keys ≈ 217,853 (+3 % YoY) ≈ 86 k rooms (300 projects)

Dubai’s share ≈ 56 % of UAE supply (> 157 k keys) Riyadh & Jeddah lead pipeline

Average occupancy (UAE) 78 – 79 % (Aug YTD 2025) ~72 % (major cities)

Every new resort or mixed-use community translates into more lawns, pools, and landscaped areas requiring constant maintenance.

For example, Palm Jumeirah alone hosts ~1,850 private and resort pools. Manual upkeep is costly and inconsistent; robotics ensures continuous standards and data-tracked performance.

As the hospitality sector grows, demand for tech-enabled FM contracts scales with it — linking Accurate ME’s hospitality research expertise with the emerging automation segment.

Saudi Arabia: The Scale Advantage

Under Vision 2030, Saudi Arabia’s giga-projects — NEOM, Red Sea, Diriyah Gate, AlUla — represent one of the world’s largest pipelines of luxury, eco-tourism, and smart-city developments.

Each project integrates sustainability, smart infrastructure, and ESG metrics, creating perfect conditions for autonomous maintenance ecosystems.

Government and private developers are seeking:

- Smart irrigation integrated with IoT sensors.

- Robotic pool cleaners and surface sweepers for hotels and residences.

- AI-based facility management dashboards combining data from robotic devices.

For investors, this alignment means the KSA market offers scale, while the UAE provides stability and proven models. A joint feasibility or pilot across both markets offers optimal regional exposure.

Robotic pool cleaners

Why Now — Five Converging Forces

- Hospitality expansion: Massive new hotel & resort stock → recurring need for pool & landscape maintenance.

- Labor-cost pressure: FM wages rising 8–12 % annually; automation provides predictable OPEX.

- Sustainability mandates: Dubai 2040 Urban Plan → 60 % green/recreational space; automation supports efficient resource use.

- Smart-city agenda: Vision 2030/2031 initiatives accelerate IoT integration & AI FM systems.

- Channel maturity: Existing distributor networks (Maytronics, Husqvarna) reduce entry risk.

Investment Outlook 2025 – 2030

The GCC cleaning-robot market is forecast to grow at ~20.8 % CAGR (MarkNtel Advisors). Within five years, robotic FM solutions will shift from luxury to mainstream, particularly in gated communities, retail parks, and hospitality clusters.

Opportunity zones:

- Distributor partnerships → represent global brands regionally.

- Local assembly or leasing models → reduce import cost & build service contracts.

- Data analytics add-ons → bundle device performance dashboards for operators.

- ESG integration → quantify water/energy savings in sustainability reports.

Feasibility studies at this stage should assess:

- Target segment (hospitality vs residential vs FM contracts).

- Operational climate adaptation (dust, heat, humidity).

- After-sales and training ecosystem readiness.

- Financing and leasing models to accelerate adoption.

Forces Driving Robotic Facility Services

| Segment | Market Size (2024) | Forecast CAGR | Regional Relevance |

|---|---|---|---|

| Robotic Lawn Mowers (Global) | USD 8.5 B | ~11 % | Residential & FM contracts UAE/KSA |

| Robotic Pool Cleaners (Global) | USD 2.0 B | 11–17 % | Resorts & Hospitality GCC |

| UAE Landscaping Market | USD 1.67 B | 9 % | Residential communities & public spaces |

| UAE Facility Management | USD 333 M | 8 % | Commercial & mixed-use projects |

| GCC Cleaning Robots | – | ~20.8 % | Cross-sector automation growth |

Accurate Middle East Perspective

At Accurate ME, we view robotic and smart-maintenance technologies not as gadgets but as the next cost-efficiency frontier for real-estate operators.

Our consultants combine market research, financial modeling, and field validation to quantify these opportunities — whether you plan to:

- Launch a tech-enabled landscaping company in Dubai,

- Import robotic pool cleaners for GCC distribution, or

- Integrate IoT FM solutions into a resort feasibility model in Riyadh.

Future Trends to Watch

- Integration with AI FM Platforms – robots feeding data directly into building-management dashboards.

- Hybrid Leasing Models – “Robotics-as-a-Service” for FM contractors.

- Localized Manufacturing – assembly hubs in UAE free zones to cut logistics costs.

- ESG Reporting Alignment – automation as a quantifiable sustainability metric.

- Cross-sector synergy – hospitality, residential, education, and municipal sectors adopting shared robotics infrastructure.

Automation Meets the GCC Growth Wave

Conclusion — Turning Innovation into Feasibility

The UAE and KSA have entered an investment window where automation meets scale. What began as small robotic gadgets is now becoming a strategic industry driven by green regulations, tourism expansion, and operational efficiency goals.

For entrepreneurs, distributors, and investors, the question is no longer if this market will grow, but how fast you can position yourself. Start with facts. Build your plan on research. Let data guide your entry.

Talk to Accurate Middle East

If you’re exploring an opportunity to launch or extend your business in tech-enabled facility services, smart landscaping, or robotic cleaning solutions in the UAE, Saudi Arabia or GCC region, our team can help you size the market, validate assumptions, and design a solid business model.

📞 Call UAE office: +971 50 599 5603

🕒 Request a callback in the UAE or book a free 20 min consultation

Receive a personalized proposal within 24-48 hours — and turn innovation into strategy across the UAE, Saudi Arabia, and the GCC.