Launch Of a Premium FMCG Brand in the UAE, KSA & GCC: The Safie Tissue Paper Case Study

Entering the UAE, Saudi Arabia, or broader GCC FMCG market demands more than a quality product—it requires strategic clarity, regional insight, and an adaptive go-to-market plan. When Safie Tissue Paper, a premium facial tissue in a carton box format, approached Accurate Middle East in December 2024, they had a strong manufacturing base—but lacked the targeted market strategy to launch effectively in Dubai and beyond.

The GCC FMCG sector continues to expand steadily, driven by strong consumer spending and digital retail growth trends across the region (source).

Launch of New Product UAE KSA GCC Retail FCMG Accurate

The essential questions they needed answered:

- Is there a genuine demand for premium dry tissue paper in the GCC?

- Who is the target consumer, and how do they perceive quality and packaging?

- What price point would both attract and convert buyers?

- What channels and partners would best support the launch?

Over six months, our team delivered a three-phase approach that took Safi from product concept to market-ready. In this case study, we highlight:

-A robust market research and feasibility study

-A market-entry strategy and financial model

-A hands-on business development implementation phase

Market Research & Validation: Is There Opportunity?

Launch a Premium FMCG Brand in the UAE, KSA & GCC

Validating the Idea

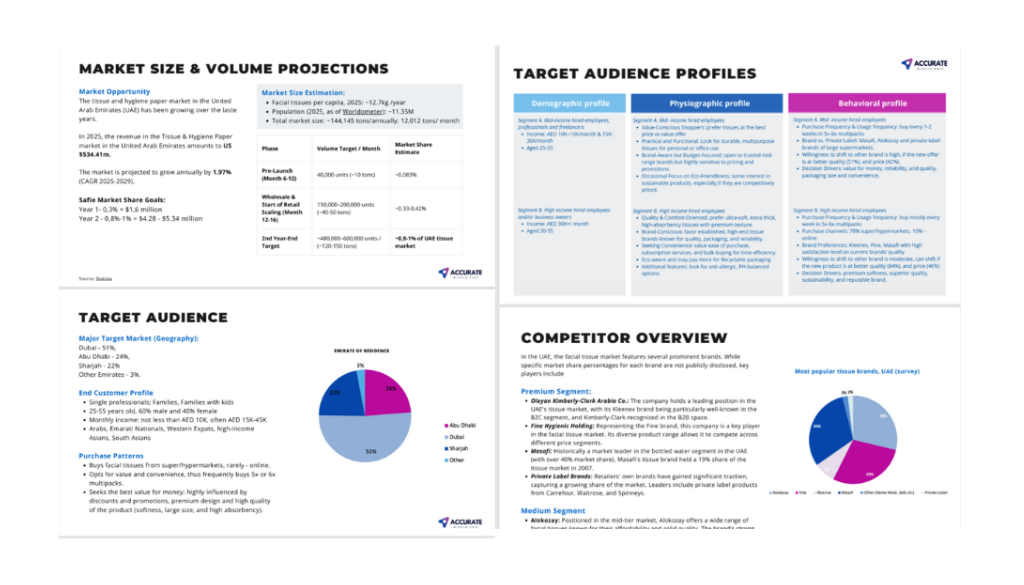

We began by testing the central hypothesis: Do Gulf consumers want — and will they pay — for a premium carton-box facial tissue product? Through secondary market data and our experience across FMCG sectors in the UAE, KSA, Bahrain, and Oman, we noted rising consumer preferences for quality packaging, differentiated features, and eco-friendly positioning—especially among millennials and higher-income households.

Segment Profiling & Consumer Persona Building

We conducted extensive surveys and in-depth interviews with potential end-users—including households, hospitality managers, and office procurement decision-makers. This allowed us to map three distinct personas:

Premium Home Users (Age 30–45, UAE nationals/UAE expats, high-income households)

Preference: stylish, “cozy” cartons for living, bedrooms and guest rooms

Purchase motivators: aesthetics, texture, extra softness, gentle strength

a. Household Buyers (B2C)

b. Hospitality / Hotel / Beauty / Wellness and Sports Segments (B2B)

Preference: high-touch, luxury look, value for money

Purchase criteria: bulk packaging, reliable quality, attractive visual display

Focus Groups & Product Testing

Validation of assumptions:

We organized an online survey and three focus groups (6-8 participants each) and testing of the product in Dubai and Riyadh to gather qualitative feedback on:

- Tissue texture, design and ply feel

- Carton design, opening mechanism, and visual appeal

- Price sensitivity and perceived value vs. existing products

Feedback insights:

Participants appreciated the carton-box for display quality and hygiene compared to plastic boxes. Suggested aesthetic improvements—matte finishes, softer pastel palettes, or bolder contemporary prints for millennial appeal. Validated consumer willingness to pay 10–15% above mainstream brands given notable quality differences.

Brand Messages, Positioning and Guidelines

Based on the findings from our market analysis and consumer insights, we developed a comprehensive branding strategy for the client. This included crafting the ideal portrait of the target audience, defining the core brand messages, and shaping the visual language that would resonate with the premium market segment in the GCC. Our creative team then designed the logo, packaging concepts, and overall visual identity, ensuring alignment with consumer expectations and market positioning. These elements were formalized into a complete brand guideline document — a brandbook — which provided clear direction on logo usage, color schemes, typography, tone of voice, and packaging standards, ensuring brand consistency across all touchpoints and future marketing efforts.

Market-Entry Strategy + Financial Feasibility

Market Entry Plan

– We built a tailored market-entry roadmap with staged milestones:

– Soft Launch (UAE Focus) – Retail test partnerships in Dubai supermarkets, lifestyle stores, and online platforms (e.g. Noon, Amazon.ae).

– Build Awareness – D2C sample boxes and digital promo campaigns on Instagram, TikTok and in-store displays.

– Scale-Up – Expand to KSA, Bahrain, and Oman following successful Dubai launch.

Pricing Strategy

– The brand’s research-backed price positioning: positioned higher than mid-tier to reinforce the “premium” narrative.

– Pricing accompanied by a promotion bundle to help penetration in new categories.

Financial Model & Feasibility

– We crafted detailed financial models projecting cash flow, gross margin, and break-even timeline.

– Sensitivity simulations covered exchange-rate fluctuations, pricing variations, and marketing spend elasticity.

Business Development: Turn Plan into Execution

Sales Training & Activation

We developed a complete training program:

- Product demos, objection handling, and brand story presentation for in‑market sales teams.

- Use of catalogs, sample packs, and campaign materials with visual consistency.

Collateral & Promotional Tools

Designed materials that reflected the high-end positioning:

A-C4 tri-fold catalogs with premium printing finishes.

Branded retail displays, shelf talkers, and sample cartons packaged with POS messaging.

Retailer Introductions

Accurate Middle East leveraged its industry network to open pilot SKUs with:

- Carrefour, Lulu Hypermarket, WestZone in Dubai

- B2B channels for gyms, beauty and HoReCa

Retailers welcomed the differentiated packaging, hygienic value, and store-proof premiums

Outcome & Results

FMCG Product Entry UAE KSA GCC Firm Accurate Middle East

In just a few months, we guided the client through the complete journey from idea to market-ready product:

-

We started by refining the initial product concept and market hypothesis through in-depth research and validation.

-

This was followed by the development of a prototype, tested through focus groups and consumer feedback to ensure the product met premium segment expectations.

-

Finally, we supported the client in transitioning to full production and creating a shelf-ready product, complete with optimized packaging, branding, and sales materials — ready to be showcased in retail outlets.

As a result, the product was successfully introduced to the UAE market, gaining immediate attention from a few national retail chains.

Why FMCG Launches in GCC Need Expert Support

Data Contextualization: GCC market dynamics differ vastly from Western or Southeast Asian benchmarks—contextual pricing, packaging, local preferences.

Market Segmentation Nuance: Success depends on distinct segment strategies—tourism vs home vs office demand cycles.

Retail Navigation: Buyer gatekeeper rules (e.g. MOQ, listing timelines), in-store placement strategies and promotion methods must be local.

Brand Consistency: Premium launches risk dilution without cohesive messaging across all tools and touchpoints.

Cost of FMCG Product Market Entry Package

Transparent pricing helps brands plan investments with confidence. Below is an outline of our FMCG market research, feasibility, and launch support costs in the UAE, KSA, and GCC, based on project complexity and regional coverage.

| Service Scope | Description | Typical Investment (USD) |

|---|---|---|

| Consumer Research & Product Testing | Surveys, focus groups, and analytics to validate market demand | 8,000 – 12,000 |

| Financial Modeling & Entry Plan | Multi-market modeling and price strategy for UAE or KSA (any other GCC country) | 5,000 – 15,000 |

| Development & Launch Support | Sales activation, collateral design, retailer introductions | 15,000 – 18,000 |

| Total (Full 3-Phase Project) | End-to-end FMCG market launch package | 33,000 – 55,000 |

Ongoing support packages also available for brand evolution, pack refreshes, and category extensions.

How to Get Started

Schedule a no-obligation 30-minute consultation with our lead FMCG consultant via WhatsApp/Call/Email. Or fill in the brief for market research and strategy at the LINK>>

Define your product scope—from hygiene to packaged food.

Receive a tailored proposal (scope, timeline, cost estimate) in 72 hours.

Kick off the project, and in 2–3 months receive a full feasibility report and buyer presentation kit.

📧 team@meaccurate.com

📱 WhatsApp / Call: +971 50 559 5603

How to start a Premium FMCG Brand Launch in the UAE, KSA & GCC?

Launching a successful FMCG product in the UAE, KSA, and GCC means going beyond great packaging or a strong product. It requires consumers insight, market awareness, well-positioned branding, finance modeling, and in-market sales activation—all of which Accurate Middle East specializes in delivering.

Our work with Safie Tissue Paper demonstrates the proven path:

- Research & validation to confirm market fit

- Competitive pricing and phased strategy

- Launch support blending expert execution and local know-how

Ready to replicate this success for your brand? Let’s collaborate and transform your FMCG vision into GCC market reality.

| |

Author: | |

| Ekaterina Novikova Senior Researcher | |

| 15+ years of experience in feasibility studies, market studies, business intelligence in the UAE, KSA, and GCC. Senior Researcher at Accurate Middle East Research and Consulting in Dubai. |

Related Article: Business Plan Development in the UAE

A strong product launch begins with a solid foundation — a business plan that connects market insights to financial reality. Our Business Plan Development in the UAE article explains how Accurate Middle East builds data-backed strategies that turn ideas into investor-ready plans. From defining target markets and pricing models to projecting revenues and startup costs, it outlines how the right business plan can transform research findings into profitable execution.