Market Size, Growth, FoodTech Trends & Feasibility Insights (2026–2033)

Last Updated:14 January 2026

Executive Snapshot

Food industry market research in the UAE and Saudi Arabia shows a high-growth, structurally resilient sector, driven by population growth, tourism, digital food delivery, government food-security strategies, and rapid FoodTech adoption. Between 2026 and 2033, the strongest expansion is expected in foodservice, cloud kitchens, food delivery platforms, agritech, and food manufacturing, while food retail continues steady, demand-driven growth.

For investors, operators, and brands, professional market research and feasibility studies are essential to navigate competition, regulation, and cost structures in both markets.

Food Industry Market Research in the UAE and Saudi Arabia 2026-2030

What Is Food Industry Market Research in the UAE and KSA?

Food industry market research is a structured analysis of market size, growth, consumer demand, competition, pricing, regulation, and financial viability across food retail, foodservice, manufacturing, and FoodTech.

In the UAE and Saudi Arabia, it is typically used to:

- Assess market entry or expansion feasibility

- Validate restaurant, café, QSR, or cloud kitchen concepts

- Support investment, licensing, and financing decisions

- Reduce operational and regulatory risk before launch

Why the UAE and Saudi Food Markets Are Strategically Important

The UAE and Saudi Arabia represent the two most dynamic food markets in the GCC, but they differ structurally:

– The UAE is driven by tourism, expatriate demand, premium dining, and FoodTech adoption.

– Saudi Arabia (KSA) is driven by population scale, localization policies, food manufacturing, and long-term domestic demand.

Together, they form a combined opportunity across:

- Food retail and processing

- Restaurants, cafés, and HoReCa

- Cloud kitchens and delivery platforms

- FoodTech, agritech, and sustainable production

UAE and Saudi Arabia Food Market Size and Growth Outlook (2024–2033)

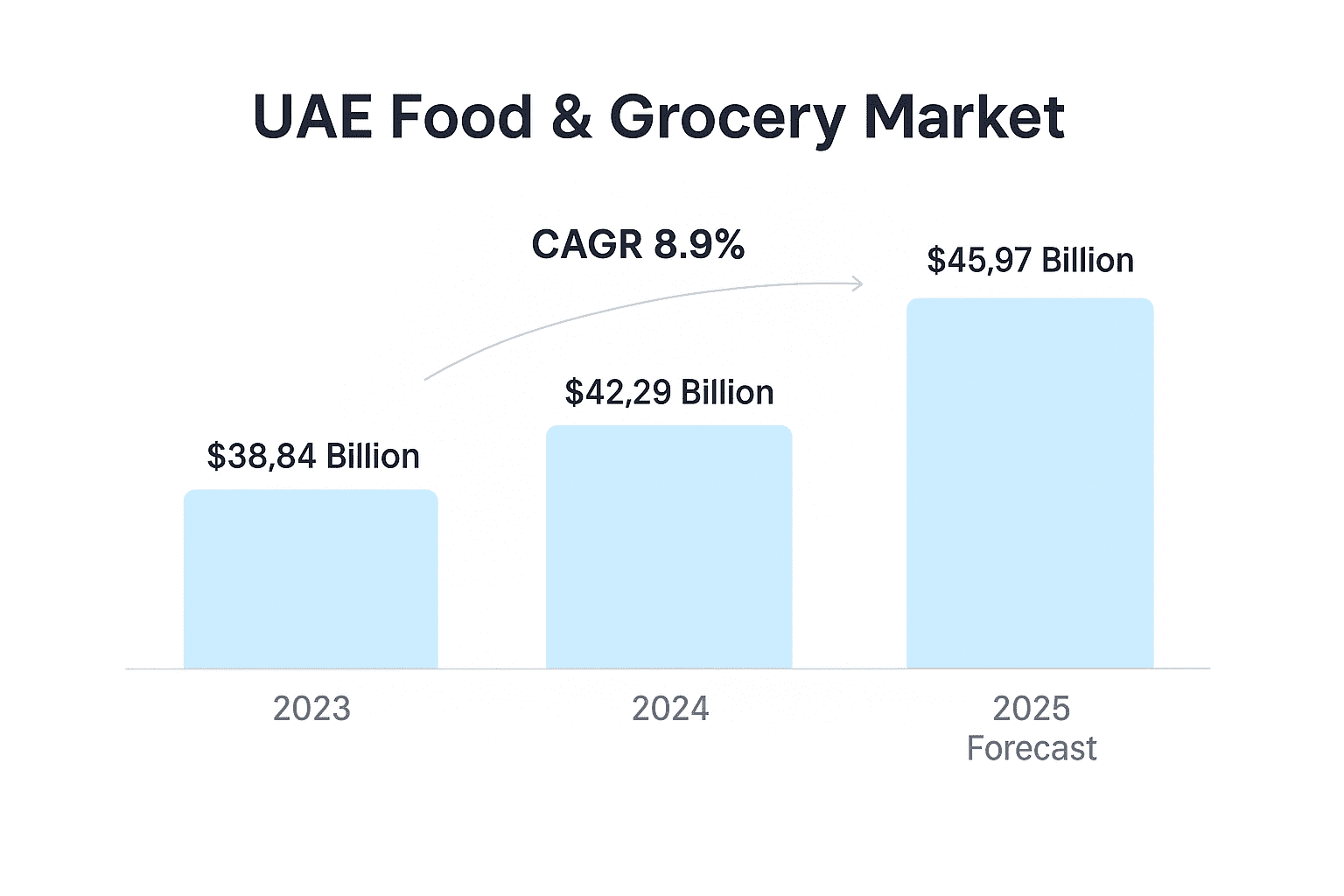

UAE Food Industry Market Size by Segment

The UAE food and grocery retail market reached USD 38.84 billion in 2023 and is forecast to grow to approximately USD 56 billion by 2033, at a 4.1% CAGR.

The foodservice sector is the fastest-growing segment, driven by dining-out culture, tourism, and delivery platforms.

The UAE’s food industry market research shows robust growth across all segments, with foodservice leading in CAGR due to delivery platforms, cloud kitchens, and premium dining demand.

Saudi Arabia Food Market Growth Overview

Saudi Arabia’s food market is larger in absolute volume and supported by:

- Population growth exceeding 36 million

- Vision 2030 localization targets

- Large-scale food manufacturing and processing investments

Key growth areas include:

- Quick-service restaurants (QSR)

- Café chains and delivery-led formats

- Food processing and domestic manufacturing

- Agritech and water-efficient farming

For many brands, UAE entry acts as a pilot, followed by scaled expansion into KSA.

Key Segments of the Food Industry in the UAE and KSA

Food Retail and Processing

Growth is supported by:

- Premiumization of grocery demand

- Rising interest in organic, clean-label, and functional foods

- Government incentives for local food manufacturing and packaging

Food security strategies in both countries aim to reduce import dependency and strengthen domestic supply chains.

Foodservice and HoReCa

The foodservice market includes:

- Restaurants and cafés

- Quick-service and fast-casual formats

- Cloud kitchens and delivery-only brands

Growth drivers:

- High dining frequency among residents

- Tourism-led demand for experiential dining

- Expansion of delivery infrastructure and digital ordering

Key insight: Foodservice delivers the highest CAGR across the food industry in both the UAE and KSA.

FoodTech (Food Technology) and Agritech

FoodTech covers:

- Online food delivery platforms

- Cloud kitchens and dark stores

- AI-driven logistics and demand forecasting

- Vertical and controlled-environment farming

The UAE FoodTech market was valued at ~USD 4.75 billion in 2023 and is projected to reach USD 8.9 billion by 2030.

Valued at USD 4.75 billion in 2023, the UAE’s food technology market is expected to reach USD 8.90 billion by 2030. This covers everything from AI-driven supply chain management to vertical farms that grow crops all year with minimal water use.

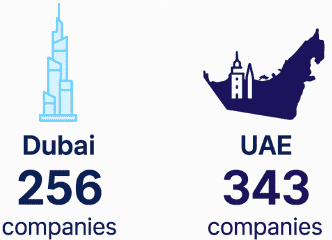

Food Tech Companies in the UAE

- In Dubai alone, the food-tech sector includes 256 companies , of which 45 are funded, raising a collective USD 1.02 billion .

- Nationwide across the UAE , there are 343 food-tech companies , with 48 having secured funding; 15 have reached Series A or higher, and 11 have progressed to Series B.

Online Food Delivery Services in the UAE

- The online food delivery market was valued at USD 720.7 million in 2024 , and it’s expected to grow to USD 1,799.1 million by 2033 , at a CAGR of 10.2% .

- Another report estimates the online food delivery services market at a much higher USD 9,267.3 million in 2024 , projected to reach USD 14,533.3 million by 2030 , attaining a CAGR of 8.3% .

While these figures show market size instead of the number of companies, they highlight the sectors fast growth.

A recent list highlights of key food delivery apps in Dubai and the UAE, include:

-

- Talabat

- Deliveroo

- Careem NOW

- Keeta

- Zomato

- EatEasy

- Carriage

A broader Middle East report lists leading delivery platforms serving the UAE, such as Talabat, Deliveroo, Careem Now, Zomato, plus regional players like Ngwah, AlShrouq Express, Meals on Me, Tawseel, and Supermeal.

Summary Snapshot: FoodTech UAE 2025

| Category | Approximate Number or Notable Players |

| Food-tech companies (UAE) | ~343 (48 funded, 15 Series A+, 11 Series B) |

| Food-tech in Dubai | ~256 (45 funded) |

| Major delivery platforms | ~6–10 prominent names (e.g., Talabat, Deliveroo, Careem Now, Zomato, EatEasy, Carriage, Ngwah, etc.) |

FoodTech Business Opportunities in the UAE and Saudi Arabia

Online Delivery & Cloud Kitchens

- Low-capex, scalable entry models

- Strong alignment with delivery-first consumption

- Increasing competition requires data-driven positioning

- Vertical Farming & Sustainable Production

Large-scale investments, such as the USD 680 million vertical-farming joint venture between Plenty (US) and Mawarid (UAE), highlight the push toward water-efficient local production.

AI, Automation & Smart Supply Chains

- Demand forecasting

- Waste reduction

- Blockchain traceability

These technologies increasingly influence investment decisions.

How to Conduct Food Industry Market Research in the UAE and KSA

How to Conduct Food Industry Market Research in the UAE and KSA

Market research should precede any food business launch or expansion.

Step 1: Define the Scope

- Cuisine or product category

- Service model (restaurant, café, QSR, delivery)

- Geography (city-specific or national)

Step 2: Secondary Research

- Government statistics

- Industry reports

- Paid databases (Statista, Euromonitor International etc)

This stage establishes market size, growth rates, and macro trends.

Step 3: Primary Research

- Required for investment decisions:

- Consumer surveys and interviews

- Competitor benchmarking (menus, pricing, formats)

- Location and delivery economics

Secondary data explains the market. Primary research validates the business case.

In our recent feasibility studies for foodservice and manufacturing clients in the UAE and Saudi Arabia, we see recurring gaps between perceived demand and actual unit economics.

Feasibility Study Framework for Food Industry Projects in the UAE

A tailored feasibility study is the best way to assess opportunities in the UAE’s food sector. A thorough analysis should include:

- Market Analysis: Understand the size, growth rate, and competitive dynamics in retail, foodservice, and technology.

- Demand Forecasting: Consider tourism trends, population growth, and household income data.

- Financial Modeling: Estimate capital expenditures, operating expenses, return on investment, and test different scenarios.

- Regulatory Review: Understand UAE food safety, labeling, and import/export laws, supply chain.

- Risk & Sustainability Assessment: Account for supply chain risks, environmental impacts, and scalability of operations.

Sector-Specific Insights:

- Retail & E-commerce: Demand for convenient, premium, and health-focused products is climbing.

- Foodservice: Cloud kitchens, quick-service restaurants, specialty coffee-shops, and immersive dining experiences are taking a larger share of the market.

- Food Technology: Growth in vertical farming, blockchain traceability, and AI-driven logistics is creating new investment channels.

- Processing & Manufacturing: Government incentives make domestic production increasingly competitive with imports.

Why Professional Food Industry Market Research Matters

The UAE and KSA food markets are high-growth but highly competitive. Assumptions around demand, pricing, or costs often lead to underperformance.

Professional market research and feasibility studies help to:

- Reduce investment risk

- Validate real demand

- Identify profitable niches

- Support financing and licensing decisions.

Food Industry Market Research Services in the UAE and KSA

Accurate Middle East provides:

- Food industry market research and analysis

- Restaurant and café feasibility studies

- FoodTech and agritech market assessments

- Financial modeling and investment support

Coverage includes the UAE and Saudi Arabia, supporting local and international clients across retail, foodservice, manufacturing, and technology.

Conclusion & Next Steps

The food industry market research in the UAE and KSA, and wider GCC shows sectors ready for strong growth, backed by tourism, innovation, and government policies and growth of population. Whether you’re looking into food retail, foodtech, hospitality, manufacturing, or agritech, a specific feasibility study can lower investment risks and find profitable opportunities.

Accurate Middle East focuses on providing detailed market research and feasibility studies for the UAE and Saudi Arabia food industry. This helps clients make informed and strategic decisions. Contact us via WhatsApp or by phone in the UAE +971 50 599 5603. You can also request a callback or a free consultation by clicking the button below or filling out the brief for market research to receive a proposal within 24-48 hours.

Contact us today to discuss your food industry project in the GCC.

| |

Author: | |

| Dr. Elena Zhukovskaya Senior Consultant, Partner | |

| 20+ years of experience in market research, business management, investor relations, and brand communications across the UAE, KSA, and GCC. Author of 50+ publications and a regular speaker at leading business events in the region. |

Related Article: Market Entry for Product UAE & KSA

Thinking about launching your product in the UAE or Saudi Arabia? The process can be complex — from regulations and pricing to choosing the right local partners. Our latest article breaks it all down into a clear, actionable roadmap. Discover every step you need to take to successfully introduce your brand to GCC markets in

-> Market Entry for Product UAE & KSA: A Step-by-Step Guide to Product Launches