In a region where regulation evolves rapidly and investment opportunities emerge at a transformative scale, real estate developers must act with both agility and precision. This article is useful for those developers, real estate companies, investors and strategic partners who are evaluating entry into the UAE and Saudi Arabia (KSA) markets, and who understand that a robust feasibility study is not a cost but a critical differentiator.

We will explore:

- Why the UAE and KSA real-estate markets offer compelling but distinct entry opportunities.

- What the latest data and regulatory shifts imply for your project timetable, risk profile and value creation logic.

- How to structure a feasibility study to give you clarity, defensibility and competitive advantage, rather than a generic “yes/no” report.

- Why partnering with a regional specialist such as Accurate Middle East can significantly elevate your odds of success.

Read on if you are serious about entering the Gulf real-estate sector with strategic intent, not just opportunistic speculation.

Real Estate Feasibility in UAE KSA – Expert Insights

Market Real Estate Context – UAE

Demand, pricing and investor flows

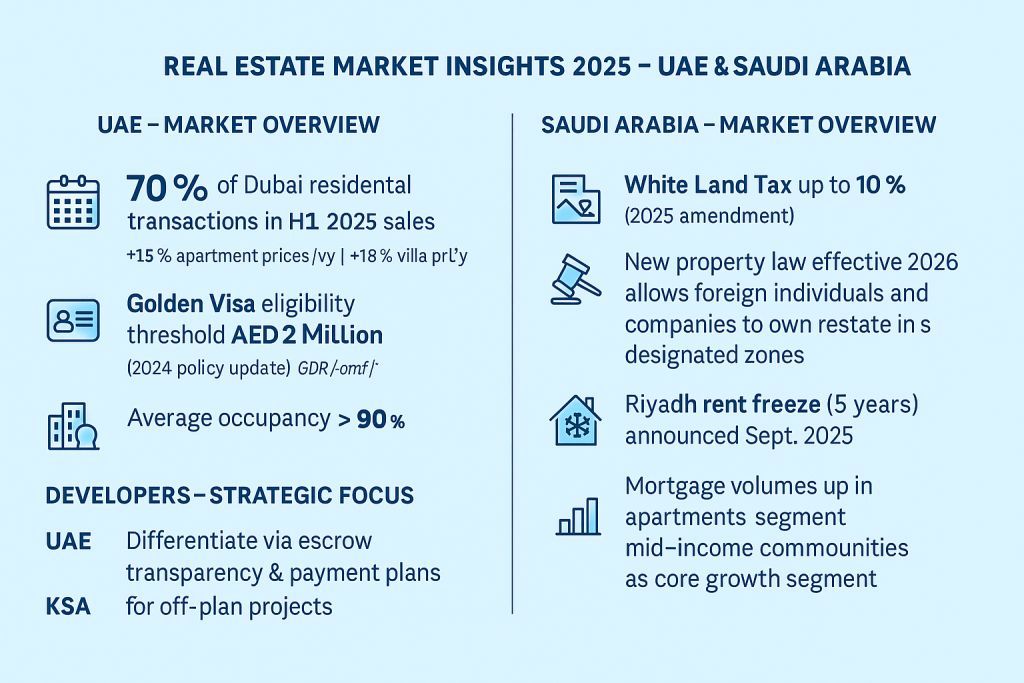

The UAE remains one of the most globally connected real estate markets in the Gulf. According to a Q1 2025 report by CBRE, the market demonstrated resilience despite global headwinds. Moreover, data from the residential segment indicate that in Dubai, apartment prices rose by 15.22 % year-on-year and villas by 17.81 %.

Yet, it is not one-way growth: analysts at Fitch Ratings expect an increase in supply of about 16 % for 2025-2027, which may pressure pricing, especially in commodity segments.

From a developer lens, this implies:

- Off-plan remains a critical channel, especially for capturing investor appetite early.

- Locations with supply discipline or premium amenity differentiation will outperform generic products.

- Margin pressure will emerge in segments with weak payment plans or weak off-plan pipeline.

Regulatory & structural enablers

The UAE’s liberalisation of residency tied to property (for example, eligibility via minimum investment thresholds) remains a strong attractor. Meanwhile, improved transparency, stricter escrow and release regimes across emirates raise the bar for new entrants and emphasise reputational risk.

For feasibility studies this means you must model not just land cost + build cost + sales revenue, but also: escrow fund timeline, buyer deposit profile, cancellation risk, hand over schedule risk, and foreign investment yield expectations.

Strategic entry considerations

When we at Accurate Middle East assess a developer’s UAE opportunity, we focus on four levers:

- Unit mix & target niche – family-sized apartments, townhouses, lifestyle villas (especially in Abu Dhabi) are seeing strongest growth.

- Payment plan design – off-plan with 0–60 % payment until hand-over remains attractive; but entrants must factor in longer funding durations and higher interest-rate risk.

- Launch timing vs hand over timing – with supply pipelines increasing, first-mover advantages shrink if you hand over late in the cycle.

- Exit channel clarity – resale/secondary market liquidity varies by segment; modelling should include 3-5 year hold scenarios.

Market Real Estate Context – Saudi Arabia (KSA)

A strategic pivot in real-estate openness

KSA’s real-estate market is undergoing what many would call a structural transformation. On the regulatory front, the introduction of new off-plan guidelines in early 2025 by Real Estate General Authority (REGA) aims to raise transparency, formalise developer obligations and build confidence in the institutional investor community.

More fundamentally, a new law – effective January 2026 – will allow foreign individuals and companies to own real estate in designated zones across the Kingdom.

For developers, this shift is pivotal: you are moving from a “domestic-only” mindset into a market opening for regional/international capital, with the accompanying disciplines and transparency required.

Market dynamics & timing

Some key features to note:

- The land-bank and ‘white land’ tax regimes (vacant land holding costs) are intensifying. The amended White Land Fee Law includes variable tiered rates up to 10 % for idle land.

- Foreign investor tax/treatment is being improved; for example, reports suggest taxes for non-Saudi investors have been cut to 5% in certain instances.

- While full foreign ownership is set to take effect in 2026, early-mover developers with local partnerships are already positioning themselves for the upswing.

Feasibility implications

From a feasibility standpoint in Saudi Arabia you need to treat the market as “first phase” of global opening, not a mature market. The implications:

- Partner selection is strategic: you will need a local anchor (land, off-plan registration, approvals) plus an international track record to unlock trust and capital.

- Regulatory roadmap must be explicit: licensing, Wafi-compliance for off-plan sales, escrow setup and reporting to REGA must all be modelled.

- Land cost & holding risk are rising: the white land tax introduces a cost of delay; your model must include sensitivity to timeline slippage.

- Demand segmentation is evolving: Rather than only high-luxury products, mid-housing for Saudi nationals, staff housing for corporates, and build-to-rent are emerging sub-themes.

Comparative Feasibility Framework for UAE vs KSA

Key feasibility dimensions

When conducting a feasibility study for a real estate development in UAE or KSA, we recommend focusing on the following core dimensions:

- Market sizing & absorption – What is the realistic demand pool? Buyer vs tenant splits? End-user vs investor?

- Competitive supply pipeline and risk – How many units are likely to come to market in your timeframe? What is the vacancy risk? (e.g., UAE supply increase for 2025-27)

- Regulatory/regime risk – Entry requirements, escrow regime, foreign ownership rules, taxation, white land risk.

- Financial modelling – Land cost, build cost, interest rate/financing, sales revenue, timing, hand-over schedule, cancellation risk, exit assumptions.

- Go-to-market/branding/positioning – Are you delivering commodity or differentiated products? Which segment, what price-per-sq-m, what payment-plan?

- Exit strategy & liquidity – Especially for investor driven products, what resale market and yield assumptions can you model?

Feasibility Study for Real Estate Development in UAE and Saudi Arabia Accurate ME

Where UAE and KSA differ (and what that means for developers)

- Speed to market: UAE is more developed, with more established institutional frameworks; KSA is opening up and offers first-mover advantages but inherently more timeline and regulatory risk.

- Product mix: In UAE, luxury, foreign investor led off-plan remains strong; in KSA, mid-housing, mixed-use and early foreign-entry zones may deliver stronger margins because of scale and policy backing.

- Pricing/valuation environment: UAE prices have grown strongly (e.g., Dubai residential up ~15-17 % y/y) and are also facing supply and correction risks. KSA pricing still has upside with structural tailwinds (Vision 2030, giga-projects).

- Regulatory burden & transparency: Both markets demand high compliance but KSA is building its regulatory architecture in real-time – which means your feasibility study must include “regime-build risk” or scenario modelling.

- Land/holding cost risk: KSA’s white-land tax increases risk of holding land dormant; in UAE heritage land cost is high but holding cost risk is better understood.

Feasibility Study Packages for Real Estate Developers (UAE & Saudi Arabia): Approx. Timeline & Fees

| Project Scale | Typical Scope | Approx. Timeline | Estimated Cost (AED) | Estimated Cost (SAR) |

| Small Project | Residential or boutique mixed-use concept up to ~100 units. Includes concise market research, basic financial model, and short feasibility summary. | 2-3 weeks | 30,000 – 40,000 | 32,600 – 42,800 |

| Medium Project | Mid-size development (150 – 300 units) or multi-phase residential cluster. Includes full market and pricing analysis, demand modeling, and 5-year financial feasibility. | 3–5 weeks | 45,000 – 65,000 | 47,900 – 67,300 |

| Large Project | Master community, mixed-use or investment-grade asset. Comprehensive feasibility with regulatory pathway, scenario modeling, investor deck, and financial sensitivities. | 7-8 weeks | 80,000 – 120,000 | 82,600 – 122,200 |

Optional Add-Ons

| Add-On | What You Get | Extra Days | AED | SAR |

| Primary Expert Interviews (4-5) | Transcript insights, pricing margins, on-the-ground validation | 4–6 | 12,000 | 12,240 |

| On-Site Market Audit (UAE or KSA) | Site visits, photo log, micro-market checks, broker round-table | 3–4 | 9,500 | 9,690 |

| Valuation Companion (RICS format) | Independent valuer coordination + valuation annex | 5–7 | 18,000 | 18,360 |

| Interactive Dashboard (Power BI) | KPIs, pricing heatmaps, absorption tracker, exportable charts | 6–8 | 16,000 | 16,320 |

Sample Feasibility Study Cases for Developers – Accurate ME

Case 1 – Residential Mid-Rise Project in Dubai

Client request:

A regional developer sought to assess the financial and market viability of launching a 180-unit residential tower in Dubai’s Jumeirah Village Circle.

Our scope:

Accurate Middle East delivered a full feasibility study including demand forecasting, off-plan competitor analysis, and payment-plan benchmarking.

Result:

The study identified a sustainable price corridor (AED XX – XX / sq.ft) and validated a positive IRR of 19 %, enabling the client to secure project financing and proceed to design stage.

Case 2 – Mixed-Use Community in Riyadh

Client request:

A Saudi investment group needed validation for a 600-unit mixed-use development combining residential, retail, and serviced apartments.

Our scope:

We analyzed land-use regulations, White Land Tax implications, and modeled three development phasing scenarios under the Vision 2030 housing initiatives.

Result:

Accurate Middle East recommended a phased construction model that reduced upfront capital by 22% while maintaining target yield. The project was approved by the board and moved into JV structuring.

How Accurate Middle East Approaches Your Feasibility Study

Because we specialise in GCC market-entry for real estate and infrastructure, we deploy a structured six-step feasibility protocol:

- Market Diagnostic – Detailed demographic, investor vs end-user demand, absorption benchmark, pricing trajectory.

- Competing Supply & Pipeline Mapping – Identify what product is forthcoming in your sub-market, what your product will be measured against.

- Regulatory Audit – Deep dive into land ownership, off-plan licensing, escrow regime, permission-timing, foreign-ownership rules (especially in KSA for 2026 opening).

- Financial Model Build-Out & Sensitivity Analysis – Land & build cost inputs, payment-plan modelling, cancellation risk, interest rate sensitivity, exit assumptions, hold-period scenarios.

- Go-to-Market Positioning & Risk Mitigation – Product strategy, target segment, brand/amenity premium, payment-plan design, buyer incentives, localisation of sales/outreach.

- Implementation & Contingency Planning – Hand over timeline risk, milestone monitoring, cost overrun buffers, eventual exit or JV path.

Our deliverable is a developer-ready feasibility report (PDF + executive slide deck) that goes beyond “is it feasible?” to “how do we win?” and “what must we monitor / mitigate to succeed?”.

Talk to Us

For any developer or investor seeking a meaningful entry into the Gulf real-estate arena in 2025 – whether targeting the advanced ecosystem of the UAE or the structurally opening environment of KSA – the key is rigorous feasibility backed by regional intelligence, regulatory foresight and execution discipline.

At Accurate Middle East, we combine 15+ years of GCC-consulting expertise, data-driven market intelligence and on-the-ground partnerships to give you a feasibility study that’s not just informative but action-oriented.

To discuss your project, or to receive a tailored proposal for a feasibility study covering UAE, Saudi Arabia and the broader GCC, please, contact us on WhatsApp at +971 50 599 5603 or call our Dubai office. You can also schedule a free consultation or request a detailed brief via our form here. We promise a custom-designed response within 24 hours.

Let’s turn your real estate ambitions in the UAE, KSA, and GCC into a structured, executable reality.

| |

Author: | |

| Ekaterina Novikova Senior Researcher | |

| 15+ years of experience in feasibility studies, market studies, business intelligence in the UAE, KSA, and GCC. Senior Researcher at Accurate Middle East Research and Consulting in Dubai. |