Why B2C Market Research Is the Gateway to Consumer Markets in the Gulf The UAE and Saudi Arabia represent two of the most rapidly evolving consumer markets in the world. Fueled by ambitious government visions — Saudi Vision 2030 and UAE Centennial 2071 — the region is experiencing a transformation in how people shop, live, and spend. Yet for companies aiming to enter these markets, success is not automatic.

B2C market research UAE KSA Saudi Arabia

Consumer expectations are shifting, e-commerce adoption is accelerating, and retail landscapes are becoming more competitive. This makes B2C market research in the UAE and KSA a decisive first step.

This article provides a detailed guide to: How to conduct B2C market research in the Gulf. Which methods and companies are best suited for gathering reliable insights. The role of consumer insights, e-commerce trends, and retail analysis in shaping winning business strategies. Why Accurate Middle East is the partner of choice for businesses seeking feasibility studies, market analysis, and consumer research in the GCC.

How to Conduct B2C Market Research in the GCC

Conducting B2C market research in the UAE and Saudi Arabia requires a different approach than in Western markets. Unlike in Europe or North America, reliable consumer data is not always openly available. Cultural preferences, local regulations, and rapid digital transformation make standardized global models insufficient. At Accurate Middle East, we use a three-dimensional approach: Consumer Behavior Studies – In-depth surveys, ethnographic studies, and digital behavior analysis reveal how people choose products and services. Retail & E-commerce Analytics – Combining POS data, online shopping platforms, and market intelligence to uncover demand patterns.

Competitor and Brand Benchmarking

Mapping how existing players position themselves in terms of pricing, channels, and marketing strategies. This approach ensures that research is not abstract, but directly tied to business questions like: Should I launch this product in Riyadh or Dubai? What price range works? Which channels should I prioritize? B2C Market Research: Core Components B2C market analysis in the Gulf region can be broken down into several essential elements: Market Sizing & Forecasting: Estimating the value of the consumer market — e.g., the UAE e-commerce market is forecasted to reach US$16.3 billion by 2030, while Saudi Arabia’s e-commerce market will exceed US$27 billion.

B2C market research tools 2025 trends UAE KSA

Consumer Segmentation

Identifying groups by age, nationality, income, and lifestyle. For example, Saudi Arabia’s youthful population is highly digital, while Dubai’s consumer base includes diverse expatriate segments.

Cultural & Lifestyle Insights: Religion, tradition, and social norms affect product acceptance — from food & beverages to luxury goods.

Channel Analysis: Mapping offline retail, malls, social commerce, and digital marketplaces like Noon, Namshi, and Amazon.sa.

B2C Market Research Companies

B2C Market Research Methods in the Gulf UAE KSA

Why Local Presence Matters? There is a clear difference between reports created abroad and research conducted on the ground. Many international agencies provide generic data, but fail to capture consumer specifics in the Gulf. When evaluating B2C market research companies in the UAE and Saudi Arabia, look for firms that:

- Operate local field teams for surveys and focus groups.

- Have at least 5 years of experience in GCC consumer research.

- Provide custom insights rather than recycled global reports.

- Cover both online and offline retail channels, which remain equally important in the region.

Accurate Middle East offers these advantages. With offices in Dubai and projects across Riyadh, Jeddah, Doha, and beyond, we combine global methodology with Gulf-specific expertise.

B2C Market Research Methods in the Gulf (GCC)

When to Use Quantitative Surveys Online/mobile surveys targeting different consumer segments.

| Method | Application in UAE & KSA | When to Use |

|---|---|---|

| Quantitative Surveys | Online/mobile surveys targeting different consumer segments. | Estimating demand for new products or services. |

| Focus Groups | Group discussions uncovering attitudes, perceptions, and motivations. | Testing marketing campaigns or product concepts. |

| Mystery Shopping | In-store evaluation of retail service quality and consumer experience. | Benchmarking against competitors in malls or supermarkets. |

| Digital & Social Analytics | Analysis of online engagement, social commerce, and consumer reviews. | Assessing e-commerce platforms and digital marketing performance. |

| Ethnographic Studies | Observing consumer behavior in real-world settings. | Understanding cultural nuances, especially in food, fashion, and healthcare. |

By combining these approaches, Accurate Middle East ensures that B2C market research is not just data collection but a strategic decision-making tool.

UAE E-Commerce Market

A Digital Powerhouse The UAE e-commerce market has become one of the fastest-growing in the world. Valued at nearly US$12 billion in 2023, it is projected to reach US$16.3 billion by 2030, supported by:

- High internet and smartphone penetration.

- Government support for digital payment systems.

- Dubai’s positioning as a regional retail hub.

Categories leading this growth include electronics, fashion, and food delivery, but new verticals like healthtech and online education are gaining traction.

Market Research in Dubai: Understanding the Consumer

Dubai has become the region’s consumer capital — a city where global brands test products, study shopper behaviour, and launch new retail concepts before scaling across the GCC. Conducting market research allows businesses to understand diverse consumer groups, from luxury buyers and digital natives to price-conscious expatriates. The city’s unique mix of cultures and advanced retail infrastructure make it the perfect environment for focus groups, pilot product testing, and e-commerce analytics. For any company entering the GCC market it serves as both a proving ground and a strategic hub for building regional consumer insight.

Market Research in Abu Dhabi: Data for Long-Term Growth

Abu Dhabi represents a different side of the UAE market — strategic, institutional, and focused on sustainable growth. Conducting market research in Abu Dhabi helps investors and companies understand government-led demand, industrial diversification, and the lifestyle shifts shaping consumer behavior in the capital. From healthcare and edtech to retail and real estate, market insights in Abu Dhabi reveal business opportunities. For brands and startups, this research is key to aligning business plans with the emirate’s long-term economic vision and investment priorities.

Saudi Arabia E-Commerce Market: Scale Meets Vision 2030

The Saudi Arabia e-commerce market reached US$23 billion in 2023, with projections of US$27.1 billion by 2030. Its expansion is driven by:

- A large, youthful population (over 60% under 35).

- Government-backed initiatives to digitize retail.

- Integration of mega-projects like NEOM into retail innovation.

Unique to Saudi Arabia is the rise of social commerce, with consumers increasingly making purchases via Instagram, Snapchat, and TikTok.

GCC Consumer Market Research – Regional Dynamics

While the UAE and Saudi Arabia lead, the broader GCC offers equally promising opportunities. Qatar, Kuwait, Oman, and Bahrain share characteristics and trends such as:

- High disposable income, switching of mid-income customers to luxury and premium goods.

- Strong mall culture alongside digital growth (the UAE and GCC one of the fastest growing ecommerce markets due to high tech adoption and the young age of the population).

- Government incentives, growth of retail spaces, new initiatives for retail customers to attract international brands.

A regional approach to B2C research ensures that companies avoid siloed strategies and instead capture synergies across Gulf states.

B2C market research tools 2025 trends UAE KSA

Retail Trends in the UAE and Saudi Arabia

Consumer preferences are shifting across both countries:

Immersive Retail: 79% of UAE consumers and 77% of Saudis prefer stores that offer interactive experiences.

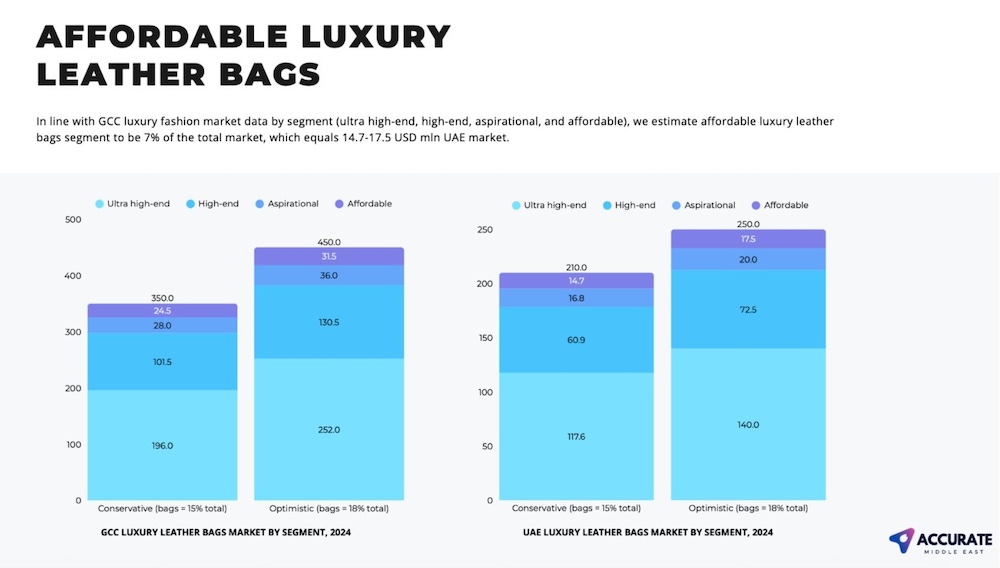

Luxury Consumption: The GCC luxury fashion market reached US$5.2 billion in 2023, growing nearly 10% annually.

Clean Beauty & Health: The Gulf’s beauty market will exceed US$60 billion by 2025, with clean beauty alone forecasted at US$2.6 billion.

Omnichannel Retailing: Consumers demand a seamless link between online and offline shopping.

These trends underline why consumer insights in UAE & KSA must be tailored to both digital-first strategies and physical retail experiences.

Case Studies: Turning Consumer Insights Into Market Advantage

Case 1: Entering the Emirates Fast Fashion Market

A European fashion retailer approached Accurate Middle East to assess entry into the Dubai and Abu Dhabi markets. Through consumer surveys, retail benchmarking, and mall traffic analysis, we discovered that:

- Millennials and Gen Z were highly engaged with online shopping.

- Expatriates preferred international brands, while locals sought exclusivity.

- Optimal entry required a hybrid model: flagship mall stores supported by an aggressive digital strategy.

Within 18 months, the client launched in two premium malls and achieved 30% above forecasted sales in year one.

Case 2: Launching an EduTech Platform

A European EduTech startup approached Accurate Middle East to evaluate the viability of launching a subscription-based learning platform for students and professionals in the UAE.

Research Approach:

- Consumer surveys across parents, university students, and working professionals.

- Focus groups to explore attitudes toward digital education, perceived quality vs. traditional learning, and price sensitivity.

- Competitor benchmarking against regional e-learning and tutoring services.

Findings:

- The largest challenge was trust and credibility — parents and students were cautious about replacing traditional tutoring.

- Target audiences were willing to pay, but only if localized content and Arabic-language support were included.

- Subscription models worked best with tiered pricing (basic access vs. premium features).

Impact: The EduTech platform launched with localized courses and adaptive pricing, achieving 30% higher adoption in the first six months than forecasted.

Case 3: Tissue Paper Market Testing

Launch of New Product UAE KSA GCC Retail FCMG

A consumer goods company wanted to launch a new tissue paper brand in Dubai and Abu Dhabi. The goal was to learn about quality expectations, packaging preferences, and reasons households might switch brands.

Research Approach:

- Focus groups with families and young professionals tested different product samples.

- Surveys measured purchase behavior, preferred formats (box vs. pocket packs), switching patterns and brand loyalty.

- Observation studies in retail outlets, competitor analysis looked at shelf visibility and packaging appeal.

Findings:

- Consumers valued softness and durability above all other features.

- Packaging design had to balance premium aesthetics with clear functionality.

- Many households were open to switching brands if pricing was competitive and distribution was wide.

Impact:

The product was launched with packaging redesigned to emphasize softness and premium comfort. Within a year, the brand secured distribution in three leading supermarket chains in the UAE.

Case 4: Innovative Beverage in New Packaging – Market Perception Study

An international beverage company planned to introduce a new drink in a unique, eco-friendly package in the UAE. The Client wanted to understand how consumers felt about it before the launch, if there were some concerns or fears or stoppers.

Research Approach:

- In-depth interviews with early adopters and health-conscious consumers.

- Focus groups to uncover emotional reactions, perceived risks, and barriers to trying the product.

- Concept testing with visual prototypes and comparison to competitors.

Findings:

- While consumers valued sustainability, the novel packaging created doubts about safety and taste.

- Some participants of the research confused the packaging with different type of materials, which led to incorrect associations.

- Marketing communications needed to inform and reassure buyers about safety and quality.

Impact: The company repositioned its campaign to focus on health + eco-safety messaging. The result: a successful launch in UAE supermarkets, with consumer acceptance reaching 70% within the first quarter.

B2C Market Research in UAE & Saudi Arabia

Why Choose Accurate Middle East for B2C Market Research in GCC

Accurate Middle East is not just a research provider. We are your strategic partner in:

- Market entry and go-to-market strategy.

- Feasibility studies tailored to consumer-facing industries.

- Business planning with realistic financial projections.

- Ongoing consumer insight tracking across the GCC.

Our value lies in turning data into clear business decisions — where to enter, what to launch, how to price, and how to grow.

Talk to Us Today

Partner With Accurate Middle East The Gulf is an exciting consumer market — but it is also complex. B2C market research in the UAE and Saudi Arabia provides the clarity needed to navigate cultural and business norms, regulatory and legal requirements, and fast-moving consumer behaviors.

📞 Ready to unlock the GCC consumer opportunity? Connect via WhatsApp.

Call us directly +971 50 599 5603

Prefer written contact? Fill in our brief form and receive a customized proposal within 24 hours. Whether you need a sample feasibility study, a consumer research framework, or a full market entry strategy, Accurate Middle East is here to build your success in the GCC.

| |

Author: | |

| Ekaterina Novikova Senior Researcher | |

| 15+ years of experience in feasibility studies, market studies, business intelligence in the UAE, KSA, and GCC. Senior Researcher at Accurate Middle East Research and Consulting in Dubai. |

Related Article: Launch of FMCG Product in the UAE Market

Consumer goods remain one of the most competitive and fast-moving sectors in the Gulf. Our recent FMCG product launch study in the UAE explores how local and international brands navigate pricing, packaging, and distribution challenges — and what insights drive successful entry into supermarkets and e-commerce channels. The article also highlights real market testing results, showing how data-driven strategy can reduce launch risks and improve shelf performance.