Unlocking solar-project opportunities across the Gulf with data-driven intelligence

Why are we writing this article? Because any serious player looking at the GCC solar market needs rigorous market analysis, viability modelling and regional intelligence – not just headline numbers. If you’re exploring solar energy market entry, solar projects in the UAE or Saudi Arabia, or a broader GCC rollout, this article supplies:

- A concise snapshot of market size, trajectory and key regional projects in the UAE and KSA

- Insight into regulatory frameworks, capacity targets and feasibility criteria that determine “bankable” solar developments

- A clear explanation of how professional consulting services (market research + feasibility study + business-plan support) make the difference between speculative hope and actionable strategy

You should read this if you are a developer, investor, EPC supplier, energy entrepreneur or industrial end user exploring solar in the UAE, Saudi Arabia or beyond in the GCC. By the end you’ll know why you might commission a feasibility study, how to evaluate the major metrics and what “entry readiness” looks like.

Solar Energy Market in the UAE & Saudi Arabia

GCC Solar Energy Boom – Why the UAE and Saudi Arabia Lead the Region

Two of the most dynamic solar markets today are the United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA). Their policies, project pipelines and strategic imperatives make them the logical starting point for any solar-market play in the Gulf.

The UAE solar energy market is valued at approximately USD 6,4 billion in 2024 with its size is projected to reach ~73.5 TWh by 2033 — up from ~11 TWh in 2024 (CAGR ~22.3%) according to recent data. The country receives, on average, ~3,568 hours of sunshine per year and peak sun hours of ~5.8 hrs/day, creating ideal solar resource conditions. Source

Solar energy market report

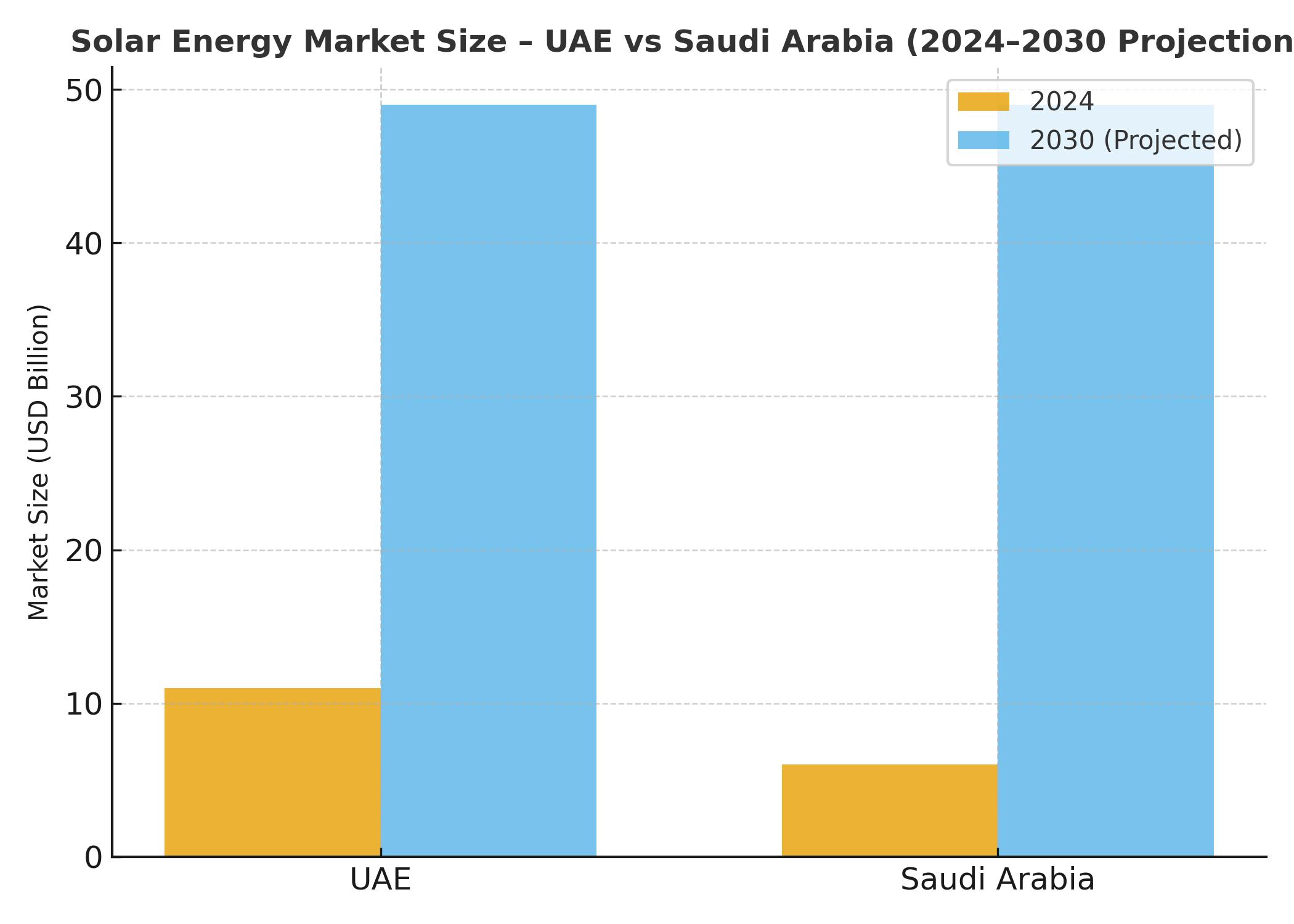

In Saudi Arabia, as per the experts, the solar energy market is valued at approximately USD 6 billion in 2024 and projected to reach ~USD 49 billion by 2030 (CAGR ~42%). Тhese growth rates reflect national renewable/solar targets (e.g., multiple gigawatts of solar tenders annually) and a commitment to diversify away from fossil-fuel-only power.

For companies considering GCC market entry, this means: the prize is real, the momentum is accelerating, and the entry window is now. But gaining meaningful traction requires more than entering the market – it requires a robust feasibility study, market sizing, regulatory modelling, and on ground intelligence.

Solar Market in the UAE – Capacity, Projects & New Developments

The UAE solar market is anchored by major state-led programmes and large scale IPP projects. A few key highlights:

- The iconic Mohammed bin Rashid Al Maktoum Solar Park (MBR) in Dubai is one of the world’s largest single site solar parks under an IPP model and will exceed 5 GW capacity by 2030.

- In Abu Dhabi the 2 GW Al Dhafra Solar PV project was commissioned in mid 2023 and achieved industry leading tariffs (e.g., USD 1.32 c/kWh) as an indicator of the capital intensity and competitive dynamics.

- The UAE’s renewable energy target includes scaling clean energy share, deploying solar at scale, and attracting associated manufacturing and local content value chains. For example, the solar energy systems market in the UAE (revenue basis) USD 2.8 billion by 2030 (from USD 0.7 billion in 2022).

- The rooftop solar PV segment in the UAE is also growing — one projection puts the market at USD 5.11 billion by 2030 (CAGR ~8.7%).

For feasibility studies, this means you must model: high irradiance, regulatory changes, evolving tariff structures, grid access costs, regional rules, and competitive procurement dynamics. Our consulting team at Accurate Middle East supports developers and EPCs in sizing opportunities by emirate (Dubai/Abu Dhabi) and by segment (utility vs rooftop vs industrial) to guide partner screening and business planning.

Solar Market in Saudi Arabia – Scaling from Pilot to Mega Projects

Saudi Arabia’s solar story is equally compelling, yet different in scale and structure.

- The country’s utility scale solar pipeline is vast: for example, several projects totalling multiple gigawatts have been awarded in 2024-25. Recent market research reports the solar PV market value at USD 3.92 billion in 2023, forecast to reach USD 44.9 billion by 2029 (CAGR ~49.9%).

- The share of solar within the wider renewable energy target (wind + solar) is very high — one source estimates solar accounts for ~93.9% of the renewable energy market in 2024.

- Solar resource quality is exceptional. For example, one dataset for the Kingdom shows average annual Global Horizontal Irradiation (GHI) ~2,227.5 kWh/m² and Photovoltaic Power Output (PVOUT) ~1,899 kWh/kWp per year.

- Large scale procurement and low tariff bidding are characteristic: mega parks of 1 GW+ are the norm, often backed by sovereign/off-taker frameworks, which increase the need for robust feasibility modelling.

For any company evaluating entry into the Saudi solar market, a feasibility study must incorporate: land-acquisition logistics (often desert terrain), grid interconnection timelines, PPA structuring, domestic content/local manufacturing ambition, and detailed cost modelling under competitive bid scenarios.

Market Size, Investment Pipeline and Cost Trends

Understanding market size and cost trends is essential for sound business planning and feasibility analysis.

- In the UAE, the solar energy market (in generation terms) is expected to reach ~73.5 TWh by 2033, up from ~11 TWh in 2024 (CAGR ~22.3%).

- Market revenue data: the UAE solar energy systems market was USD 0.7 billion in 2022 and projected to reach USD 2.8 billion by 2030.

- In Saudi Arabia: the market value was around USD 6 billion in 2024 and estimated to reach USD 49 billion by 2030 (CAGR ~42%).

- Also, the competitive cost of solar is clearly visible — both markets are achieving world class tariffs: for example in UAE a project achieved USD 1.32 c/kWh. (see prior section)

- The solar PV panels market in Saudi Arabia alone was USD 1,023.5 million in 2023 and projected to reach USD 1,123.1 million by 2030 (though growth is slower in equipment-only segments).

As your consulting partner, Accurate Middle East builds market models that reflect these metrics: installed capacity growth, tariff curve trajectories, equipment cost sensitivities, local content impact, and pipeline conversion probability — all customised to your project scope and geography.

Regulatory and Licensing Framework

Entering the UAE or KSA solar markets means navigating complex yet increasingly transparent regulatory and licensing landscapes. That is where professional advisory pays off.

UAE:

- Each emirate has its framework (e.g., Dubai Electricity and Water Authority (DEWA) in Dubai; Abu Dhabi Water & Electricity Authority (ADWEA)/Emirates Water and Electricity Company (EWEC) in Abu Dhabi).

- IPP model, competitive bidding, fixed term PPAs, and associated land leases.

- Emerging local content rules, grid access tariffs, storage integration considerations.

Saudi Arabia:

- The Saudi Power Procurement Company (SPPC) issues tenders; streamlined environmental/permitting routes are now well defined.

- Local content thresholds, domestic manufacturing ambitions, large scale land packages, desert site clusters in North/Tabuk regions.

- Utility-scale dominates; distributed/rooftop is still emerging but gaining traction.

Our consulting approach for feasibility studies typically includes: mapping the regulatory step-by-step for each jurisdiction, estimating time/hurdle for land+grid+licence, modelling PPA rate sensitivities, and assessing local content incentives and risks.

Solar Energy Feasibility Study – What Clients Must Assess

Solar Energy Market Research and Feasibility Study UAE Saudi Arabia

For an investor or developer thinking of launching a project in the UAE or Saudi Arabia, commissioning a proper solar-feasibility study is indispensable. Here are its core components:

- Technical assessment: Solar irradiation data (GHI/DNI), shading, site layout, module performance, lifetime degradation. For example, Saudi Arabia’s PVOUT data (~1,899 kWh/kWp) underscores high resource yield potential.

PVKnowhow - Market assessment: Pipeline of tenders, tariff trends, competitive benchmark projects (for example UAE’s Al Dhafra 2 GW project).

- Financial modelling: CAPEX/OPEX, debt/equity structuring, LCOE (Levelised Cost of Energy), ROI, IRR.

- Regulatory & licensing: Permits, grid access costs, land lease costs, off-take risk, regulations.

- Business planning: Strategic positioning (EPC vs IPP vs O&M), partner selection, supply chain risk, market entry sequencing.

- Market sizing and segmenting: Opportunity by geography (emirate or region in Saudi Arabia), by sector (utility, commercial & industrial, rooftop) and by product (PV modules, trackers, storage).

Our team at Accurate Middle East designs a bespoke “feasibility package” for solar projects which integrates all these layers — and we tailor this to developer/investor role, geography, scale and timeline.

B2B Opportunities – EPC, O&M, Component Suppliers

Beyond power generation, the growth of solar in UAE & KSA creates strong B2B service market opportunities. And you should factor these in your business plan.

- EPC and O&M firms are in demand: as utility parks scale into multiple gigawatts, long term operations contracts and maintenance packages are vital.

- Component supply chain: solar modules, inverters, tracking systems, energy storage systems — many global manufacturers now look to Gulf base plates or regional hubs. For example the UAE PV panel manufacturing market is increasingly studied.

- Rooftop and commercial/industrial solar: In the UAE, the rooftop solar PV market is projected to reach ~USD 5.11 billion by 2030.

- Service models such as solar-as-a-service, lease models, shared solar deserve careful evaluation in your feasibility plan.

Our consultancy can assist companies offering EPC, O&M or component services by delivering market segment sizing, competitor benchmarking, service offering design, and regional entry-roadmap to maximise B2B opportunity.

Why Work with a Professional Feasibility Study Firm

Given the complexity, the data intensity and the competitive nature of solar projects in the GCC, engaging a professional consulting firm gives you a strategic edge. Here’s what Accurate Middle East brings:

- Deep regional expertise: We operate in Dubai and servicing both UAE and KSA means we understand local authorities, land/grid sponsors, regulatory timelines, and market norms.

- Proven tools & modelling frameworks: From irradiation modelling to tariff benchmarking, from regional impact to partner ecosystem mapping — our feasibility models are customised to your scale and ambition.

- Strategic business planning integration: We don’t stop at “can the project work?”. We map how your company enters the market, selects partner or investor, defines service offering (IPP vs EPC vs O&M) and positions competitively.

- Bilingual and GCC ready deliverables: All outputs (market analysis report, feasibility study deck, business plan summary) can be delivered in English and Arabic if required, aligned to regional decision-makers.

- Fast-track timeline: For many clients, we deliver a customised proposal within 24 hours, and a full schematic feasibility study in 4-6 weeks, enabling you to engage next step negotiations before your competitors.

If you are serious about solar market entry in the UAE, Saudi Arabia or across the GCC you must treat market analysis and feasibility study as strategic instruments, not optional add-ons.

Talk To us Today

The solar energy opportunity in the UAE and Saudi Arabia is vast and accelerating. From multi gigawatt utility scale parks to growing rooftop and industrial segments, the strategic imperative for entrants is clear: you must model the market, validate the feasibility, craft a business plan and act quickly.

At Accurate Middle East, we specialise in solar market research, feasibility studies, and business-planning services tailored to the UAE, KSA and wider GCC. Whether you are a new entrant scouting opportunities, an EPC/commercial player looking for regional expansion, or an industrial end user assessing captive solar solutions — we bring the regional experience, analytical rigour, and strategic insight you need.

Talk to us for a tailored proposal. Contact us via WhatsApp at +971 50 599 5603 from the UAE, or schedule a free consultation through our website. If you’d like us to prepare a customised market research or feasibility study brief, fill in our online form and receive your tailored proposal within 24 hours.

We look forward to supporting your solar energy ambitions across the GCC.