Entering a new market in the GCC begins long before incorporation documents are filed or offices are opened. For most foreign companies, the real challenge starts earlier — understanding what is allowed, what is restricted, what requires approval, and which regulatory pathways determine timelines, costs, and operational feasibility. This is especially true in the UAE and Saudi Arabia, two of the fastest-growing and most regulated business environments in the region. Companies often underestimate how deeply the regulatory landscape affects decisions such as business model design, pricing, staffing, CAPEX/OPEX planning, and the ability to scale. A concept that works perfectly in Europe or Asia can face unexpected obstacles in Dubai, Abu Dhabi, or Riyadh simply because licensing, permits, or compliance obligations have different rules — and different consequences.

This is exactly why conducting a structured regulatory analysis in the UAE & KSA becomes a critical first step — it helps organisations clarify feasibility, identify constraints early, and design a market-entry strategy that is fully aligned with local regulatory realities.

Regulatory Analysis in the UAE & KSA Market Entry and Business Setup

This article was written to answer the questions companies often ask us:

- What regulations apply to my activity in the UAE or KSA?

- Which licenses will I need to operate?

- Are there regulatory barriers I should know before investing?

- How does this fit into a feasibility study or business plan?

- Where is the optimal setup location — mainland, free zone, or Saudi Arabia?

Below is a practical, research-driven guide created for business owners, investors, and international brands exploring the GCC. It reflects how Accurate Middle East approaches regulatory analysis as an essential part of market entry strategy, market research, and feasibility studies, focusing strictly on analysis and consulting, not execution or legal work.

What Regulatory Analysis Really Means in the UAE & KSA

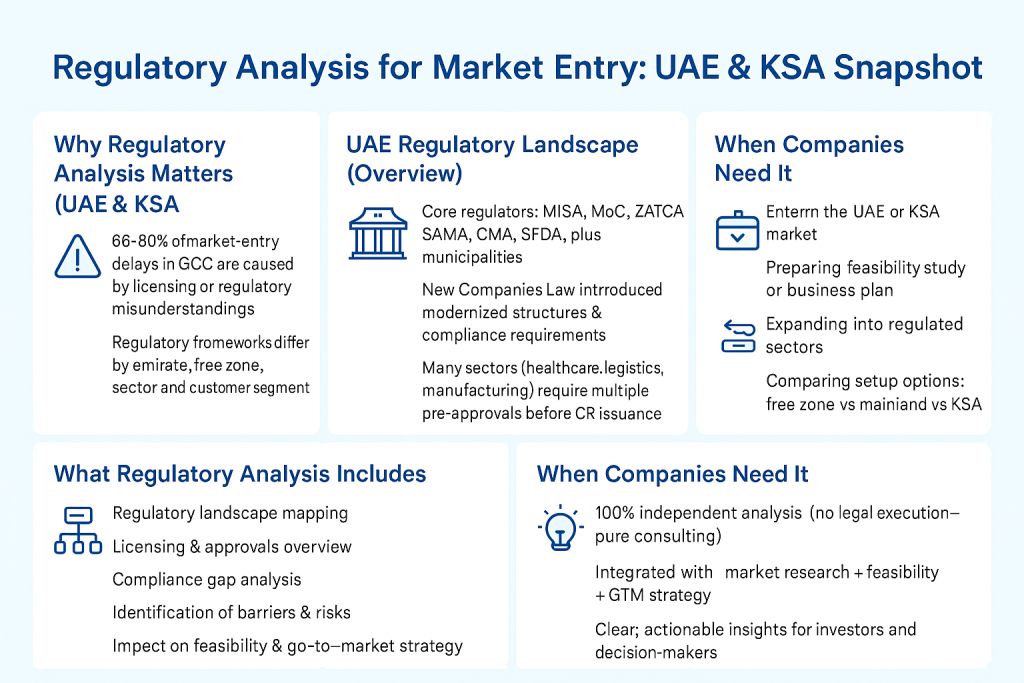

When companies explore new markets, they usually focus first on size, demand, competition, and financial projections. However, in both UAE and KSA, the regulatory environment can determine whether a business model is viable at all. Regulatory analysis, in our consulting context, is a structured assessment that covers:

- The regulatory landscape governing a specific activity

- A high-level overview of required licenses, permits, approvals, registrations

- Identification of regulators and authorities involved

- Practical operational restrictions, compliance conditions, and limitations

- A regulatory compliance gap analysis comparing your concept vs. local requirements

- Potential risks, barriers, ambiguities, dependencies, and timelines

- Implications for market entry, feasibility, budget, staffing, and go-to-market strategy

It is not a substitute for legal advice or execution. Instead, it answers a simple but critical question: “Can this concept operate in the UAE or KSA — and what would it take?” This clarity is what investors, partners, banks, and internal leadership teams expect before approving expansion into the region.

Why Regulatory Analysis Is Essential Before Entering the GCC

The UAE and Saudi Arabia have welcoming environments for foreign businesses — but also multi-layered, sector-specific, and frequently updated regulations. Understanding them early prevents misalignment between expectations and reality.

1) It reveals the real operational pathway.

Licensing in the GCC is not universal. The same activity can have different requirements depending on: Emirate (Dubai vs Abu Dhabi), Mainland vs free zone Sector (healthcare, energy, fintech, industrial, F&B, education, etc.),Target customer (B2B vs B2C).

Regulatory analysis gives you the complete picture before you commit resources.

2) It prevents delays, rejections, and incorrect structuring.

Most business delays occur when companies choose the wrong licence category or misunderstand regulatory classifications. A structured analysis eliminates this risk.

3) It uncovers restrictions that impact the business model

Examples include:

- Activity limitations in certain free zones

- Local-partner requirements in selected activities

- Approvals from health, energy, financial, or media regulators

- Specific facility layout or staffing requirements

- Approvals tied to product categories (cosmetics, supplements, equipment)

4) It strengthens the feasibility study and business plan

Every investor wants documentation that includes:

- Regulatory feasibility

- Permitting timetable

- High-level compliance requirements

- Risks affecting cost, timelines, and operations

Therefore, regulatory analysis is one of the pillars of a professional market entry strategy.

Regulatory Analysis for Market Entry

Understanding the Regulatory Landscape in the UAE

The UAE has a broad and diverse regulatory system, with different authorities depending on the activity, location, and sector. For companies entering the market, this landscape must be mapped clearly from day one. See UAE Government — Official Business & Licensing Portal.

Mainland regulators

Key authorities include: Department of Economy & Tourism (Dubai), DED equivalents in other emirates, Ministry of Economy Ministry of Human Resources (labour), UAE Central Bank, Securities & Commodities Authority, ESMA / Emirates Standardization and Metrology, Municipalities and Civil Defense, Health regulators (DHA, DOH, MOHAP).

Each of these regulators may require separate approvals, depending on the nature of the business.

Free zone regulators

Common UAE free zones with distinct rules include:

DIFC & ADGM – financial services, fintech, regulated activities

DMCC – commodities, trading, general business

RAKEZ, HFZA, KIZAD, DSOA – industrial, manufacturing, tech, logistics Dubai Healthcare City – medical, wellness, clinical operations

Companies must understand what each free zone allows, restricts, or requires additional approvals for.

Activity classifications and their impact

In the UAE, licensing starts with defining the exact activity. A single word in activity phrasing — “technical services”, “advisory”, “retail”, “manufacturing”, “wholesale”, “import/export” — can drastically affect: Required approvals

- VAT or corporate tax treatment

- Ability to trade onshore vs free zone

- Staff requirements

- Facility specifications Insurance obligations

Sector-specific examples

- Fintech & financial services → mandatory approvals from financial regulators (ADGM FSRA or DIFC DFSA). Healthcare & wellness → approvals from DHA, DOH, or MOHAP depending on the emirate.

- Industrial activities → ESMA compliance, environmental permits, civil defense approvals.

- F&B & retail → food safety, municipality requirements, hygiene certifications. These variations make regulatory analysis an indispensable part of project planning.

Regulatory Environment in Saudi Arabia (KSA)

Saudi Arabia is rapidly transforming its business environment under Vision 2030. For foreign companies, the regulatory landscape is both promising and complex.

Key regulatory authorities MISA – investment license

Ministry of Commerce – commercial registration

ZATCA – tax & compliance

SAMA / CMA – financial and capital market regulators

SFDA – food, medical devices, cosmetics

Municipal authorities – facility approvals Sector regulators in energy, telecom, education, logistics, construction

Pre-setup considerations

Regulatory analysis includes: Eligibility for foreign ownership Licensing pathways (MISA categories) Post-setup obligations Requirements tied to Saudiization Restrictions for certain products or activities Approvals for manufacturing, food production, medical categories

Impact of the new Companies Law

The recent changes modernized corporate structures, simplified incorporation, and improved foreign investor conditions. However, specialized activities still require additional approvals, which must be identified early.

Why KSA requires a separate regulatory assessment

A setup structure that works in Dubai might need adjustments in Riyadh. Market entry into both countries demands a dual regulatory model, especially for multinational expansions. 5. What Accurate ME’s Regulatory Analysis Includes (Consulting Only) Our regulatory analysis is designed to help companies make informed decisions without providing legal execution or acting as a compliance agent. We deliver clarity, direction, and risk visibility.

Regulatory Landscape Mapping in the UAE, KSA, GCC

A structured overview of all relevant laws, authorities, and regulatory frameworks applicable to your activity in the UAE and/or KSA or other GCC countries.

Licensing, Permits & Approvals Overview usually include:

- Which licences are required

- Which authorities issue them

- Expected sequence of approvals

- Dependencies, pre-conditions, and potential constraints

- Indicative timelines based on publicly available data

Regulatory Compliance Gap Analysis

Comparison of your planned model with local requirements to identify: Missing approvals

Activity misalignment

Facility or staffing conditions

Operational restrictions

Areas that require additional clarification with regulators

Risk & Barrier Assessment

At Accurate Middle East we highlight:

- Activity limitations

- Foreign ownership considerations

- Additional approvals required

- Potential showstoppers affecting operations

- Ambiguities that may influence timelines or feasibility

Impact on Feasibility, Operations & Go-To-Market.

Regulatory Landscape Comparison — UAE vs KSA

| Criteria | UAE (United Arab Emirates) | KSA (Saudi Arabia) |

| Primary Regulators | DET/DED, Ministry of Economy, Municipalities, ESMA, UAE Central Bank, SCA, DHA/DOH/MOHAP | MISA, Ministry of Commerce, ZATCA, SAMA, CMA, SFDA, Municipalities |

| Setup Models | Mainland, multiple free zones (ADGM, DIFC, DMCC, RAKEZ, DSOA, DHCC) | Single national system with activity-based approvals across ministries |

| Licensing Complexity | Activity-based classification; additional permits depend on sector & emirate | Investment license + activity approvals + CR; many sectors require multi-step pre-approvals |

| Foreign Ownership | 100% permitted for most activities (mainland + free zones) | 100% permitted in many sectors; some activities require local conditions or additional approvals |

| Regulatory Updates | Frequent updates in fintech, healthcare, F&B, industrial | Rapid regulatory reforms under Vision 2030 across most sectors |

| Typical Additional Approvals | Municipality, Civil Defense, ESMA, sector regulators (finance, health, education, industrial) | SFDA, SAMA/CMA, municipal approvals, environmental & industrial permits |

| When Regulatory Analysis is Critical | Free zone vs mainland decision, activity classification, multi-regulator approvals | MISA eligibility, compliance conditions, Saudization impact, multi-step licensing |

Regulations influence when you start your business:

CAPEX/OPEX

Hiring model

Facility choice

Revenue model

Jurisdiction selection

Implementation timeline

Our analysis connects these elements into your business plan and market entry strategy.

When Companies Need Regulatory Analysis

Based on more than a decade of consulting across the GCC, regulatory analysis is essential when:

- Exploring UAE or KSA market entry You need factual clarity before investing.

- Assessing business model feasibility Regulatory factors often impact margins, costs, and go-live date.

- Comparing setup locations Mainland vs free zone (DMCC, ADGM, DIFC, RAKEZ, etc.) UAE vs KSA Single entity vs multiple entities

- Expanding into regulated sectors Healthcare, fintech, industrial manufacturing, F&B production, education, logistics.

- Preparing an investor-ready feasibility study

- Investors require regulatory clarity as part of the due-diligence package.

Regulatory Landscape Saudi Arabia Company Setup

How We Conduct Regulatory Research (Methodology)

Accurate ME follows a structured, research-driven approach:

Desk Research Using Open Data:

We analyse: UAE and KSA government portals Regulatory guidelines and official manuals Sector-specific frameworks Publicly available licensing information Investor guides and regulatory circulars Free zone rulebooks

Benchmarking Across Jurisdictions:

Comparisons between: Mainland companies vs free zone licenses, UAE vs KSA, sector regulations across emirates etc.

Expert Input and Consultations:

When necessary, we collect additional insights from industry specialists or compliance consultants.

Risk & Barrier Matrix:

We map all potential regulatory risks and outline clear mitigation pathways.

Integration with Market Research & Strategy:

Our final regulatory analysis directly supports:

- Market demand assessment

- Feasibility studies

- Business planning

- Go-to-market strategy

- Investor presentations

This integrated approach differentiates Accurate ME from legal firms and corporate service providers.

Practical Examples of Regulatory Analysis (Generalized)

Below are simplified illustrative cases that demonstrate how regulatory analysis supports decision-making.

Example 1- European F&B Concept

The client needed clarity on:

- Food safety approvals

- Municipality requirements

- Import regulations for ingredients

- Warehouse and cold chain structure

- Activity classification and limitations

Regulatory analysis resulted in a feasible path with a recommended jurisdiction and a clear sequence of approvals.

Example 2 – Technology Company Entering KSA

The company required a better understanding of:

- MISA licensing

- Pre-conditions for commercial registration

- Post-setup compliance (ZATCA, Saudization)

- Approval requirements for hardware imports

The analysis identified two potential corporate structures and key risks influencing timelines.

Example 3 – Medical Device Distributor Targeting GCC

We analysed:

- SFDA rules

- Import and registration requirements

- Facility prerequisites

- Free zone warehousing limitations

The final report helped structure the business model and expansion roadmap.

Get a Solution within 48 hours!

Let’s Explore Your Regulatory Pathway Together

Regulatory analysis is not a formality — it is a foundation for strategic decision-making, cost forecasting, feasibility assessment, and smooth market entry. Whether you plan to enter the UAE, expand into Saudi Arabia, or operate across the GCC, you need a clear, well-researched understanding of the regulatory landscape before taking your next step in setting up your business. Accurate Middle East provides unique, analytical, and practical regulatory analysis guidelines that can be added to market research, feasibility studies, and business planning at new markets.

Our approach is designed for business owners who require clarity, structure, and confidence before investing in the region.

If you’re exploring expansion and need a detailed regulatory assessment, reach out to us. For inquiries, consultations, or tailored proposals:

Message us on WhatsApp.

Call us in the UAE: +971 50 599 5603

You may also request a callback or schedule a consultation using the button below. Prefer a fast start? Complete our brief here.

You will receive a personalized proposal within 24-48 hours. Accurate Middle East is ready to support your business ambitions across the UAE, Saudi Arabia, and the GCC — with the clarity and depth you need to make confident decisions.