Grocery shopping in the GCC is no longer an additional channel for sales — it has become a mirror of consumer priorities, digital adoption, and wellness-driven lifestyles. In both the UAE and Saudi Arabia, consumer research in 2025 shows a sharp turn toward healthier products, new shopping habits, and a growing interest in online channels.

Yet, the GCC is not a uniform market. Online grocery research in UAE shows that consumers still favor brick-and-mortar shops and value freshness when it comes to products, while Saudi Arabia is moving faster toward online grocery adoption, driven by discount sensitivity and mobile-first behavior.

This article unpacks the latest YouGov data, highlighting how consumer trends 2025 are shaping the sector — and explains how Accurate Middle East helps businesses, investors, and retailers translate these insights into practical strategies through consumer research, grocery market analysis, surveys, and focus groups.

Online grocery market research in UAE

Online Grocery & Digital Consumer Behavior

Recent online grocery market research in the GCC highlights just how different the two leading markets have become. In Saudi Arabia, grocery apps and digital-first platforms are already a natural part of daily life, with most households comfortable ordering bulk items online. In the UAE, consumers remain more attached to hypermarkets, but adoption of delivery apps is rising quickly among younger families and busy professionals. For retailers and FMCG brands, this means that online channels cannot be treated as a secondary sales tool — they need their own pricing strategy, product mix, and promotional campaigns. Understanding these patterns through localized consumer research allows companies to design an online grocery strategy that reflects how people actually shop, not just how global trends suggest they should.

Grocery & Wellness Shopping Trends in UAE & KSA

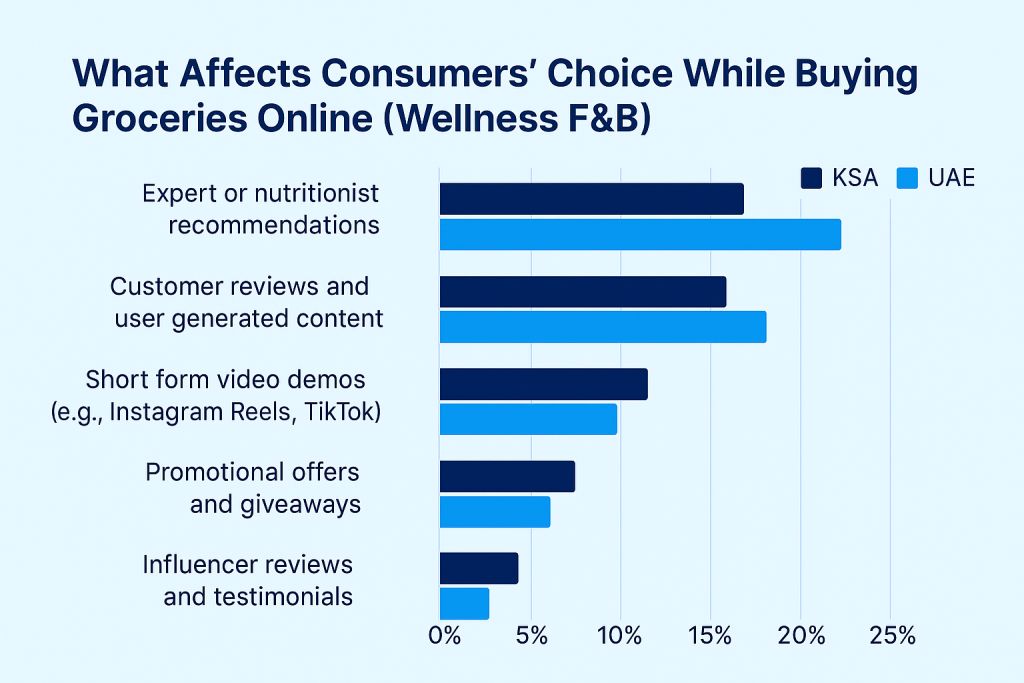

The latest YouGov surveys (Feb 2025, 2,020 respondents) show that wellness is no longer a niche trend — it has become mainstream in the GCC.

- Two in five shoppers (40% of consumers) in the UAE and KSA buy wellness-focused groceries at least once a week

- 69% of consumers are willing to pay more for wellness products like organic, gluten-free, or functional foods.

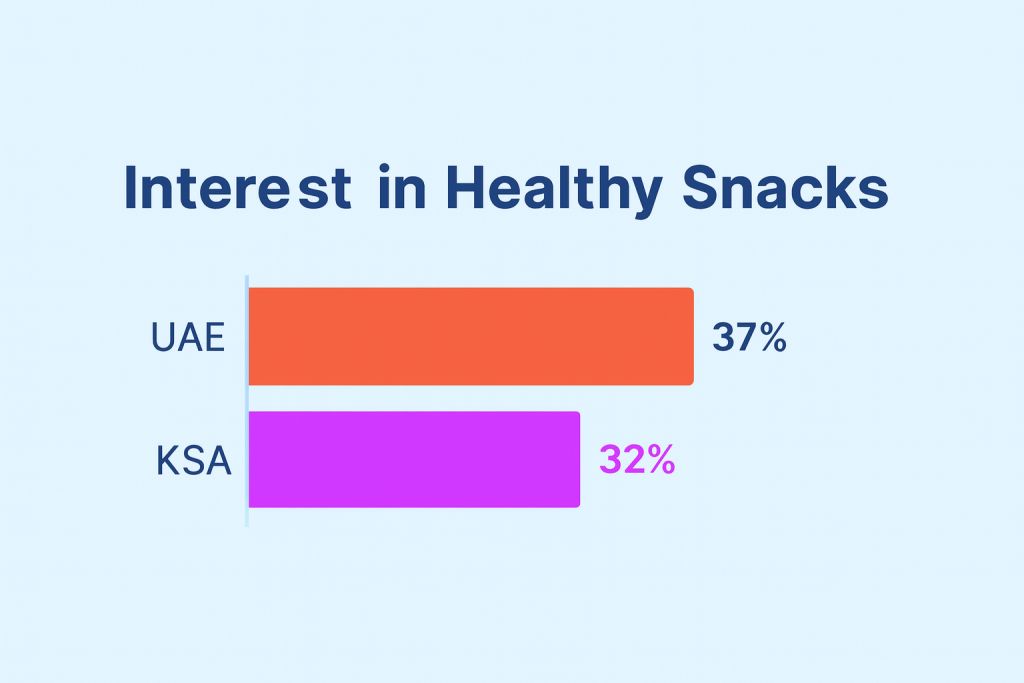

- Millennials (35–44 yo) show the highest intent: 50% plan to buy more organic, 49% more supplements, 45% more healthy snacks.

- Carrefour (UAE), Panda (KSA), and LuLu Hypermarket dominate shopping trips, though by trip type (big shop vs. top-up), the leaders vary.

Interest in healthy snacks

These insights underline the importance of grocery market analysis in the UAE and KSA. Businesses cannot rely on global assumptions — they need local data to plan product ranges, pricing, and retail partnerships.

Online Grocery & Digital Consumer Behavior in the GCC

The rise of digital channels is reshaping grocery shopping:

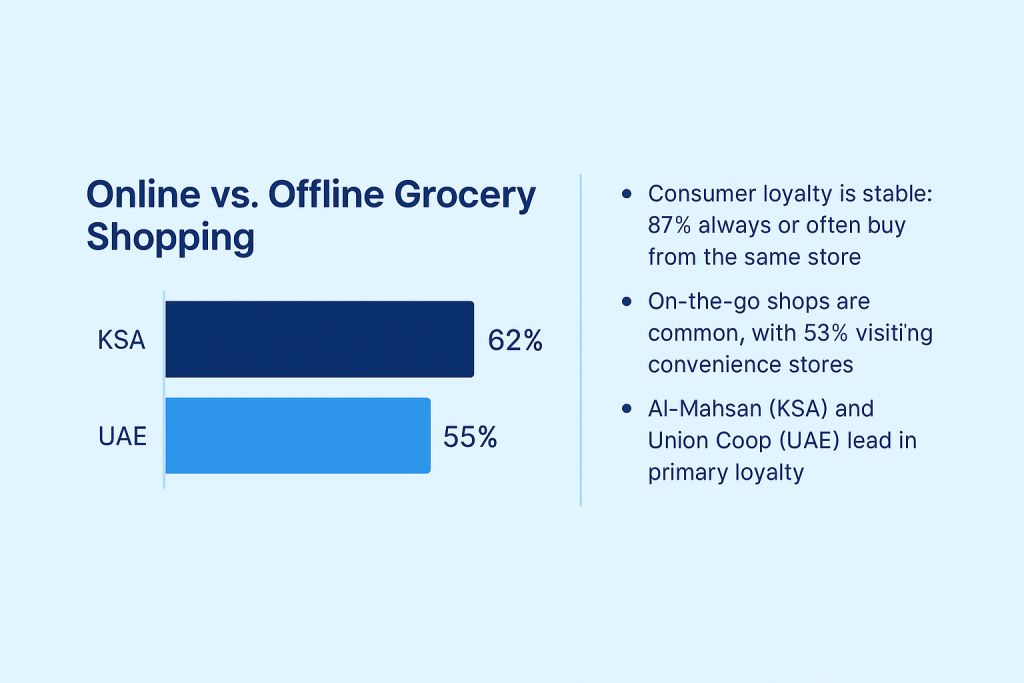

- 62% of Saudis already shop for groceries online.

- By contrast, 55% of UAE consumers still prefer offline shopping.

This creates two different markets: Saudi Arabia is moving quickly into digital-first grocery retail, while the UAE remains rooted in traditional hypermarkets — but with growing adoption of delivery apps.

For brands, this means two things:

- Online grocery market research in UAE is essential to track the pace of transition from offline to online.

- Companies need a marketing strategy for online grocery platforms tailored to each country:

- UAE: prefers freshness, quality, and availability.

- KSA: chooses price promotions and loyalty schemes.

Online vs Offline shopping

Key Consumer Profiles & Motivations

Consumer motivations differ significantly between UAE and KSA, and across age groups:

- UAE: 31% prioritize freshness when choosing where to shop.

- KSA: 28% prioritize discounts.

- Food labels matter: Organic and sugar-free labels are the most trusted, while plant-based remains less attractive (only 18% actively seek plant-based options).

- Barriers to plant-based adoption: Higher price (34%), taste/texture concerns (27%), cultural preferences (19%).

Online grocery and consumer purchase patterns UAE KSA GKK

These insights highlight why consumer profile research in UAE & KSA is so critical. Companies that fail to understand these nuances risk misaligning their product and pricing strategies.

Why does your business need to track grocery trends and consumer profiles regularly?

With the growing demand for online grocery, there are a lot of factors which can affect purchase decisions, which are highly regional: freshness and quality in the UAE, discounts and price sensitivity in Saudi Arabia. In both the UAE and Saudi Arabia, consumers are shifting toward wellness-focused products, healthier lifestyles, and online shopping platforms.

For business owners, FMCG brands, retailers, and investors, this raises important questions:

- What do consumers in UAE and Saudi Arabia really want from grocery shopping?

- How are generational differences shaping product choices?

- Where does online grocery market research in UAE indicate the biggest growth potential?

- How can companies design the right marketing strategy for online grocery platforms?

Accurate Middle East Research and Consulting helps brands to get to know their consumer profiles, purchasing trends, and implications for businesses — and explains how consumer research, focus groups, and feasibility studies help turn market data into profitable strategies.

Research Methods: From Surveys to Focus Groups

One of the report’s biggest takeaways is the lack of open consumer data in GCC markets. Unlike in Europe or North America, where extensive datasets exist, most insights in the UAE and Saudi Arabia must be generated directly.

This makes surveys, product testing and focus groups critical tools for online grocery research and consumer profiling.

At Accurate Middle East, we deploy:

- Consumer surveys: To measure demand, pricing sensitivity, and brand recognition.

- Focus groups in UAE and KSA: To test reactions to new wellness products, online grocery apps, and marketing campaigns.

- Mystery shopping and observational research: To understand real-world behavior inside hypermarkets and online platforms.

This is where Accurate Middle East helps clients go beyond surface-level statistics and generate actionable insights.

Implications for Retailers, FMCG & Investors

The consumer research shows clear implications:

- Retailers must tailor store strategies: Carrefour in UAE should reinforce freshness messaging, while Panda in KSA should double down on discount-driven campaigns.

- FMCG brands cannot assume plant-based will scale quickly — but healthy snacks and organic products have clear momentum.

- Investors should use grocery market analysis UAE & KSA to identify where the “wellness premium” is strongest and where digital platforms will scale fastest.

This is why feasibility studies and business planning are so valuable: they connect consumer insights to financial modeling, market entry plans, and investor-ready strategies.

For investors, grocery market analysis in UAE and Saudi Arabia provides clarity on where to prioritize capital deployment, whether in offline expansion or online channels.

How Accurate Middle East Supports Clients

At Accurate Middle East, we not only collect market data, but convert it into practical business results – strategies, plans, and foundation to the right decisions. Our retail and FMCG services usually include:

- Online grocery market research in UAE & KSA: understanding digital adoption rates, consumer preferences, and competitive benchmarking.

- Consumer research & profiling: detailed segmentation of shoppers by age, income, lifestyle, and wellness priorities.

- Focus groups & surveys: design, execution, and analysis to validate demand for new products and online grocery platforms.

- Grocery market analysis UAE & GCC: identifying trends, mapping competitors, and quantifying market size.

- Business planning & pitch decks: converting consumer insights into clear investment strategies and funding presentations.

For every client, our deliverables include analytical reports, Excel models, and presentation decks — practical tools for decision-making.

Grocery market analysis

Why Work with Our Research Team in the UAE or Saudi Arabia?

The grocery and wellness market in the UAE and Saudi Arabia is dynamic, competitive, and full of opportunity. But it is also fragmented, with consumers divided by age, country, and shopping channel. Success requires more than reading global trend reports — it requires localized consumer research, online grocery market analysis, and carefully designed marketing strategies.

At Accurate Middle East we support clients with online grocery market research, grocery market analysis, and tailored marketing strategies for online grocery platforms to ensure competitive advantage. We partner with businesses, investors, and retailers to navigate these markets with precision. Whether you are planning to enter the GCC grocery sector, expand your product portfolio, or test an online grocery platform, our team provides the research, insights, and planning you need.

📞 Talk to us today:

Our research team will review your request within 24 hours and response with a propoer solution and a customized proposal. Whether it’s a sample report, a consumer research, product testing, a full market entry strategy or a business plan, we are here to support your ambitions in the UAE, Saudi Arabia, and across the GCC.

| |

Author: | |

| Dr. Elena Zhukovskaya Senior Consultant, Partner | |

| 20+ years of experience in market research, business management, investor relations, and brand communications across the UAE, KSA, and GCC. Author of 50+ publications and a regular speaker at leading business events in the region. |