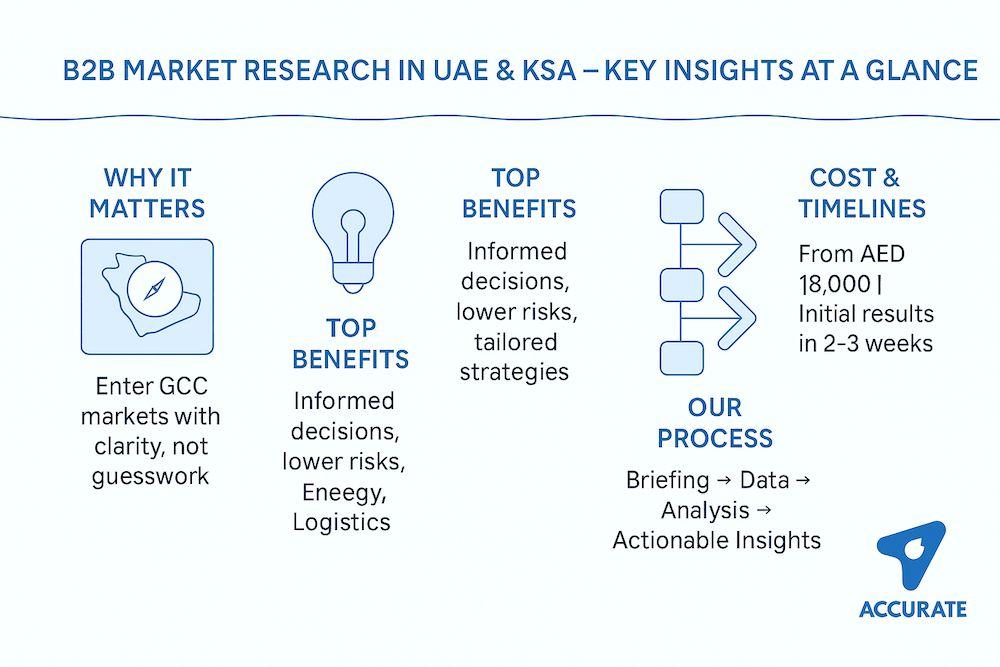

Why B2B Market Research Matters in the UAE & Saudi Arabia

Looking to enter the UAE or GCC market? Market research for B2B in the UAE is the first essential step to build a successful market entry strategy. In this article, we explain why market research is critical when expanding into the UAE, KSA, or the wider GCC region, what common mistakes companies make without proper research, and how in-depth analysis can prevent costly decisions. You will also learn how to choose the right consulting firm for market research in the UAE, Saudi Arabia, and GCC, see examples of market analysis projects in the UAE, and understand how to order market research UAE services tailored to your business needs.

Expanding into the UAE or Saudi Arabia without proper research is a bit like setting out on a journey without a map. Both markets are exciting, but also complex — shaped by rapid growth, evolving regulations, and cultural diversity. B2B market research in the UAE & KSA helps companies make sense of these factors by clarifying customer expectations, pricing sensitivities, and competitor strategies. With this knowledge, business owners can avoid costly missteps and design strategies that truly connect with local buyers and partners.

The Strategic Role of Market Research for B2B in GCC

In today’s rapidly changing Gulf business environment, companies that rely solely on assumptions often end up making costly decisions. Whether you’re launching a new product, expanding into a new city, or validating demand before investing, market research in the UAE and Saudi Arabia is no longer optional—it’s essential.

B2B market research

Key Benefits of B2B Market Analysis in GCC Countries

Informed decision-making: Replace assumptions with real data.

Risk reduction: Spot barriers early and plan around them.

Tailored strategies: Each industry — from energy to IT — requires a unique entry plan.

Competitive advantage: Identify market gaps and position your business effectively.

By investing in B2B market analysis across the GCC, companies gain the clarity to enter confidently, optimize their operations, and grow sustainably.

From startups in Dubai to multinational brands entering Riyadh, companies across sectors use market research to:

- Understand local consumer behavior

- Benchmark competitors

- Forecast demand

- Reduce risks

- Justify investment decisions

At Accurate Middle East, we specialize in customized market research insights and business intelligence the UAE and KSA-wide, designed for companies planning to enter or develop in the UAE, KSA or Gulf region. In this article, we break down what market research includes, why it’s a must-have, how to order it, sample cases, pricing, and how your business can benefit.

Industries That Depend on B2B Research in the Middle East

The need for business-to-business market insights in the GCC cuts across almost every sector. Construction and engineering companies rely on supplier and tender analysis. Healthcare, beauty, wellness market players must understand and regularily track regulations, certifications, and procurement channels. Technology, fintech, and logistics firms use research to track buyer behavior and adoption trends. Whether you’re a tech small company exploring opportunities or a multinational expanding your presence, B2B research ensures your business model aligns with local market situation.

B2B Market Research Services

Market analysis or research is the process of gathering, arranging and analysing and interpreting data to help businesses make informed decisions based on facts without guessing. Our UAE and KSA market studies typically include:

- Size and growth dynamics

- Customer or consumer behavior and insights

- Demand analysis and segmentation

- Competitive landscape and benchmark

- Market sizing (volume and value)

- Pricing strategies and positioning

- Distribution channels and sales models

- Regulatory and legal base

- Entry barriers and local doing-business rules

Depending on the project, we also recommend to use such primary research tools as:

- Focus groups

- Expert interviews

- Customer interviews

- Product testing

- Retail/shopper observations

- Online and offline surveys

Every study comes with:

- A full PDF report (35–60 pages)

- An Excel-based market model (with dynamic assumptions)

- Executive summary and visual dashboards

Market Research Business-To-Business for Local Insights

Dubai, Abu Dhabi, Sharjah, and other Emirates each have unique characteristics when it comes to:

- Consumer preferences

- Pricing strategy and sensitivity

- Language and cultural factors

- Business rules and regulations

Our market research UAE service focuses on:

- Emirate-level demand breakdowns

- Interviews with local B2B and B2C buyers

- Mystery shopping in retail environments

- Trends in sectors like F&B, retail, healthcare, tech, education, and real estate

Whether you’re testing a new product idea or planning your business expansion, having access to accurate local data can mean the difference between a successful launch and an expensive mistake – wrong time/positioning/marketing.

Market Research B2B in KSA: Scaling Smart in the Kingdom

Saudi Arabia is undergoing massive transformation under Vision 2030. But to succeed, you need to understand the local market nuances:

- Male/female consumer behaviors

- Differences between Riyadh, Jeddah, and Dammam

- Government initiatives and incentives

- Cultural sensitivities in marketing and product offering

Our market research KSA team works with businesses looking to:

- Test product concepts before launch

- Understand competition in retail or B2B

- Estimate demand in secondary cities

- Navigate compliance, pricing, and localization strategies

The GCC is not a one-size-fits-all market. You need tailored insights by country, city, and sector—and that’s precisely what we deliver.

B2B market research services

How We Conduct B2B Feasibility Studies in UAE & KSA

At Accurate Middle East, we combine desk research with direct market intelligence. Our team speaks with industry experts, buyers, and potential partners, while cross-checking data against official publications and databases. A B2B feasibility study in the UAE or Saudi Arabia typically covers market sizing, competitor benchmarking, regulatory mapping, and revenue projections. The result isn’t just raw numbers but actionable recommendations that help you move forward with confidence.

Order Business Intelligence in UAE or KSA: 6-Step Approach

At Accurate Middle East, we follow a clear, professional process to ensure each client gets seamless experience and real, actionable insights as a result of our services. Here’s what to expect:

Step 1: Briefing & Objective Setting

We hold a discovery call to understand:

- Your business goals

- Questions you need answered

- Target audience or segment

Step 2: Preparing the Research Task

We draft a detailed proposal including:

- Scope of work

- Methodologies (quantitative/qualitative)

- Timeline and deliverables

- Cost estimate

Step 3: Data Collection

Our team collects:

- Public and commercial data

- Interviews (online or in-person)

- Surveys, mystery shopping, and competitor mapping

Step 4: Market Analysis

We perform:

- Demand modeling

- SWOT analysis

- Consumer behavior trends

- Risk identification

Step 5: Report Development

You receive:

- A professionally designed PDF report

- Dynamic Excel model (with pricing, volume, growth)

- Summary presentation (optional)

Step 6: Post-Delivery Call

We review the results, explain scenarios, and provide recommendations for:

- Market entry strategy

- Product pricing

- Distribution channels

B2B Market research framework

Market Research B2B Example: Retail Brand Entering the UAE

Client: Mid-size European fashion accessories brand

Goal: Assess the feasibility of opening physical stores in UAE malls

We Delivered:

- Consumer survey of 600 respondents across 3 Emirates

- Benchmarking of 12 competitors (pricing, store size, product mix)

- Location demand heat map (Dubai Mall, Mirdif City Center, Yas Mall)

- Insights into tourist vs resident footfall

Result: Client delayed launch in 2 low-potential malls and focused investment in Dubai Mall with modified pricing strategy. Result: 18% higher ROI than the original plan.

Market Research Cost: Transparent & Scalable Pricing

Our pricing is flexible based on methodology, geography, and scope.

Company Size / Scope Estimated Cost (AED)

Startup / One-city basic research 9,000 – 12,000

SME / Multi-city + survey + analysis 15,000 – 30,000

Corporate / In-depth KSA + UAE 35,000 – 60,000+

Every study is custom. We never use templates, and all deliverables are built from scratch for your business case.

Why Companies Order Market Research from Accurate Middle East

✅ Experience: 15+ years in the UAE and GCC, 300+ studies completed

✅ Sector Expertise: Retail, F&B, manufacturing, tech, healthcare, services

✅ On-the-ground Access: Native Arabic/English speakers, regional coverage

✅ Speed: Most projects delivered in 10–18 business days

✅ Actionable Reports: Not just data, but insights you can use to act

Our clients include:

- International brands entering the Gulf

- Local entrepreneurs validating new ideas

- Government suppliers and contractors

- Real estate developers, franchises, and FMCG companies

Why You Should Order Market Analysis UAE Services Today

Market research isn’t a luxury. In the UAE and KSA, it’s your safety net and growth engine. Whether you need a deep market study, competitive analysis, customer segmentation, or product testing, we’re here to help.

With Accurate Middle East, you get:

- A structured approach

- Reliable insights

- Clear next steps

- Custom PDF + Excel reports

- A local partner with global understanding

Thinking of launching in the UAE or KSA?

Don’t guess. Order a tailored market research study today.

For inquiries, consultations, or tailored proposals, contact us directly via WhatsApp at or call us in the UAE at +971 50 599 5603. You can also request a callback or schedule a free consultation by clicking the button below. If you’re interested in market research services, simply fill in our brief form here — and receive a customized proposal within 24 hours. We’re here to support your business ambitions across the UAE, Saudi Arabia, and the GCC.