Every ambitious construction project begins with an idea. But in the fast-moving markets of the UAE, Saudi Arabia, and the wider GCC, turning that idea into a profitable reality requires more than enthusiasm and funding. The central question every investor must ask is: Will this project generate sustainable returns within the region’s unique market and regulatory environment?

The answer lies in a construction project feasibility study. Far from being a simple financial exercise, a feasibility study provides the evidence, clarity, and strategic direction needed to attract financing, mitigate risks, and align with local demand.

This article explains the role of feasibility studies in the GCC construction sector, outlines the key components, compares dynamics in the UAE and Saudi Arabia, and demonstrates how Accurate Middle East supports investors with actionable insights and strategies.

Construction Project Feasibility Study

What Is a Construction Project Feasibility Study?

A construction project feasibility study is a structured assessment of whether a proposed development can be executed successfully and profitably. It combines market intelligence, technical evaluation, financial modeling, and regulatory analysis into one cohesive roadmap.

Unlike a simple cost breakdown, a feasibility study answers broader strategic questions:

- Is there sufficient demand for the project?

- Will projected revenues cover capital and operational costs?

- How will regulations, ownership laws, or licensing affect delivery?

- What risks could undermine profitability, and how can they be managed?

For instance, planning a luxury residential tower in Dubai Marina requires more than construction cost estimates. It involves assessing rental yields, absorption rates, and whether demand is shifting toward mid-income housing. Similarly, a logistics hub in Riyadh demands an analysis of supply chain flows, government industrial policies, and land lease structures.

Why Feasibility Studies Matter in the GCC Market

Rapid Market Growth with Intensifying Competition

The GCC construction market is expanding quickly. The UAE’s construction sector is projected to reach USD 133 billion by 2027, while Saudi Arabia currently has more than USD 1.3 trillion worth of projects in its Vision 2030 pipeline. Yet, growth brings competition — and only well-positioned projects backed by solid feasibility data can succeed in crowded markets.

Complex Regulatory Environment

Whether in Dubai, Abu Dhabi, or Riyadh, construction projects must comply with zoning laws, building codes, environmental requirements, and foreign ownership regulations. A feasibility study ensures compliance is understood from the start, preventing costly delays later.

Access to Capital

Regional banks and private equity investors require feasibility reports before approving loans or equity participation. A study that includes a robust financial model with ROI forecasts demonstrates preparedness and reduces lender risk.

Market Entry for Foreign Investors

For international developers, feasibility studies are a gateway to local consumer insights, competitive benchmarks, and cultural nuances. They bridge the knowledge gap between global ambition and regional reality.

Construction Project Feasibility Study in UAE, Saudi Arabia

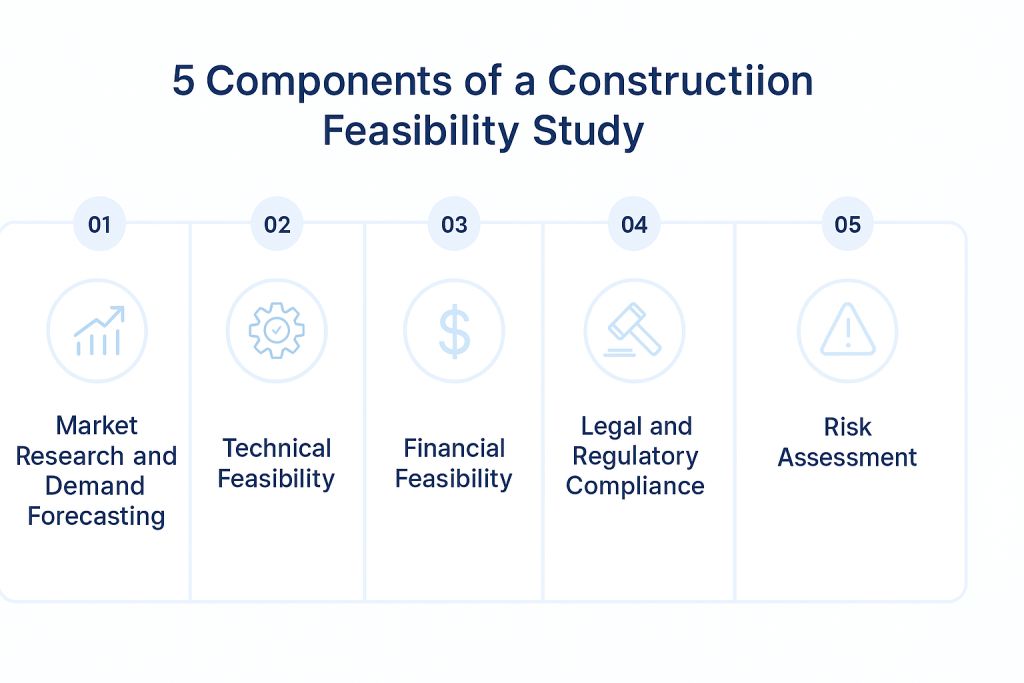

Core Components of a Construction Feasibility Study

1. Market Research and Demand Forecasting

- Analysis of demand-supply dynamics in targeted sectors.

- Identification of consumer preferences (e.g., rising demand for mid-income housing in Dubai or medical facilities in Riyadh).

- Forward-looking projections based on population growth, tourism flows, and infrastructure expansion.

- In Dubai, for example, mid-income residential demand is forecasted to represent over 50% of new supply by 2026, reshaping the focus of developers.

2. Technical Feasibility

- Site evaluation, including accessibility and infrastructure connectivity.

- Preliminary design considerations.

- Identification of construction challenges, such as soil conditions or utility availability.

- For industrial projects, energy access and logistics infrastructure often become decisive technical factors.

3. Financial Feasibility

- Development cost structures: land, construction, materials, and labor.

- Revenue modeling depends on sales prices, rental yields, and appreciation rates. Break-even timelines and ROI analysis are essential.

- A hospitality project in Abu Dhabi, for example, must consider seasonal occupancy trends and changing tourist profiles, not only construction costs.

4. Legal and Regulatory Compliance

- Zoning approvals and building permits.

- Ownership restrictions (such as freehold vs leasehold zones in the UAE).

- Health, safety, and environmental standards.

- These requirements differ between emirates and are stricter in some Saudi jurisdictions, where projects often need to align with Vision 2030’s sustainability goals.

5. Risk Assessment

- Market risks, such as oversupply or demand slowdowns.

- Political or regulatory risks tied to evolving economic policies.

- Operational risks, including construction delays and cost overruns.

- By quantifying and planning for risks, investors are able to build resilient financial structures.

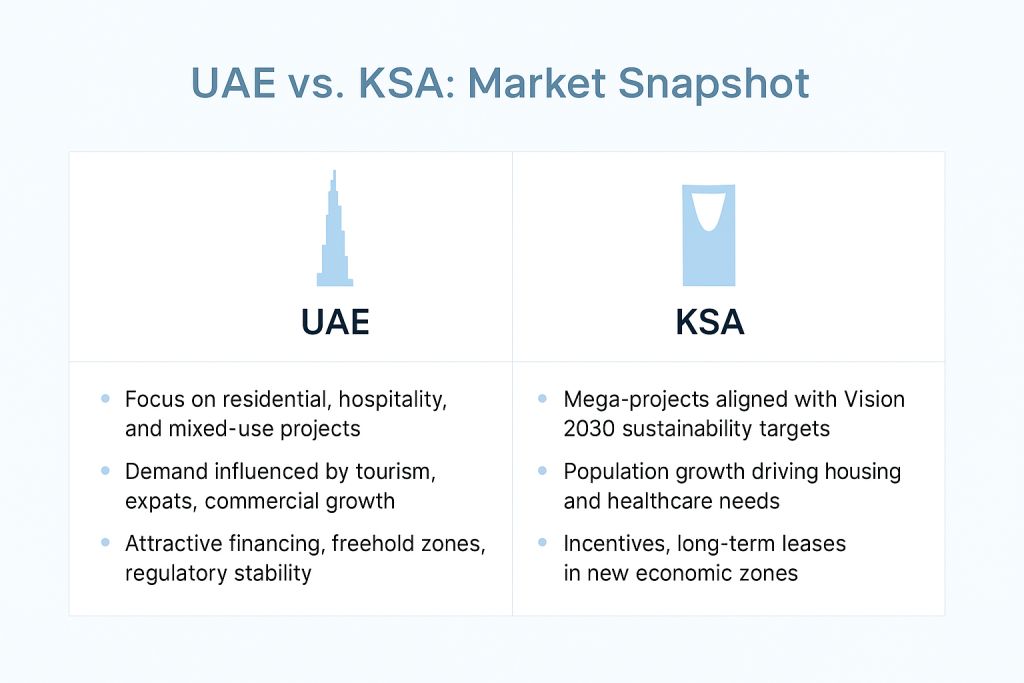

UAE Market Snapshot: Construction Opportunities in 2025

The UAE remains one of the most fastest developing construction markets in the GCC and MENA:

- USD 133 billion market size by 2027, growing at around 4.7% CAGR.

- Strong demand in residential, hospitality, and logistics projects.

- The government pushes for sustainability and smart infrastructure, especially in Dubai and Abu Dhabi.

Developers or construction companies entering the UAE must change to meet consumer preferences. There is a growing demand for affordable and mid-income housing. At the same time, they should recognize opportunities in luxury mixed-use projects linked to tourism and business centers.

Construction market size and growth UAE vs KSA

Saudi Arabia Market Snapshot: Vision 2030

Saudi Arabia presents a different but equally attractive opportunity:

- Over USD 1.3 trillion in planned and ongoing projects under Vision 2030.

- Mega-projects such as NEOM, Qiddiya, and the Red Sea Project redefine global urban planning benchmarks.

- Residential demand driven by population growth and rising homeownership targets.

- Expanding opportunities in industrial, logistics, and healthcare construction.

Unlike Dubai’s established premium real estate focus, Saudi feasibility studies often emphasize sustainability, infrastructure integration, and long-term demographic shifts.

Construction real estate development feasibility UAE vs KSA

Case Example: Mid-Luxury Development in Dubai, UAE

A European investor approached Accurate Middle East to assess a residential project in Business Bay. Our feasibility study identified:

- Rising demand for mid-luxury projects.

- Competitive saturation in ultra-luxury towers.

- Financial model projecting ROI of 14% within five years.

Based on our recommendations, the client secured financing and positioned the project within Dubai’s most resilient residential segment.

Typical Pricing and Timelines for Feasibility Study

| Project Size | Starting Fee (AED) | Estimated Timing |

|---|---|---|

| Small–Medium | 25,000–35,000 | 8–10 weeks |

| Large | 55,000+ | 2,5–3 months |

How Accurate Middle East Adds Value

Accurate ME provides feasibility studies that align with investor goals, financial realities, and GCC market dynamics. Our methodology ensures that the projects of our clients are not only financially viable but also strategically positioned for long-term success in the country.

Our services include:

- Comprehensive market research and demand analysis.

- Financial modeling that meets investor and lender requirements.

- Technical and regulatory feasibility assessments.

- Risk management strategies tailored to the GCC environment.

- Advisory on business setup and licensing procedures.

With decades of experience, our consultants turn feasibility studies into practical strategies. They connect vision with execution.

Construction project feasibility study by Accurate

How to start working with us

A construction project feasibility study is the critical foundation of success in the UAE, Saudi Arabia, and GCC markets. It validates assumptions, secures financing, and minimizes risks in one of the world’s most competitive construction environments.

If you are considering a new development — whether a residential tower in Dubai, a hospitality project in Abu Dhabi, or an industrial facility in Riyadh — Accurate Middle East is ready to provide in-depth analysis and strategic guidance.

For inquiries, consultations, or tailored proposals, contact us directly via WhatsApp at or call us in the UAE at +971 50 599 5603. You may also request a callback or schedule a free consultation by clicking the button below. If you’re interested in market research services, simply fill in our brief form here — and receive a customized proposal within 24 hours.

At Accurate Middle East, we don’t just evaluate projects — we help turn them into profitable realities.